Naming the first chief relationship officer for CAP COM Federal Credit Union ($2.6B, Albany, NY) was a matter of the right person being in the right place at the right time.

Susan Fogarty who has experience in marketing, sales, and wealth management joined CAP COM in May 2019 after serving as executive director of the Palace Performing Arts Center in Albany.

There, she spearheaded a project to restore the historical landmark. Here, she shares talks about her new role in helping CAP COM make the most of its restructuring under a member-impact umbrella.

Is the chief relationship officer a new role at CAP COM?

Susan Fogarty: Yes. As our former president and CEO retired, the senior team was restructured to include an additional leadership position and alignment of member-facing teams. In addition to our CEO, I’m one of five chief officers including our EVP/chief financial officer, our chief technology officer, chief lending officer, and chief investment officer.

When and why did the credit union create the title?

SF: When we transitioned from the prior CEO to our current one, there was an opportunity to structure several areas under a member-impact umbrella. As CRO, I oversee the credit union’s marketing and public relations, community relations, business development, retail branches, customer service, deposit operations, and card divisions. I lead a cross-functional team to advance financial wellbeing and deliver guidance and service to CAP COM members and their families.

Did the credit union create the role for you?

SF: It was functionally the right choice for the credit union in our evolution as an organization, and I have a unique background that encompasses sales, marketing, and wealth management.

What challenges does the role of chief relationship officer address?

SF: As with most credit unions, we face the challenge of providing best-in-class technology along with best-in-class service and financial guidance. The Amazonification of the service sector has challenged us all to be more nimble, accelerate our speed to market, and provide easy user solutions.

CU QUICK FACTS

CAP COM FCU

DATA AS OF 03.31.21

HQ: Albany,NY

ASSETS:$2.6B

MEMBERS:144,368

BRANCHES:12

12-MO SHARE GROWTH:24.6%

12-MO LOAN GROWTH:9.5%

ROA: 1.71%

In today’s world, many financial institutions have had to choose which sector they want to serve and are not in the business to be all things to all people. We’re constantly finding ways to serve all CAP COM members while staying cutting edge, growing our business, and advocating for members.

What opportunities does the role address?

SF: Every challenge is an opportunity. The opportunity to sharpen our pencils in how we go to market. How we present ourselves as financial professionals in our branches and contact centers. How we innovate deposit and payments solutions. And most importantly, how we bring more members into the credit union fold allowing more people to experience the excellent rates, high service levels, and unparalleled advocacy.

How does your role positively impact members at CAP COM?

SF: My role is to empower CAP COM employees to make smart, member-centric decisions through continued training, recognition, and coaching. Working with our team of leaders, we must continually model smart, efficient business decisions along with compassionate, empathetic leadership. The way to create positive member impact is to create positive employee impact. I’m very lucky because CAP COM has systems and processes in place for training, recognition, and employee development that support our organizational goals.

As the chief relationship officer, how can you ensure current and future members enjoy a full relationship with CAP COM?

SF: I work with our teams to make sure everyone is educated in our full range of products and services. That means reinforcing the value proposition of our great rates, full product suite, and advice from a range of financial professionals. We want our teams to be passionate about bringing in new members, helping single-service members discover more about how we might help them, and not being afraid to invite people to do business with us.

What makes you a great fit for this job?

SF: Having experience from large global companies to startups has given me a great education in best practices. I spent the first 17 years of my career in sales and marketing in the music industry. I was part of team that helped launch Richard Branson’s Virgin company in 1997, and I also spent time at RCA during the launch of the American Idol series. I also got to see the profound impact of digital distribution on the music industry and am aware of how quickly the landscape can shift.

In 2003, after the sudden death of my father who was only in his 50s, I helped my mother settle his estate. We were lucky we had resources, but it was complex, and I started to think about a career in finance. I started my Certification in Financial Planning(CFP) and then began what is now a 13-year career in banking, spending most of that in private banking and wealth management. I became a Certified Wealth Strategist, and I like to think I have my finger on the pulse of what people really need from their financial advisors and institutions.

Who do you report to? Who reports to you?

SF: I report directly to CAP COM CEO Chris McKenna. Chris became CEO shortly before I came on board and has a clear vision for growth and success. I always consider it part of my role to make sure we’re delivering on that vision. He’s very collaborative with our senior team and sets a tone where everyone has a voice. That allows us to do the same with our people.

