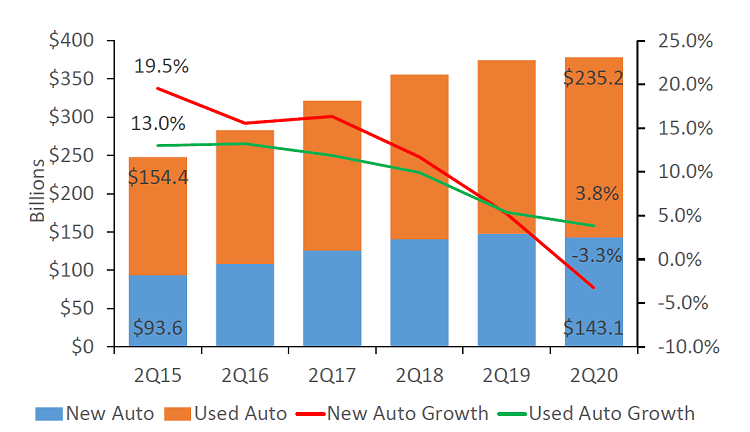

Vehicle sales in the United States slowed dramatically during the COVID-19 lockdowns. According to FRED Economic Data from the Federal Reserve, total auto sales decreased from a seasonally adjusted annual rate (SAAR) of 17.2 million in February to a lowof 9.1 million in April, the smallest monthly SAAR since 1981. Although reopening economies helped sales partially rebound in June, millions of lost sales significantly impacted lender balance sheets. Low interest rates helped offset a decline inoverall market demand for new vehicles. The direct-from-manufacturer financing captured new auto market share from financial institutions, where used auto purchases were the driving force for auto loan growth.

Key Points

- Auto loan balances expanded 1.0% annually at credit unions nationwide as of June 30. This is the slowest rate since 2011. Used auto loan balances grew 3.8% annually; new auto balances contracted 3.3%.

- Surpassing $378.3 billion, total auto balances comprised 32.9% of the credit union loan portfolio.

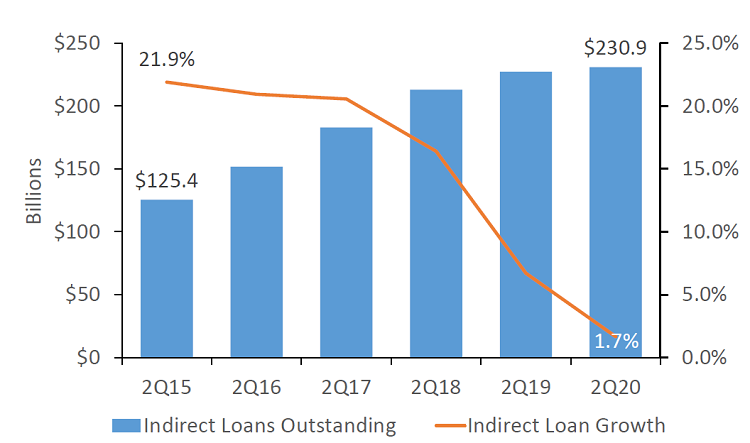

- Indirect loan growth has been slowing for more than a year and continued slowing into the second quarter of 2020. Total indirect balances rose 1.7% annually, 5 percentage points below the rate recorded in second quarter2019.

- Auto loan penetration fell to 21.0%, 25 basis points lower than last June 30 and 20 basis points lower than first quarter 2020.

NEW VS USED AUTO BALANCES

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Though indirect loans made up 60.9% of total auto loans at first quarter, indirect loan growth has slowed for three consecutive years. This is a major factor in decreased auto loan growth at cooperatives nationwide.

INDIRECT LENDING

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Indirect loan balance growth continued to slow in the second quarter of 2020 and hit the lowest rate since 2011.

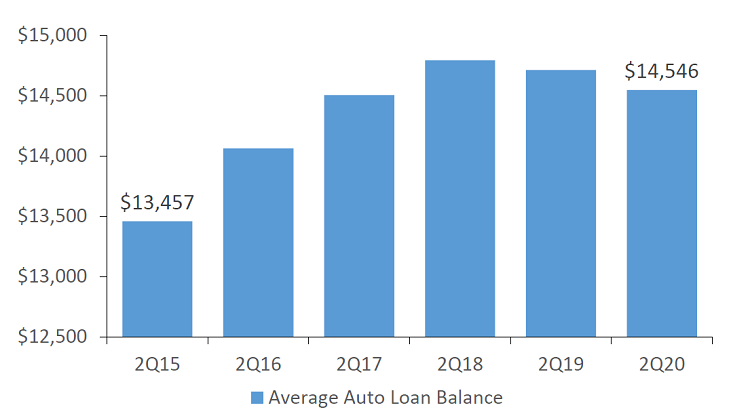

AVERAGE AUTO LOAN BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Consumer demand for off-lease and other used vehicles led to a decline in the average auto loan balance for the second consecutive year.

The Bottom Line

The credit union industry began changing its auto lending strategy in 2018 with a pronounced pullback from indirect lending, which had been a primary source of growth during the previous decade. When COVID-19 hit, this decline in available lending channelscoupled with a slowdown in consumer spending doubly impacted credit union balance sheets. Auto lending growth fell to decade-long lows, and average auto loan balances fell as members financed less expensive used vehicles. Auto delinquency remainshistorically low at 0.47%.

This article appeared originally in Credit Union Strategy & Performance.