CU QUICK FACTS

Member One FCU

Data as of 03.31.16

HQ: Roanoke, VA

ASSETS: $778.3M

MEMBERS: 95,209

BRANCHES:14

12-MO SHARE GROWTH: 10.2%

12-MO LOAN GROWTH: 10.3%

ROA: 0.72%

Change of any magnitude is a challenge for an organization, but evolving salary structure requires significant planning as well as great diplomacy.Member One Federal Credit Union ($761.8M, Roanoke, VA) experienced this firsthand when it changed how it pays mortgage lenders.

We wanted to begin rewarding and compensating our mortgage loan officers the same way the competition outside the credit union industry was, says Richard Socha-Mower, director of consumer and real estate lending.

This is in contrast to Member One’s historical stance of paying a smaller incentive but a larger base salary. And Socha-Mower knew pay scale would not be the only change.

A Need For More Change

To close more mortgages, Member One also extended business hours to include evenings and weekends.

We needed MLOs who were willing to take calls and meet with members during extended hours, Socha-Mower says. Our new compensation model was the incentive for that.

We also wanted real estate professionals to know we had a lending staff that knows the industry and are partners for them, he adds.

In addition to staff availability, flat mortgage growth was another push to the new pay model.

There was no incentive for MLOs to bring in more volume, so we decided to help them increase their compensation by driving more business to us, Socha-Mower says.

Industry regulations require Member One to maintain specific pay parameters for MLOs, but Socha-Mower recognized the opportunity in offering incentives.

You have to incent the behavior you want, he says. To inspire MLOs to own what they do for the credit union.

According to Socha-Mower, data shows the mortgage industry standard is tipping toward a commission-only model, but Member One executives settled on a combination of a lower base salary and higher incentives.

What MLOs produce in volume today is up to them, Socha-Mower says of the new model.

And providing a good base salary and strong incentive pay precludes a focus only on producing volume rather than serving members.

Don’t reinvent the wheel. Get rolling on important initiatives including incentives plans using documents, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to the credit union’s needs. Visit Callahan’s Executive Resource Center today.

Implementing The New Pay Strategy

Executing the new compensation model meant recruiting the right MLOs, and many of the credit union’s former MLOs transitioned to other roles at the credit union.

We knew this would attract a certain type of candidate, Socha-Mower says. The candidates we hired knew they had to be salespeople who could build strong relationships with members and real estate agents.

The new model also requires a restructured onboarding process. No longer do MLOs immediately begin taking applications. Instead, they work from the real estate center in Roanoke headquarters in a process that takes 30-90 days, according to Socha-Mower.

For more experienced MLOs, the process takes fewer days, but the credit union doesn’t want to send MLOs into the field until they know how to take an application in accordance with both industry regulations and Member One’s mission, the Member One executive says.

The latter is why new employees spend their first day in orientation learning about the Member One culture and business focus, which is driving member value over generating mortgage volume.

All new MLOs and other employees learn that our mission is serving the individual member sitting in front of us, not just their own or credit union interests, Socha-Mower says. It doesn’t matter how little or how much they apply for, we serve every member the same way each time.

We needed MLOs who were willing to take calls and meet with members during extended hours. Our new compensation model was the incentive for that.

So, MLOs don’t learn about systems or application processes during initial orientation. The message that first day underscores how the team works together to create an experience members tell their friends, family, and colleagues about.

In the days that follow, MLOs learn back-office procedures to understand how Member One’s 10-member real estate team cooperates to serve members. Then, MLOs get systems training. Only after they have some proficiency in those areas do they begin working with experienced MLOs to take applications.

Software helps our MLOs complete applications correctly, but we won’t send any out until they can complete a comprehensive and compliant application while educating the member and keeping them happy with the process, Socha-Mower says.

That’s when Member One sends MLOs into the community to build the network that attracts mortgage business and grows volume.