I have five direct reports the vice president of marketing, the director of community engagement, the vice president of member services, the director of deposit and payment operations, and a senior relationship manager for strategic partnerships. I am continually motivated by the team of leaders I get to lead they are smart, talented professionals who bring their best self to their roles every day. I get a lot of joy watching them grow in their careers and continue to make a great impact on the success of CAP COM.

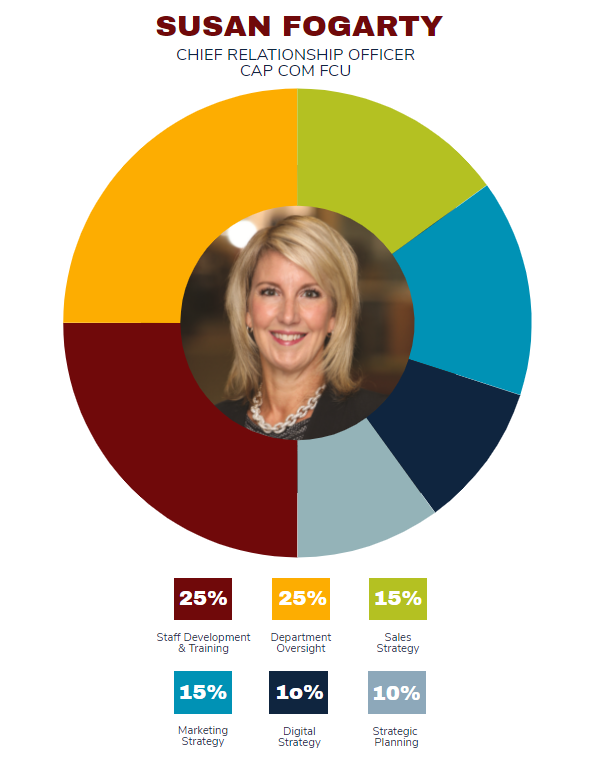

What are your areas of responsibility?

SF: I oversee the credit union’s marketing, community relations, public relations, business development, retail branches, contact center, deposit operations, and card divisions. These areas encompass approximately 200 employees.

What is your daily routine?

SF: Most days I try to start my morning with a run. Then it’s organizing the day and getting kiddos out the door or awake in front of a computer these days!

Most of our teams have early morning huddles. When I can, I jump into a quick, informal virtual meeting. Throughout the day I’m lucky to have a variety of meetings and events that fuel my fire. I might be speaking on a Chamber of Commerce mentoring panel or having a one-on-one with an employee. Or I might be in a digital strategy session or senior team meeting.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

I love being a part of big-think, strategic planning and watching it come to fruition. But what really fills my bucket is when I get time with our employees either through the monthly new employee orientation, my team meetings, or skip levels.

How has COVID-19 changed your strategies for positive member impact at CAP COM?

SF: The pandemic forced us to make quick decisions around how to keep our employees and members safe. We shifted and moved at least 75% of our employees to work-from-home situations. We made quick decisions at the branches about closing and reopening and after shutting lobbies temporarily at the height of the pandemic we have been fully open throughout this latest phase.

Like most credit unions, we quickly implemented digital solutions to help employees and members. The team came together quickly and, in the end, our company thrived in 2020.

How do you track success in your job?

SF: Through the success of our teams, our impact on the communities we serve, the growth of our business, and the satisfaction of our members.

We measure the success of our teams in several ways and often refer to corporate goals. We have an ongoing digital survey system as well as an active social media monitoring team and, of course, we review of our Net Promotor Scores.

We also consider how much we empower leaders to feel a sense of ownership over their area. Are they innovating and creating efficiencies and new ideas? Are they leading with passion and vision?

Finally, we measure our impact to the community through dollars donated and employee volunteer hours.

How do you stay current with topics that fall under your role?

SF: It’s important to keep up with credit union trade publications and other resources like Callahan. I’ve benefited greatly from the Callahan roundtables and publications particularly being relatively new to the credit union space.

Locally, I am an active board member of our regional hospital, I participate as a mentor for events sponsored by the Chamber of Commerce and local business publications, and I continually network throughout the community.

I also like to read books by leaders in business and sports. Phil Jackson’s Sacred Hoops and of course books by my former boss, Richard Branson, are some of my favorites. I seek out Bren Brown’s talks on YouTube to improve my EQ as a leader. I am also a New York Times Sunday edition subscriber. I find new ideas in the various sections of the paper every weekend.

This interview has been edited and condensed.