The Federal Reserve is battling to keep inflation in check, and pricing increases remain a primary concern for financial markets. The Consumer Price Index (CPI) rose 7.0% year-over-year in December. That’s the highest inflation level reported since the 1980s. The Fed responded to the CPI data by confirming it would conclude tapering in March and raise interest rates shortly thereafter.

Initially, economists expected three hikes of 25 basis points each in 2022, but signals from the Fed caused economists to adjust that to at least five rate hikes. Ongoing conflict in Ukraine has caused further uncertainty around which actions the Fed will take. Beyond rate increases, markets anxiously await any word on what the Fed will do to normalize the nearly $9 trillion balance sheet it has amassed, much of that during the past two years.

Key Points

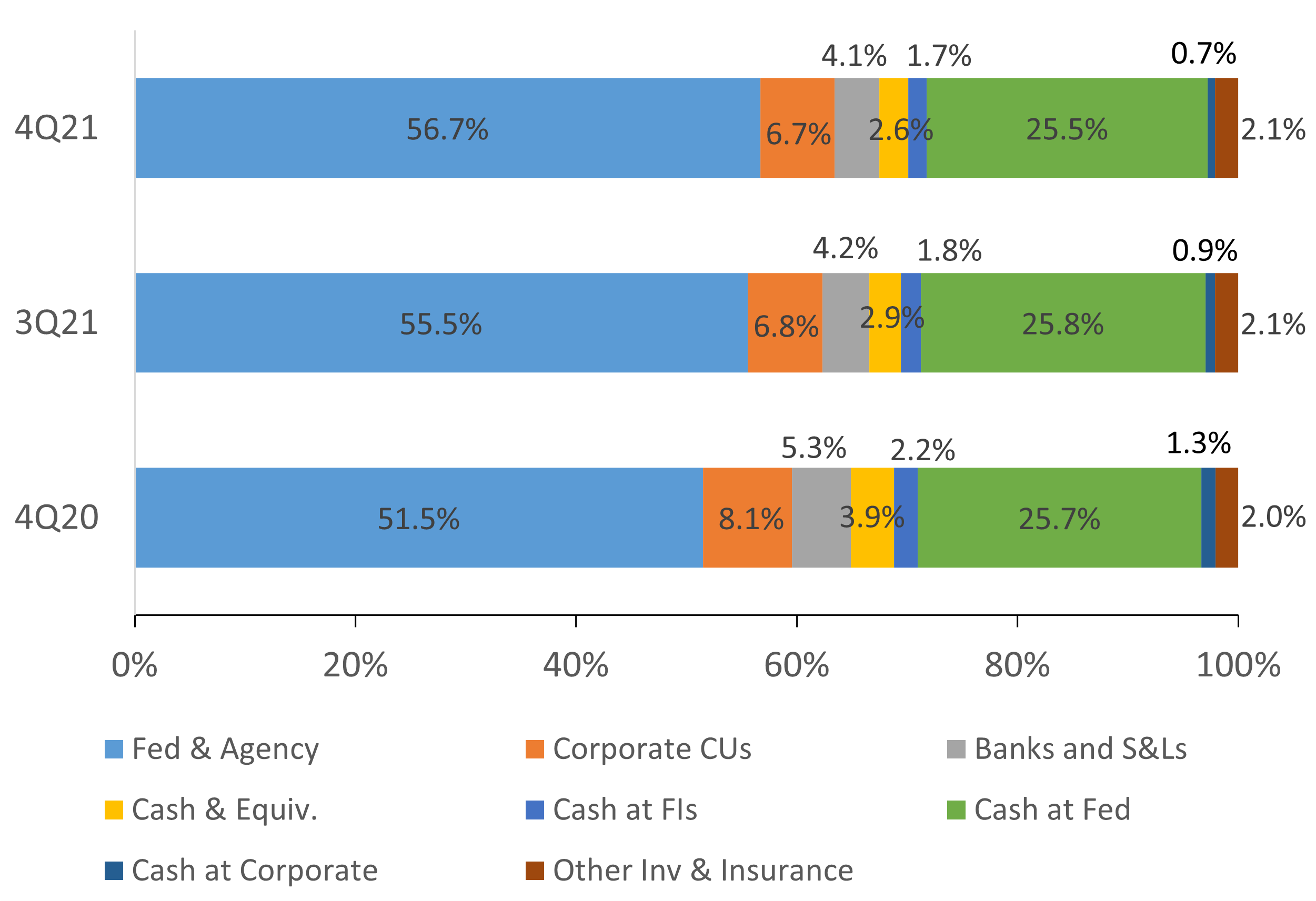

- Total investment and cash balances reached $721.3 billion at the end of December, up 19.9% from one year ago but just 1.6% from last quarter. Cash balances comprised 36.4% of total investments at year-end, the lowest portion since December 2019.

- Credit unions moved cash into higher-yielding U.S. government and agency securities, which comprised 56.7% of the total portfolio in the fourth quarter up 1.2 percentage points from the previous quarter.

- The weighted average life of the credit union investment portfolio lengthened to 2.39 years, up from 2.32 last quarter, as credit unions moved cash to longer-term securities.

INVESTMENT PORTFOLIO COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

Investment balances, including cash, grew 1.6% quarter-over-quarter. Fed and agency balances expanded as credit unions converted cash to higher-yielding loans and securities.

