Providing smooth and efficient customer service to members is crucial for credit unions, but the industry’s strict regulations often slow down service delivery.

The challenges faced by credit unions, particularly the burden of managing extensive procedural documents, creates complexities and hinders operational efficiency. Handling long documents makes it challenging for credit union employees and members to access vital information, especially with the complexity of procedural documents and frequent policy changes. Compounding these challenges is the reliance on PDFs and version control, which pose significant drawbacks to seamless operations.

98% of Arizona Financial Credit Union employees opt for an employee knowledge base over consulting subject matter experts.

At the core of customer engagement, the key to credit union genuine member engagement lives in the power of content and knowledge management. Curated content in particular can help unlock members’ meaningful journey, delivering swift, accurate, and contextually relevant support.

Curated content involves reimagining knowledge management not as a static repository but as the strategic pulse that guides every interaction. Acting as the orchestrator, specially curated content ensures a seamless flow of accurate, timely, and relevant information that enriches the omnichannel experience.

Maintaining consistency in every experience relies on having a single, up-to-date source of information. A comprehensive knowledge base that acts as a central hub can serve members and employees. Members can find answers on their own through search and FAQs or engage with a virtual assistant or live agent for personalized assistance. Employee knowledge management empowers employees with access to essential information for customer service excellence.

The Optimal Support Content: Where Does It Start?

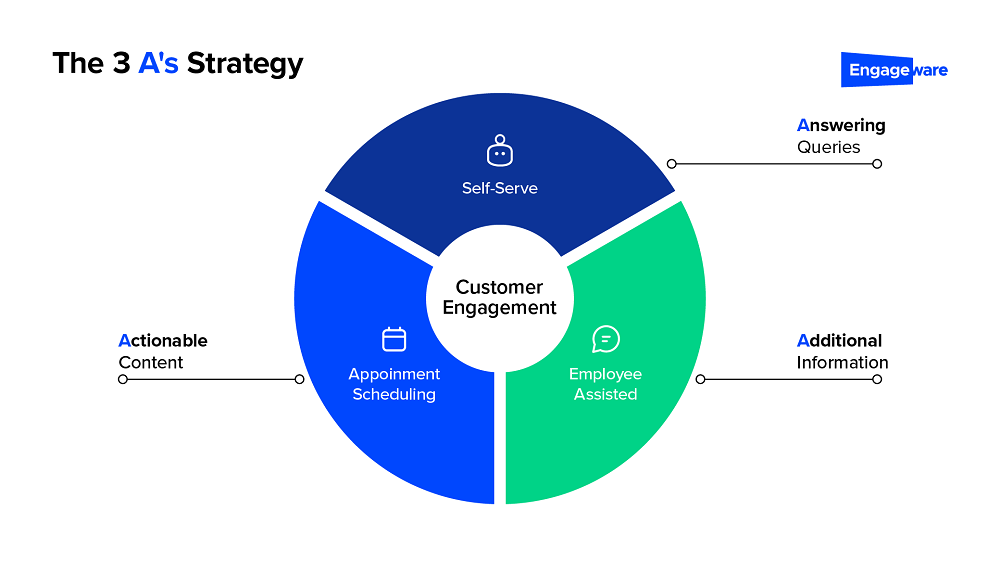

Embarking on the journey of unlocking optimal support content, we anchor our strategy in “The 3 A’s Strategy.” In this context, ensuring accuracy and relevance is key. Highlighting a centralized knowledge base is important to avoid member confusion and miscommunication that might arise from disparate data sources.

The 3 A’s Strategy shifts the emphasis from simply responding to queries to providing a comprehensive solution that not only offers answers but also enhances members’ comprehension and guides them toward purposeful actions. This angle is particularly effective in creating a seamless and valuable member experience.

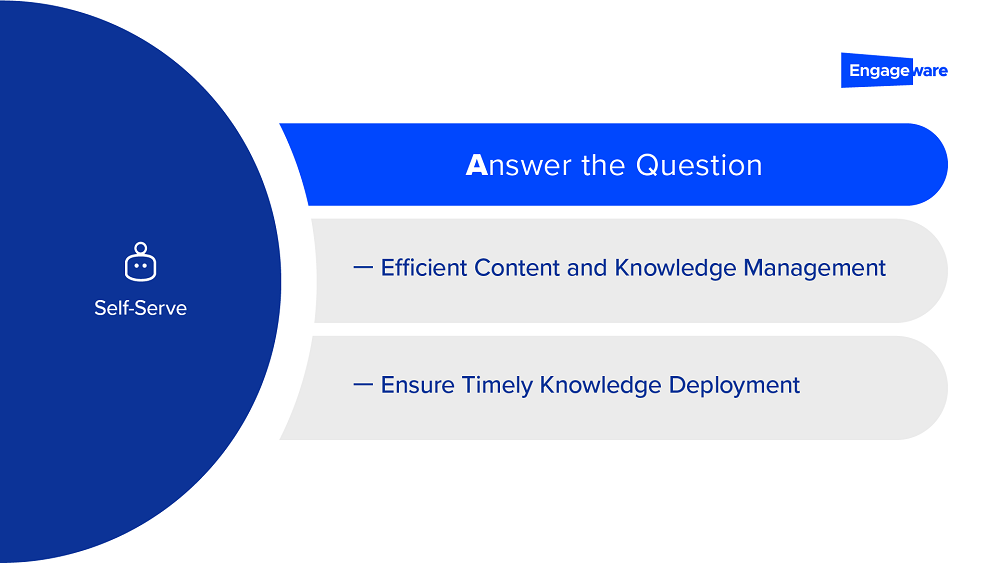

- Answer The Question: Ensure clear and concise responses to members’ queries, directly addressing their primary question.

