IH Mississippi Valley Credit Union ($1.7B, Moline, IL) is helping members achieve financial health and wellness by focusing on the organization first, then reaching out to its circles of stakeholders.

Executing on that philosophy is the responsibility of Ann McMillian, the Prairie State cooperative’s chief financial health officer. McMillian is now in her 21st year with IHMVCU, where she began in internal audit and has since held the titles of vice president of operations, executive vice president of sales, and chief operating officer. At her behest, she took on her new role in January 2020.

“The irony is not lost on me that my title change happened right before COVID-19 and the economic shutdown,” McMillian says.

Here she explains more about what the role of chief financial health officer entails at IHMVCU.

Is the chief financial health officer a new role at IHMVCU?

Ann McMillian: Yes and no. The title itself is new, but I believe financial health is part of every role at a credit union. All credit unions have a mission of financial health. As an industry, we just recently started using that term to define it.

Why did IHMVCU create this role and choose this title?

AM: Our board and management team adopted what we call our dimensions of success. If you picture a target, the outer rings include safety and soundness, a focus on digital, and member and staff experience. At the center, the bullseye, is financial health.

We need to be a safe and sound organization, with frictionless digital processes and a well-trained staff to deliver a great member experience to really help members improve their financial health. That bullseye is the center of our strategy, so my CEO wanted a position to reinforce that internally and externally.

Did the credit union create this role for you?

AM: Yes. I pitched the title to my CEO, and he liked it. My CEO knows my passion lies with helping members and how fascinated I am with behavioral economics concepts around financial health. Chief financial health officer just made sense.

What challenges and opportunities does this role address?

AM: The biggest challenge is that our business is all about human behavior, and humans are irrational and unpredictable. For example, it’s not that members don’t know they should be saving for an emergency; of course they know! It’s figuring out why they aren’t saving or can’t save and help them automate saving so they don’t have to think about it. It is tough because every member values money differently.

Figuring out the best way to help a member with their individual situation is a loyalty-building opportunity. We can nudge them in the direction that is right for their situation, but, ultimately, it is the member’s decision.

Training our staff to have empathy for every financial situation is a challenge, but it creates an opportunity for us to help with back-end digital automation. The goal would be neither the member nor the employee has to manually lift a finger. Saving just happens automatically at the right time, in the right amount, and helps a member increase their wealth.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What made you a great fit for this job?

AM: I have a well-rounded understanding of how all areas in our organization work. I also have a degree in finance, but this position is more about the psychology of people versus financial acumen. I spend a lot of my time researching behavior.

What qualifications should someone in this role hold?

AM: A passion for finding ways to help people is No. 1. You also must be willing to challenge the status quo and be willing to change processes to remove friction. Don’t be afraid to experiment, either. All too often we get stuck in our financial institution brains and we don’t consider how members actually want us to deliver service. I try to view interactions through the member’s lens.

CU QUICK FACTS

MISSISSIPPI VALLEY CREDIT UNION

DATA AS OF 12.31.20

HQ: Moline, IL

ASSETS: $1.7B

MEMBERS: 136,676

BRANCHES: 12

12-MO SHARE GROWTH: 20.9%

12-MO LOAN GROWTH: 8.6%

ROA: 0.44%

Who do you report to? Who reports to you?

AM: I report directly to the CEO. Currently, I have human resources, learning development, business development, and community outreach all directly reporting to me. I work closely with strategic initiatives, marketing, retail, and others on product and marketing rollouts.

What are your areas of responsibility?

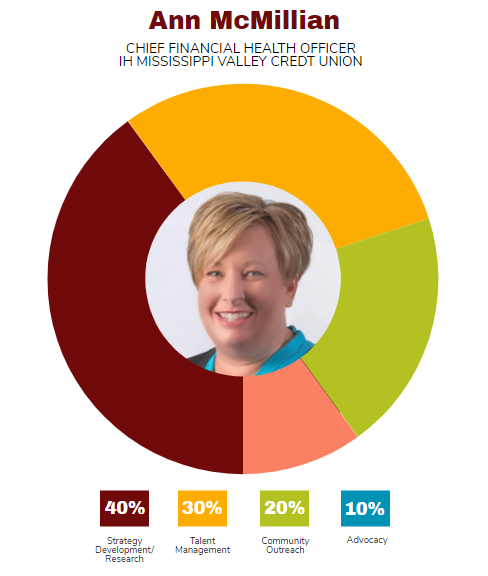

AM: I am the executive-level champion of financial health throughout the organization. My top responsibility is to support the CEO and the board of directors with our strategic initiatives, specifically with my areas of responsibility being on people and community.

One of the driving factors to delivering financial health to members is having the right team members. I work closely with our human resources department to ensure our talent management needs, both current and future, are being met.

I also strive to bring the vision to life through our community outreach, CDFI, and low-income designation initiatives. And I steward our local and national advocacy efforts as well.

What’s your daily routine?

AM: Every day seems to be different, which I like. Mornings are usually spent catching up on emails and attending meetings. I do spend a lot of time researching through reading, attending webinars, listening to podcasts, etc. I like to look outside of the credit union space to expose myself to new ideas, especially around behavioral economics. And did I mention I attend meetings?

Has COVID-19 changed strategies and tactics at IHMVCU? How have you played a role in that response?

AM: I wouldn’t say we changed our strategies or tactics during the pandemic we enhanced what we were already doing while shifting some priorities around.

The executive team’s biggest concern when the pandemic hit was for our employees and their families. Our business continuity group met daily to address how to keep our employees safe, healthy, and employed so income and benefits weren’t a stress factor. Since human resources reports to me, that was a big component at the beginning of the pandemic.

We also shifted a lot of our community donation budget to COVID relief. We took advantage of an FHLB matching grant program so we could provide capital to small business owners. We also contributed to the Iowa Credit Union Foundation’s emergency COVID relief grants. We are currently applying for the CDFI’s Rapid Response Program so we can put needed capital back into our community.

A passion for finding ways to help people is No. 1. You also must be willing to challenge the status quo and be willing to change processes to remove friction. Don’t be afraid to experiment, either.

How do you track success in your job?

AM: We’re still refining our member-level metrics for a defined, trackable financial health journey for our members. Right now, I feel like we are successful at IHMVCU when I hear our staff using the terms around financial health in conversations. Several of our team members have become certified financial counselors, which is great to build empathy.

It’s an ongoing process, but ultimately deepening relationships and creating even more loyalty with members is a measure of success. Patience is important when it comes to financial health it doesn’t just happen overnight.

How do you stay current with topics that fall under your role?

AM: I’m a member of Filene’s Think Tank. It’s a fantastic group of influential leaders that help drive credit union research and innovation. I’ve been an attendee and speaker at the CU FinHealth conferences put on by the National Credit Union Foundation (NCUF), Cornerstone Foundation, and the California and Nevada Credit Union Leagues.

I’ve participated in a couple of small convenings hosted by the NCUF and CUNA for like-minded credit unions and researchers around the evidence and next steps around financial health. The Financial Health Network’s EMERGE conference is a great resource. There are plenty of articles and people out there focused on this work.

This interview has been edited and condensed.