TREASURY YIELD CURVE RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

Yields in the middle of the curve are the most sensitive to Fed action in the short-term. They increased in response to expectations of several rate hikes in 2022.

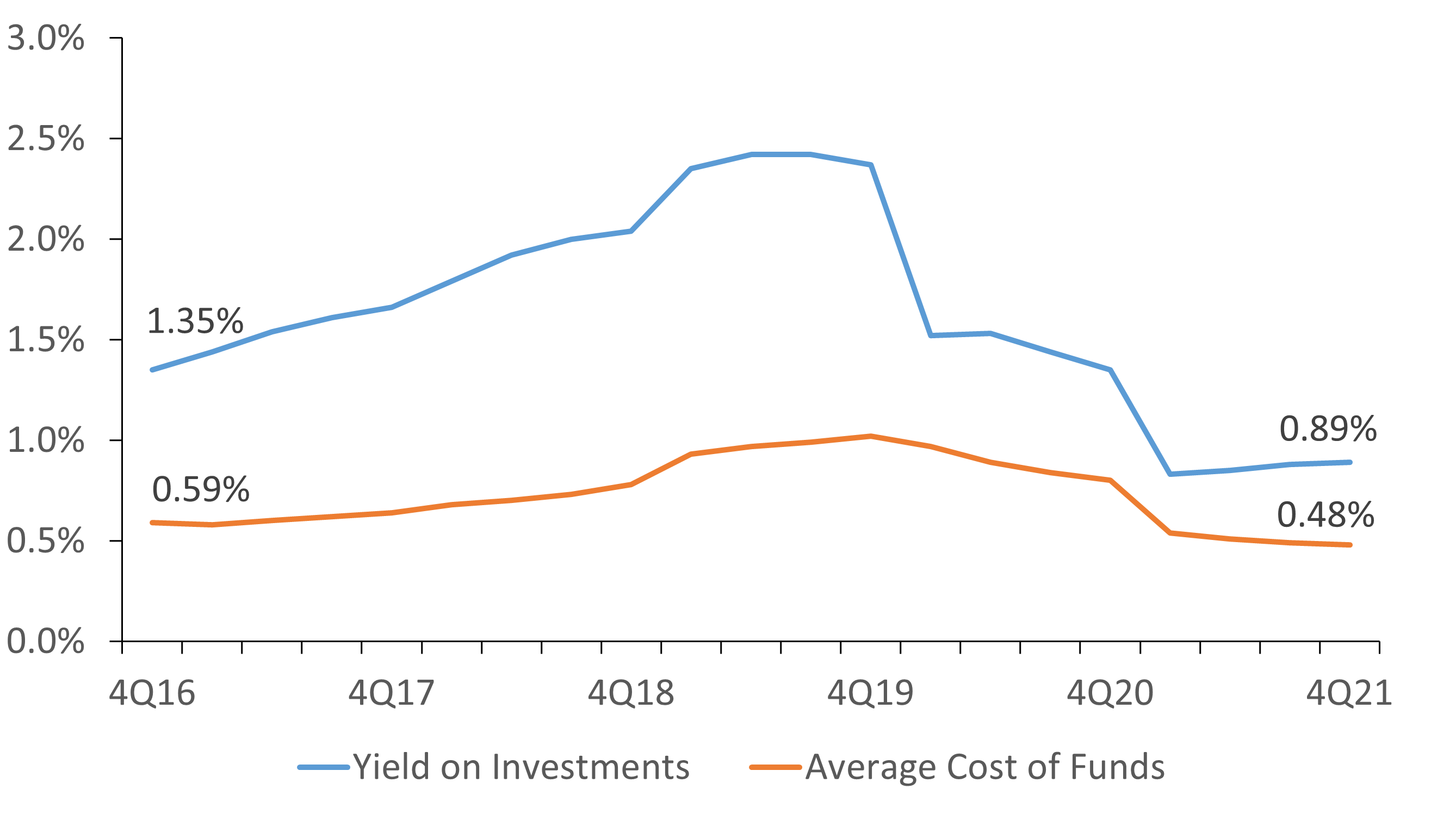

YIELD ON INVESTMENTS AND COST OF FUNDS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

Cash balances declined 1.2% in the quarter, and credit unions invested funds in securities in the middle of the curve, particularly the three-to-five-year maturity range. Consequently, the average

The Bottom Line

With share growth slowing down and loan balances sticking to balance sheets, credit unions are allocating less money to investment portfolios. Cooperatives are using cash which declined 1.2% in the fourth quarter to meet rebounding loan demand and invest in higher-yielding securities and investments. Balances of the latter expanded by $14.6 billion in the fourth quarter, with most of the money flowing into U.S. government and agency obligations.

Credit unions increased holdings of securities in the three-to-five-year maturity range, finding value in these mid-terms as yield curves adjusted to Fed announcements. Although loans are usually the preferred credit union asset, additional earnings from investment portfolios are welcome from an interest spread management standpoint.

Read the full analysis or skip to the section you want to read by clicking on the links below.

|

AUTO |

EARNINGS |

HUMAN CAPITAL |

|

INVESTMENTS |

LOANS |

MACRO |

|

MEMBER RELATIONSHIPS |

MORTGAGES |

SHARES |