Providing credit to members is one major way credit unions demonstrate their value. Cooperatives’ rates and fees are often lower than competitors, which helps members save money on pricey products.

Last year was a banner year for lending. Credit unions capped off the third quarter with 19.1% year-over-year loan growth, nearly triple the annual rate of deposit growth. This marks the highest annual loan growth rate on record for the industry in the third quarter and the third consecutive quarter of double-digit growth.

The prognosis is not all rosy, however. Although the industry’s membership base increased 4.3% year-over-year, corresponding growth in origination dollars did not follow suit. That was up just 2.2% year-over-year.

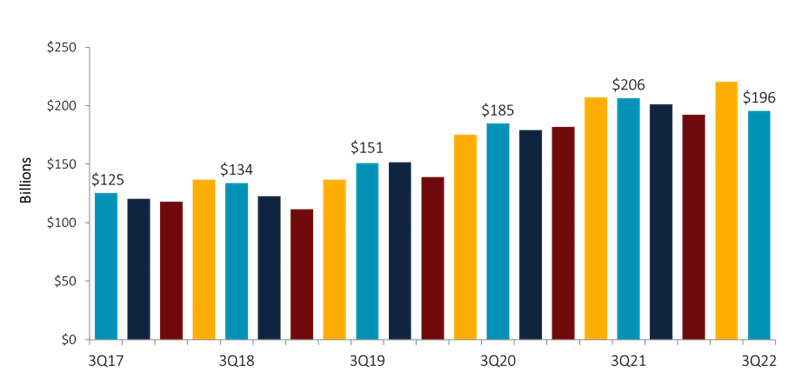

Year-To-Date Loan Originations

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Credit unions originated $195.5 billion in new loans during the third quarter and $608.3 billion year-to-date. This, in part, was reflective of increasing asset prices due to inflation. With 9.5% year-over-growth, consumer loans powered annual origination dollar growth at credit unions in 2022 and more than offset the 6.7% decline in real estate originations. However, whereas the dollar amount of originations increased, the number of loans granted decreased 9.6% annually to 28.0 million.

On a quarterly basis, the dollar value of loan originations decreased 11.3% despite adding $195.5 billion to the books. Credit unions granted fewer dollars to real estate and consumer loans in the third quarter compared to the second quarter. The number of originations, which was down 14.9%, suffered its worst third quarter-over-quarter in two decades. Both the loan number and the loan amount that credit unions granted declined heavily in the third quarter following a prosperous second quarter. Perhaps unsurprisingly, higher interest rates are the main culprit behind the slowing pipelines.

Quarterly Loan Originations

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

During the height of the pandemic, real estate originations grew at an annual rate of more than 70.0%. Fixed-rate first mortgages primarily drove this growth with originations that grew at a three-digit pace for several quarters. As the pandemic hit and members were stuck at home, many opted to take advantage of the near-zero rates to buy property for the first time or change their scenery. Now, as the Fed attempts to combat inflation, the real estate market is cooling off. Rates are rising, and the tides are turning.

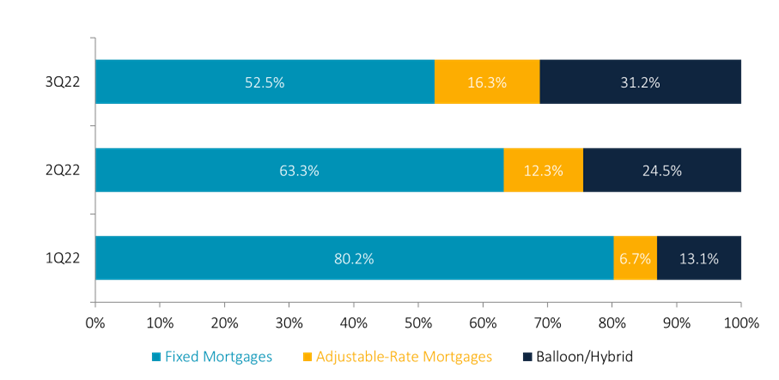

Despite softening home prices, real estate dollar originations at credit unions contracted 6.7% in the first three quarters of 2022. At $156.1 billion, residential first mortgages made up 62.5% of total real estate originations and 25.7% of all loan originations. Adjustable-rate and balloon/hybrid residential first mortgages accounted for a growing portion of first mortgage originations throughout 2022. The concentration of ARMs grew 9.6 percentage points from the first quarter to the third and comprised 16.3% of new residential first mortgages as of Sept. 30. Similarly, balloon/hybrids were up 22.8 percentage points from the first quarter to the third to comprise 31.2% of new mortgages as of Sept. 30.

First Mortgage Originations By Type

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

According to Freddie Mac, quarter-end rates for the 30-year fixed rate mortgage, 15-year fixed rate mortgage, and 5-year adjustable-rate mortgage more than doubled from one year ago to 6.70%, 5.96% and 5.30%, respectively, as of Sept 30. Rates this high haven’t been a part of economic life for Americans since the housing bubble of the late 2000s. As rates rise, members opt for adjustable-rate products — and their generally more affordable initial monthly payments — over fixed ones. Still, continued economic uncertainty, the Federal Reserve’s aggressive rate hikes, and a housing market plagued by low inventory are all combining to limit homebuyer demand.

Real estate originations might be slowing, but credit unions are generating loans at near historical highs in terms of dollars, and higher yields are incentivizing credit unions to hold onto mortgage loans rather than sell them. However, record loan growth and slowing deposit growth could lead to potential liquidity issues.

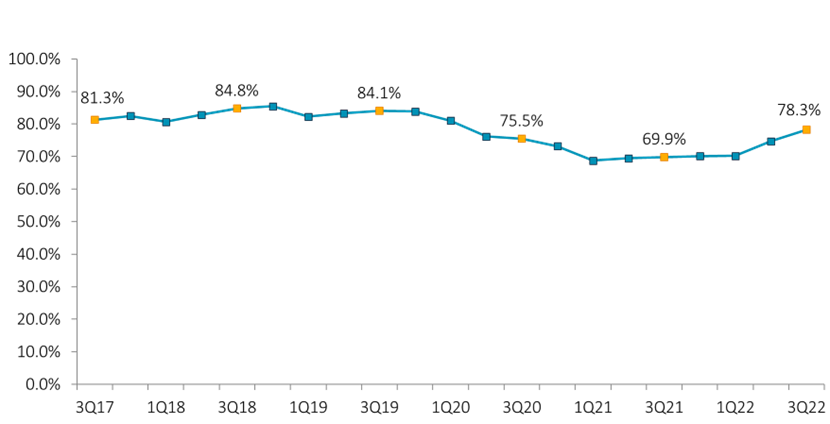

Loan-To-Share Ratio

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Shares returned to pre-pandemic growth rates and expanded 6.3% annually as of Sept. 30; loans, however, grew at a double-digit pace. Consequently, the loan-to-share ratio increased 8.4 percentage points from the prior year to 78.3% in the third quarter. Funding record loan demand is more difficult when share growth relaxes and investment securities offer realized losses and less-than-stellar fixed income performance.

Extending credit allows cooperatives to play a pivotal role in members’ lives. From financing a first home to helping start a local business, credit unions strive to increase their value to members in many ways. Credit unions respond to the evolving needs of members, and that mission must continue despite economic uncertainties. As rates rise and asset affordability changes, the financing preferences of members shifts, too. Credit unions will need to remain empathetic and nimble to best serve a membership that might face budgeting struggles in the coming quarters.

What’s Happening In Your Market?

LEARN MORE