Top-Level Takeaways

-

America’s Christian has four strategic pillars that clearly define its mission.

-

In the past three years, the credit union has used the focus these pillars provide to clearly communicate its purpose and organize its operational directives.

CU QUICK FACTS

America’s Christian Credit Union

Data as of 12.31.19

HQ: Glendora, CA

ASSETS: $434.4M

MEMBERS: 115,177

BRANCHES: 2

12-MO SHARE GROWTH: 10.9%

12-MO LOAN GROWTH: 9.5%

ROA: 0.70%

At a board retreat three years ago,America’s Christian Credit Union ($434.4M, Glendora, CA) set a clear direction for the cooperative it wanted to become.

The credit union was emerging from a period of up and down loan and share growth, although both assets and members were increasing fast. Rather than brainstorm new products and services, however, the retreat focused on how the credit union could live up to and communicate how it was fulfilling its mission to reach, serve, and teach.

America’s Christian was founded in 1958 as Nazarene Federal Credit Union to serve the ministers and parishioners of the church as well as students and faculty of local Nazarene universities and colleges. In 1993, it expanded from a federal to a state charter, and in 2003, it added Wesleyan-based denominations to its field of membership and rebranded to its current name. Today, its religious affiliation allows the credit union to serve a nationwide membership, but most of its members residein California.

At that retreat in 2017, it developed four strategic pillars Stronger Ministries, Stronger Futures, Stronger Communities, Stronger Families that serve as de facto statements of purpose. The pillars establish a clear connection to the missionof the cooperative and tie back to the credit union’s products, services, and programs.

These pillars have focused our internal efforts, says Nicki Harris, America’s Christian’s chief financial officer. We still offer all the products and services members expect from a credit union. The pillarsjust highlight the why’ behind what we do.

America’s Christian Growth Rates

ASSET GROWTH

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Since 2011, America’s Christian has added nearly $200 million in assets with approximately half of that coming in in the past three years.

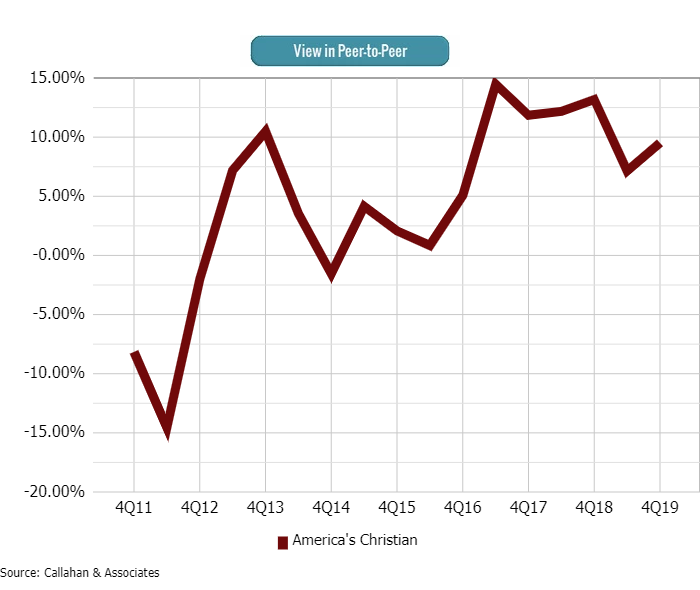

MEMBER GROWTH

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

America’s Christian attributes the spike in membership starting in 2015 to an influx of Health Care Sharing accounts originated at Medi-Share, a Christian care ministry that America’s Christian serves as a financial partner. The steady decline in members represents Medi-Share’s efforts to curb concentration risk by opening accounts at other financial institutions, says Nicki Harris, America’s Christian’s chief financial officer.

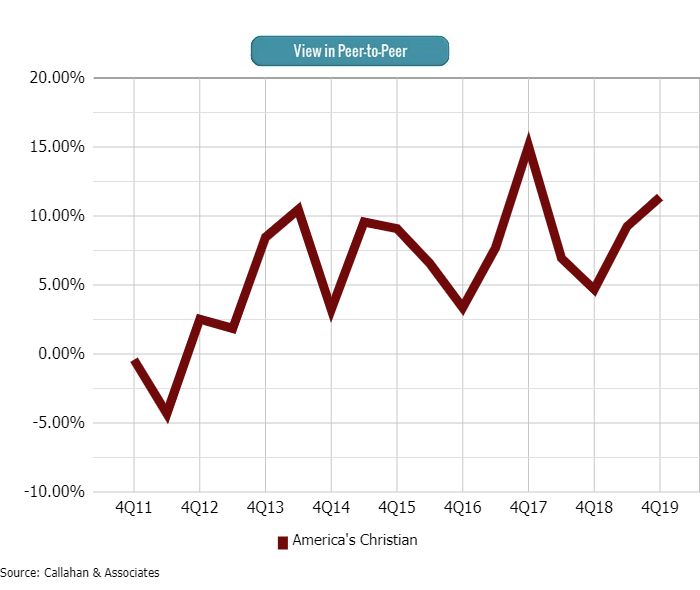

LOAN GROWTH

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Although the credit union makes approximately one-fourth of its loans to church building projects, its recent double-digit loan growth coincides with a newfound auto loan engine. In the fourth quarter of 2016, the credit union held $18 million in new and used auto. As of the fourth quarter of 2019, that portfolio totaled more than $50 million.

