CU QUICK FACTS

MSUFCU

Data as of 12.31.18

HQ: East Lansing, MI

ASSETS: $4.2B

MEMBERS: 269,344

BRANCHES: 19

12-MO SHARE GROWTH: 9.5%

12-MO LOAN GROWTH: 11.8%

ROA: 1.13%

East Lansing, MI, is a company town. That company is Michigan State University.’

One of the largest public universities in the country, MSU counts more than 50,000 students and 12,000 staff. In 2018, the university welcomed its largest and most diverse freshman class ever, with more than 8,400 freshmen stepping onto the 5,200-acre campus. Forget Greece East Lansing is Spartan country.

Founded in 1937, Michigan State University Federal Credit Union ($4.2B, East Lansing, MI) is the world’s largest university-based credit union. It got that way by bleeding green and transforming its members financial lives as much as its namesake transforms professional ones.

Each organization provides an important resource for the other. For the university, the credit union provides financial education, products, and services tailored for students away from home for the first time. For the credit union, the university provides a young membership base in need of financial services.

BEST PRACTICE: LEAN INTO LIFE-LONG LEARNING

The gap between financial knowledge and smart behaviors is pronounced when teenagers walk onto campus for the first time. That’s why MSUFCU holds financial education events. It hosted nearly 800 events for more than 20,000 attendees in 2018.

This symbiotic relationship underpins the success of the credit union. In the past decade, MSUFCU has nearly tripled its assets, doubled its members, and opened an expansive, greenglass corporate headquarters to create its own East Lansing campus. In the fourth quarter of 2018, MSUFCU outpaced its asset-based peers in products per member and average member relationship. It beats peers as well as the industry by more than a decade when it comes to its average member age, which is 35.

But times are changing. Increasingly, new college students arrive on campus with checking accounts, graduates move to city centers where the credit union doesn’t have a presence, and rapidly evolving technology makes it increasingly difficult to keep up with consumer expectations.

A New Trajectory And More Branches

When April Clobes became CEO of MSUFCU in March 2015, she inherited a growing organization in good financial shape that didn’t require an organizational shift to achieve success. But she saw the credit union’s trajectory and the challenges that would arise as a result.

For one thing, a growing organization requires a stronger structure with more clearly defined internal policies and procedures. Clobes, in her role as a self-described chief communicator, set out to establish greater transparency and alleviate perceived gaps in structure before they became problems.

She s The Boss

In an industry where more than two-thirds of employees are women, that percentage is often not reflected in the C-suite, especially not at the largest credit unions. At MSUFCU, seven of the 10 senior-level staff are women, including its CEO, as well as 70% of staff.

I don’t think that should be so unusual at a credit union, says chief marketing officer Deidre Davis. We promote and hire based on skills, knowledge, and the ability to do a job.

We needed to focus on what structure meant for an organization of the size we were becoming, she says. But we also had to put in structure to support an organization of the size we already were.

The credit union started by updating its policies and procedures, which led to the creation of new executive positions to reflect those updates.

Five years ago, the credit union combined its technology teams into a single department overseen by a chief information officer. Two years ago, the credit union moved BSA, regulatory affairs, loss prevention, and adjustments from under the CFO to a newly created chief risk officer role. At the same time, the credit union merged card services and payment services under the oversight of an assistant vice president of payment sytems.’

MSUFCU also expanded its branch network to accommodate members post-graduation.’ According to a 2018 analysis of alumni moving patterns by the Wall Street Journal , nearly two-thirds of MSU graduates move to the nation’s largest metro areas, with Detroit, Chicago, and Grand Rapids landing in the top three.’

Click the tabs below to view graphs.

LOANS TO ASSETS LOANS TO SHARES

LOANS TO ASSETS LOANS TO SHARES

FOR MSUFCU | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

In the past five years, the loan portfolio at MSUFCU has grown quickly. Although the need for deposits is real, chief lending officer Jeff Jackson says the credit union is comfortable with its loan-to-assets and loan-to-shares ratios.