Find out how your credit union is performing in your market and beyond. BranchAnalyzer provides deposit data and demographic insights to identify branching opportunities and analyze competition across the country or in your own backyard. Learn More.

Mortgage Volume Growth Follows Member Satisfaction

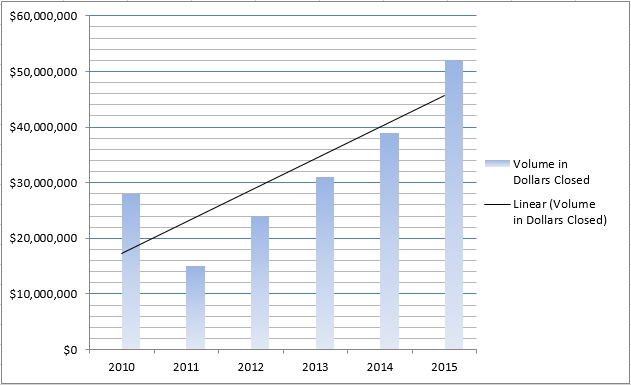

According to Socha-Mower, Member One’s volume in dollars closed since implementing the new pay structure in 2013 has increased 117% from $24 million in 2012 to $54 million in 2015. Socha-Mower believes that’s largely because members are pleased with the credit union’s strategy to shift service hours to accommodate them.

The lending leader also says Member One has learned a lot during the process.

We’ve learned not to be afraid to question our compensation model or business strategy and make changes, Socha-Mower says.

Other lessons include the importance of including current employees in structural changes, transitioning without harming those relationships, and allowing employees to shift into new roles.

Your employees are your greatest assets, Socha-Mower says. To perform and beat your competitors, make sure employees are motivated and respect for you.

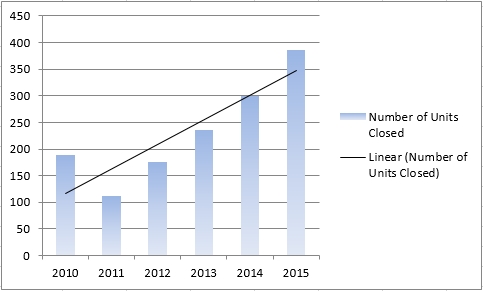

| NUMBER OF UNITS CLOSED For Member One FCU | Data as of 12.31 Callahan & Associates | www.creditunions.com |

|

|

|

| The dollar volume and number of units in mortgages closed in the past five years has increased at Member One. Source: Member One Federal Credit Union | |

A Strong Culture Means Fewer Challenges

Socha-Mower admits there are a few things he would change if he was launching the program again.

We would have been more aggressive in marketing our new hours, he says. That’s where the business increase came from, being able to grab members outside market hours.

He would also have a more formal structure already in place for new MLO onboarding to instill the Member One culture.

Our mission remained the same to get our mortgage product out to as many members as possible who could take advantage of our great service to get the right loan product for their needs, he says.

Socha-Mower says he’d also be better prepared for a new kind of recruitment.

We thought the new compensation structure would be enough to attract new talent but we didn’t get as many calls as we expected, Socha-Mower recounts. So the credit union turned to internal leaders to generate leads for solid, qualified MLOs.

Despite a few hiccups in the pay strategy transition, the resulting mortgage growth has supported many positive metrics. For example, members who have mortgages at Member One have an average of four products versus an average of two for non-mortgage members.

That brings us a lot of PFI relationships, Socha-Mower says

And those members with primary relationships aren’t shy about telling the credit union what they think.

Our members are writing notes to us to tell us how happy they are about the new hours and how positive their experience with our new MLOs has been, Socha-Mower says.

By exceeding member expectations, going beyond standard hours and standard service, and paying more for production, Socha-Mower says, the credit union went from closing $2 million a year in mortgages when he started in 1999 to more than $50 million last year.

It’s where we’ve been trying to get since the beginning, he says.