Teamwork might make the dream work, but it’s data that drives collaborative effectiveness across credit unions. The rapid advancement of analytical tools for benchmarking, market tracing, next best product predictions, and more has deepened the need for forging real connections across the cooperative to make the most of artificial intelligence.

As member-owned collaboratives, credit unions are an ideal setting to bring together individual people and data points to accomplish more for the majority. Here, managers in key business intelligence roles at six cooperatives share how they build and sustain those connections.

Read Part 1 for insights from Virginia Credit Union, Workers Credit Union, and Greater Texas Credit Union today.

GROW FINANCIAL FCU

Daniel Hirschlein has been with GROW Financial Federal Credit Union ($3.3B, Tampa, FL) since 2008, including the past seven years as assistant vice president of enterprise analytics.

How do you forge productive working relationships with the end-users of your business intelligence?

Daniel Hirschlein: The end-users of our business intelligence our data consumers need data that supports decision-making in their line of business. The best way to forge productive working relationships is to collaborate with them as partners, understand their pain points, and look for ways to align the tactical nature of their data use to overall strategic goals. We take the approach of teaching our data consumers to fish, meaning we will supply the tools and provide a level of training to enable them to access the data themselves, helping to empower them to be even better subject matter experts in their areas.

What is the most effective internal partnership you have with other departments, and why?

DH: We recently staffed our credit union to support three areas of our data strategy: infrastructure, architecture, and consumption. Infrastructure is supported by our database administrator, whose responsibility is to prepare, aggregate, and store the data from all the credit union’s data source catalog in addition to supporting our operational database systems.

Architecture is supported by our data architect, who designs and loads the enterprise data warehouse using the prepped data from the infrastructure area.

Lastly, consumption is supported by the enterprise analytics team along with the data power users within each line of business. Our responsibility is to not only surface the data within the enterprise data warehouse in reporting and dashboards but also provide a feedback loop to the architecture so it continues to support the data use cases of the business.

What project is the biggest accomplishment for BI work at your credit union? What impact did it have on the credit union’s ability to improve member service?

DH: Our analytics strategy has been to gain a better understanding of how Grow Financial operates, with the goal of achieving predictable financial performance. Developing analytics and insights around our lending portfolio has allowed us to understand lifetime financial performance of each product. Looking at our lending practices to understand the number of applications we receive, our approval rate, and the funding rate combined with the ongoing performance and disposition of the asset has allowed us to provide more competitive rates to our members and has allowed us to take on additional risk.

Coastal Federal Credit Union

Richard Sowell has been with Coastal Federal Credit Union ($4.6B, Raleigh, NC) for nearly 10 years, including the past two as vice president for reporting and analytics.

How do you forge productive working relationships with the end-users of your business intelligence?

Richard Sowell: Building relationships with departments and leaders has been fundamental to our success, and I am personally motivated by building relationships with and understanding people. This is beneficial because it helps us learn and understand business goals, challenges, opportunities, and tactics. Understanding these increases the likelihood that our solutions go beyond interesting and provide real business value. We can also fold the lessons we learn from one part of the organization into work solutions for other functions.

What is the most effective internal partnership you have with other departments, and why?

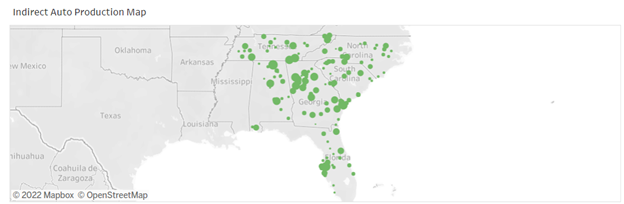

RS: Every one of our partnerships is extraordinarily valuable. I’m proud of the work we’ve been able to do in partnership with our marketing group and our vice president for marketing and product development. We’ve developed several models that allow us to reach out to members to help them, including one that helps us expand our relationship with members who join through the indirect lending channel.

We’ve examined our branch strategy and presented options for significant changes to that approach to optimize member impact through the channel. We’ve built recommendations on reducing fees and encouraging positive behaviors like direct deposit. Today, we’re working on models that will help identify and retain members who are likely to close their accounts. Partnerships with credit risk management and finance have been critical in these efforts, and several others we’ve delivered and are working to deliver.

What project is the biggest accomplishment for BI work at your credit union? What impact did it have on the credit union’s ability to improve member service?

RS: We’re working with Quantworks to build a structured analytics data library that will give more power to leaders to investigate data, measure their business, and track change. It will also provide our analytics and insights team with a faster path to delivering business-impacting models, allowing us to predict outcomes and prescribe solutions that will provide improved results.

This effort has involved significant input from every area of our business and has brought up some crucial insights even during the discovery process. Building this library is an essential step in the next phase of our analytics journey.

BCU

John Sahagian has been chief data officer at BCU ($5.1B, Vernon Hills, IL) since July 2018 and is responsible for enterprise strategy for data and analytics as well as the cooperative’s Salesforce platform.

How do you forge productive working relationships with the end-users of your business intelligence?

John Sahagian: For starters, it’s important to understand that it wasn’t technology that drove us to establish a chief data officer at BCU it was business needs and ambitions. Our primary aim is value creation, and we are working hard to understand and measure our impact on BCU’s success.

We believe great analytics don’t start with digging for answers, it starts with asking the right questions. Our business stakeholders understand best where data can have the biggest impact within their areas. So, we invest the time to learn where their biggest pain points are, where their greatest inefficiencies are, and what questions they wish they had the answers to. When we invest the time to understand where we can have the biggest impact, we tend to get great results, and the partnership flourishes.

Don’t stop here. Read Part 1 of 6 “Credit Unions Dish On Data Dashboards And Enterprise Collaboration” for even more insights, tips, and best practices.

What is the most effective internal partnership you have with other departments, and why?

JH: One of the most difficult aspects of yielding value from intelligence is figuring out how to successfully embed it into operations. Our marketing and sales teams are best able to take intelligence we produce, say a likelihood score, and insert it into their processes.

Recently, we used machine learning and past member behavior data to develop a mortgage payoff prediction model that our mortgage team started testing in small batches. Their feedback helped us quickly improve the model, automate lead creation and campaigns, and scale up volume. With response rates at 19%, this model is now our strongest mortgage lead source and is proactively retaining important member relationships.

These interviews have been edited and condensed.