Stronger Ministries

According to Harris, the credit union has prioritized financing for church buildings and parsonages since 1993. According to data from Callahan & Associates, member business loans have comprised at least 39% of America’s Christian’s totalloan portfolio since 1998, when Callahan’s Peer-to-Peer data set begins. The vast majority of those loans are construction loans for churches.

We understand churches and the challenges they face, Harris says. We believe in what they do for their communities. This is one way we support that.

MBL LOANS / TOTAL LOANS

FOR AMERICA’S CHRISTIAN CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

For the past two decades, member business loans have comprised a large percentage of American’s Christian’s loan portfolio. During the recession, member business loans often accounted for 90% of its loan activity.

In addition to construction loans, the credit union offers business accounts and related services to ministry members. But, lending is its primary way of meeting their needs. Loans vary in size, from $100,000 to several million dollars , although Harrisestimates its average church construction loan is $700,000.

The fact that churches are non-profit entities makes church lending different from other forms of commercial lending. A church’s funds are typically donated from its parishioners, which can create irregularities in cashflow and complicate underwriting.America’s Christian has set requirements for debt coverage and debt-to-net worth ratios for the latter, it won’t finance projects that puts the church more than three times above its current net worth ratio.

A church’s main expense is in its property and staff, Harris says. Those are difficult to reduce quickly, which doesn’t give them much flexibility should cash flow fluctuate.

That said, the credit union gets to know church leaders to form a better sense of the organizational and governance structure before making a final decision.

We do spend the time to get to know them, Harris says.

Stronger Futures

America’s Christian works to provide tools for every stage of life. This includes credit repair services and auto loans which tend to appeal to younger members as well as mortgages and retirement accounts which tend to appealto more established ones. The credit union also works to build stronger futures through its support of education, especially Christian higher learning.

The credit union is a long-time partner of Azusa Pacific University, in Azusa, CA, and Point Loma Nazarene University, in San Diego. Additionally, it funds six annual scholarships for members attending Christian or non-religious colleges and universities.

In 2016, it funded the Economic Impact Study for the Council for Christian Colleges and Universities. According to Harris, Christian colleges and universities are experiencing challenges in federal funding. By funding the survey, the credit union hopedto enumerate the impact these higher learning institutions have in their communities.

Ultimately, the study revealed the work of Christ-centered institutions has an economic impact worth $60 billion annually.

Stronger Communities

To create stronger communities, America’s Christian donates time, money, and resources to numerous causes, charities, and foundations that hew closely to its religious ties.

For example, the credit union works closely with foster care and adoption agencies by providing thousands of dollars in charitable donations to organizations such as Harvest Family Life Ministries and offering financial education classes to current andformer foster youth. In July 2019, the credit union held three literacy workshops at Pasadena City College, where it taught budgeting, credit score building, and goal setting to dozens of college-aged former foster youth.

When kids age out of the foster care system, often they still need support and education to guide them through personal finance, Harris says.

Stronger Families

Adopting a child can be an expensive endeavor. Harris estimates the costs range between $20,000-$40,000 depending on whether the adoption is domestic or international.

There are a number of steps in the adoption process, from qualification to preparation, Harris says. Legal costs, agency fees, travel costs. It can be a financial burden.

If a family has the desire to adopt, it might not have the financial means to do so. To meet this need, America’s Christian has offered adoption loans since 2009 that cover up to $50,000. Recently, the credit union funded its 2,000th adoption loan.

The credit union also recently provided financial support to the Care Portal, a website that connects families in need of financial support or resources with churches, charities, or other families who can provide it. The credit union itself, along withseveral employees, are listed as a resource.

It might be a foster family in need of a bed or clothing, Harris says regarding the assistance the website facilitates.

Purpose=Impact

Purpose-driven organizations outperform the market, have an easier time attracting and retaining employees, and are changing the way businesses think about their roles and responsibilities to society.

Sustainable Business Strategy with Rebecca Henderson teaches credit union leaders that being purpose-driven is more than being a community-forward organization and helps them re-examine their part in ensuring the long-term prosperityof members, employees, communities, and the environment.

The Future

America’s Christian is not just a church lender. In the past three years the credit union has grown its auto loan portfolio by more than $30 million with more than 95% of that being direct loans and it hopes to continue this success.

To ensure it has an adequate operational foundation for future growth, the credit union will begin a core system conversion in 2020 and continue to evaluate its digital offerings to better support a national membership.

We are committed to our mission and our history, supporting ministries, churches, and communities, Harris says. But we don’t forsake the consumer side. We’re investing in the technology that helps us continue that on anational scale.