RETURN OF THE MEMBER

RETURN OF THE MEMBER

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

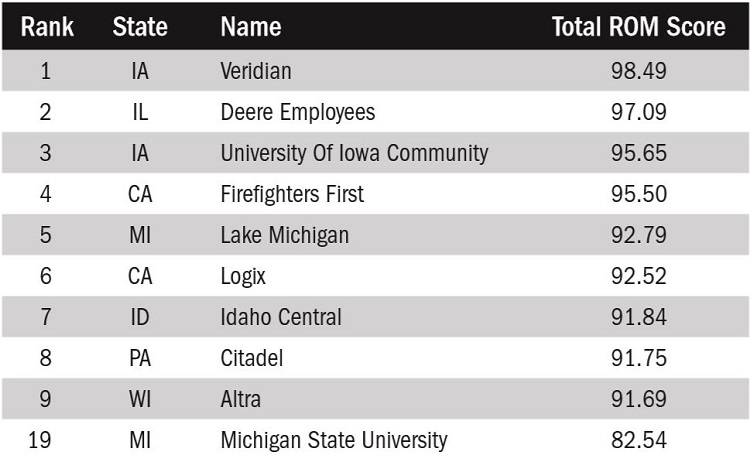

Among the 302 credit unions in MSUFCU’s asset-based peer group, the Michigan cooperative ranks 19th in Callahan’s proprietary member value metric that measures savings, lending, and product usage.

MEMBERS PER POTENTIAL MEMBERS

MEMBERS PER POTENTIAL MEMBERS

FOR MSUFCU | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

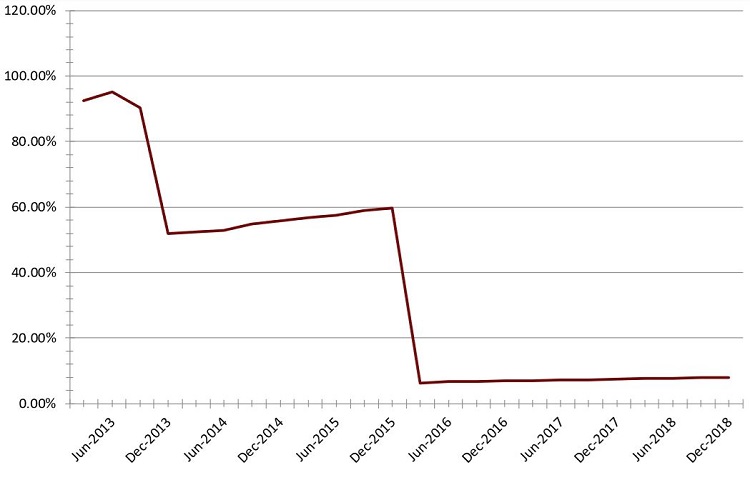

As recently as 2013, MSUFCU served nearly its entire pool of potential members, according to Callahan data. It added more than 2 million potential members when it moved into the state’s largest metro areas.

DIRECT VERSUS INDIRECT LOANS

DIRECT VERSUS INDIRECT LOANS

FOR MSUFCU | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

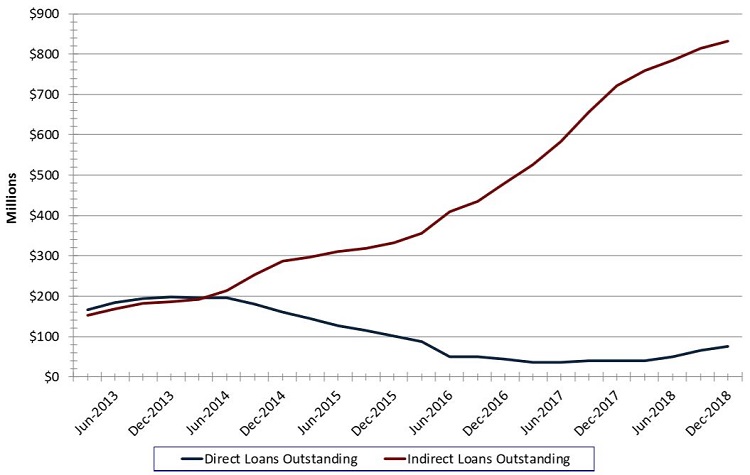

After auditing its indirect loan process, the credit union reduced several points of friction. By doing so, MSUFCU became more attractive to local dealers and, in the past five years, has increased its indirect loan volume many times over.

AVERAGE COST OF FUNDS

AVERAGE COST OF FUNDS

FOR U.S. CREDIT UNIONS $1B-$10B | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

In line with similarly sized credit unions, MSUFCU’s cost of funds has risen as the credit union tries to add deposits, specifically certificates, to its balance sheet.

AVERAGE MEMBER RELATIONSHIP (EXCLUDING BUSINESS LOANS)

AVERAGE MEMBER RELATIONSHIP (EXCLUDING BUSINESS LOANS)

FOR U.S. CREDIT UNIONS $1B-$10B | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

By following a simple mantra serve the member MSUFCU has historically outpaced asset-based peers in average member relationship.

MSUFCU has historically maintained a branch network in the cities and towns that comprise the greater Lansing area, as well as two Oakland University-branded branches in suburban Detroit. It now has a presence in mid-, southeast, and western Michigan and organizes branches into a regional structure headed by four assistant vice presidents.

As demographics change, our members leave the area and move into metro Detroit and Grand Rapids, Clobes says. We serve the university, so we’re creating a plan to be where our members are. ‘

DID YOU KNOW?

There are two definitions for Metro Detroit. The Detroit Tri-County Area covers parts of Macomb, Oakland, and Wayne counties. The Detroit-Warren-Dearborn Metropolitan Statistical Area, as defined by the Office of Management and Budget, includes all of Lapeer, Livingston, Macomb, Oakland, St. Clair, and Wayne counties.

As recently as 2013, MSUFCU was serving more than 95% of its potential membership base, according to data from Callahan Associates. In 2016, MSUFCU merged in $70 million Clarkston Brandon Community Credit Union, which served five counties in southeast Michigan. The merger extended the credit union’s potential member base by more than 2 million people, dropped its member penetration rate below 10%, and opened the door to growth in the counties where MSU graduates are moving.’

Knowing the awareness and new account activity a physical location can build, the credit union plans to open two branches in Metro Detroit by the end of 2019 and a third in the Lansing area in early 2020.’

The minute we put up Coming Soon’ signs, we see the excitement felt by our membership begin, says Lea Ammerman, executive vice president of member services. Six months before we start building, people start opening accounts with us. ‘

Kids These Days

College kids are different these days. A least, that’s what the data says.

Prior to joining MSUFCU, Deidre Davis, the credit union’s chief marketing officer, worked at another university-affiliated credit union for nearly 15 years. She’s seen the changes.

When students come to the school, they become proud Spartans and want everything to do with the university.

When students came to campus, they used to need to open an account where they were because merchants wouldn’t take out-of-town checks, Davis says.

And before the proliferation of digital banking, it was more difficult for students without local accounts to manage their money. Now, kids often open their first checking account at 13 instead of 18, Davis says, and they get a credit card at 15. Money is more mobile than ever, meaning fewer freshmen need accounts. In the case of MSUFCU, the credit union opened 3,798 new MSU student accounts in 2018.’

We used to open accounts for nearly 95% of the incoming freshman class, Davis says. Now it’s 45% to 50% because they come with a financial institution already. ‘

Considering these changes, the credit union has made a larger effort to market toward parents of students because they are more likely to sway the decision-making process. MSUFCU also has refined its product offerings to appeal to 18- to 28-year-olds to say nothing of the five age-banded youth accounts meant for members ages 0-17.

BEST PRACTICE: MAKE THE MOST OF SEGS

MSUFCU’s relationship with the school is a major benefit. When students come to the school, they become proud Spartans and want everything to do with the University, says chief marketing officer Deidre Davis. That includes banking with an institution with the same name.

The free checking product for MSU students is identical to the credit union’s Totally Green checking it moves members into once they graduate. That account offers free bill pay, e-statements, and a free quarterly FICO score update. As for credit cards, MSUFCU does not have a student product. Instead, students automatically qualify for the lowest interest rate on the credit union’s standard VISA products, even if they haven’t established a credit history.

Other financial institutions either won’t lend to younger individuals or they give them a higher interest rate, says Steve Owen, chief legal counsel. This is our way of engaging this audience and teaching them about the benefits of building a positive credit history.

MSUFCU thinks about its student members in terms of credit progression, says Jeff Jackson, chief lending officer. For members introduced to the credit union at a young age, their first loan product tends to be a credit card, which offers a convenient payment method for larger purchases.

You can’t really use cash or a debit card to buy your first set of books, Jackson says.’

From there, the credit union can move members into other products such as auto loans, mortgages, and home equity lines of credit.’

Retaining young members for the next 40 to 50 years is a priority at MSUFCU. Despite competing against national banks with a local presence, including Chase, PNC, and Bank of America, since 1998, the credit union has retained approximately 45% of student accounts opened. For recent students with accounts opened between 2014-2018 retention is an even higher 80%.’

Even so, the credit union wants to offer more for members who are further away from their college years. Later this year, it will roll out a rewards card richer than the 1% cash back it currently offers on its Platinum Plus card.’

As you grow and your finances mature, you start looking for more, says chief financial officer Sara Dolan.’

In the case of the new rewards card, it is geared toward members who are looking for a higher return or richer rewards.

BEST PRACTICE: DON’T LOOK FOR SILVER BULLET

When it comes to serving young borrowers, there is no silver bullet. There is no super-product that is going to change everything, says chief lending officer Jeff Jackson. What is valuable is taking the time to educate and explain the product to the new borrower. That’s critical to the whole process.

A Busy, Bright Future

The future for MSUFCU is as bright as it is busy.

In April, the credit union launched its foundation, the Desk Drawer Fund, supporting five philanthropic pillars: arts and culture, stable housing, empowering youth, financial education, and fostering entrepreneurialism. The name is a reference to where the credit union started in 1937, but it’s also a reminder to employees and members that the credit union, however large it might grow, hasn’t forgotten the core values on which it is founded.’

Although MSUFCU is no stranger to community giveback, the foundation allows it to focus on specific areas of philanthropic focus, says Whitney Anderson-Harrell, the credit union’s chief community development officer and the foundation’s executive director.’

After that, MSUFCU is narrowly dipping its toe into private student lending, says CLO Jackson.’

MSU’s College of Veterinary Medicine recently approached the credit union about providing a loan supplement for graduate students. The pilot program is limited to students in the vet school and the College of Osteopathic Medicine, but it’s been successful thus far, Jackson says.’

We’re taking it slow, focusing on Michigan State University students at this point, he says. It’s never going to have a huge balance sheet impact, but we hope it attracts graduate students and they become lifelong members. ‘

At year-end, MSUFCU’s assets totaled just north of $4 billion. With a larger pool of potential members, new branches, new loan programs, and a robust internal structure in place, it’s not hard to imagine the state’s thirdlargest credit union crossing the $10 billion threshold sooner rather than later. Good thing the credit union has invested the time and processes to be prepared when that day comes.’

We’re in a strong financial position, says CEO Clobes. We’ll continue to be successful if we do what we do well and take care of our members. I have the team to get that done. ‘

This article appeared originally in Credit Union Strategy Performance. Read More Today.

Wait, There’s More!

This is just one section of the Anatomy Of Michigan State University Federal Credit Union series that appears in Credit Union Strategy Performance. Read the whole discussion today.

READ MORE