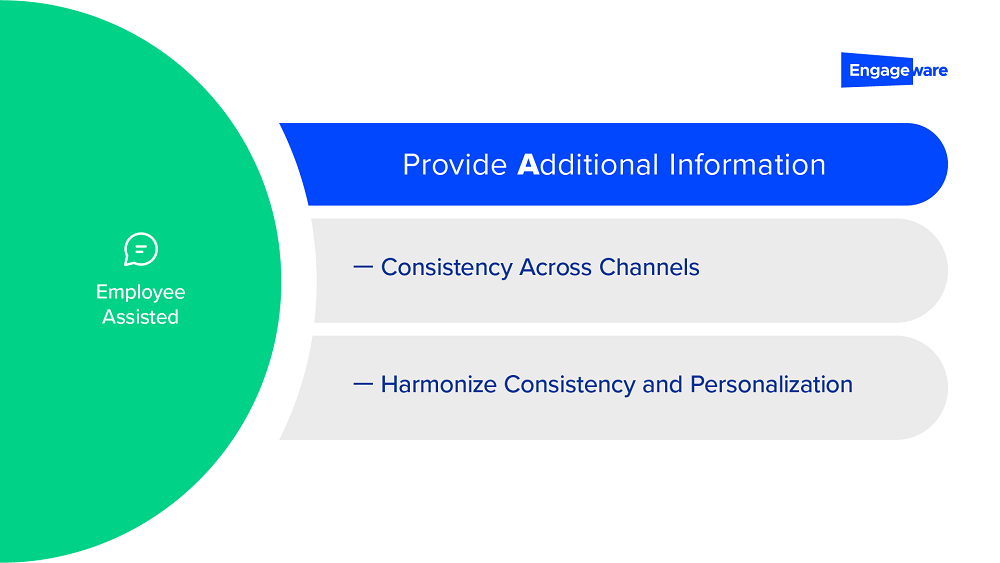

- Additional Information: Supplement the answer with relevant additional information, creating a comprehensive and context-rich solution. This additional information should be easily accessible and linked directly within the response.

- Actionable Content: Offer members actionable steps they can take based on the information provided. This involves including relevant calls-to-action that guide members toward relevant and desired actions.

This strategic approach transcends the static nature of traditional documentation and ensures every channel offers a consistent, valuable experience that is aligned with the credit union’s commitment to excellence.

Key Content Applications That Elevate Your Credit Union Success

Let’s dive into some key applications of The 3 A’s Strategy.

- Efficient Content And Knowledge Management: Efficient content to easily find and follow. Provide clear and concise information about policies, procedures, and frequent questions. Including helpful articles and video tutorials, boosting member experience.

- Ensure Timely Knowledge Deployment: Optimize your employee knowledge base for prompt responses, driving timely answers. This reduces employee training time, minimizes member wait time. Amplifying the impact of curated content on your credit union’s success.

- Consistency Across Channels: Communicate consistent information such as procedures and policies across several touchpoints. Boosting a unified message and fostering brand identity.

- Harmonize Consistency And Personalization: Curated information nurtures an omnichannel experience and aligns with the need of member-centric engagement. Providing also personalization features that allow members to access their specific information through self-service tools, like asking for a virtual assistant.

- Facilitate Connections To Expert Resources: Curated content connects your credit union members with expert insights, assuring presence is always available and enhancing overall service. These resources can include personalized CTAs, such as suggesting scheduling an appointment for a loan inquiry, and guidance from a virtual assistant or live agent.

- Master Onboarding Excellence: Efficient onboarding builds lasting member connections. Beyond initial education, ongoing engagement involves introducing more services, encouraging resource exploration, and fostering community. Ensuring members stay connected, informed, and valued throughout their credit union journey.

- Tailored Solutions Through Content Ownership: Assume control of your content and technology, aligning strategically with 3 A’s principles — accuracy, additional information, and actionable content. Notably, AI-driven virtual assistants, powered by a robust knowledge base, transcend basic query responses. They excel in anticipating needs and delivering actionable content in real time. This shift ensures interactions are not just informative but purposeful, significantly enhancing the overall member experience and aligning seamlessly with action-oriented solutions.

In today’s financial landscape, reliance on static documents imposes significant limitations, hindering operational efficiency and disrupting the flow of seamless member interactions. To overcome these challenges, credit unions must embrace a shift toward relevant and efficient content support.

This strategic approach hinges on the adoption of a robust knowledge management system — not only as a technological upgrade but also as a strategic standpoint in reshaping how credit unions engage with their members. It provides an interactive platform that delivers consistent value for members and employees.

Overall, having a centralized curated content and knowledge base dramatically enhances precision, availability, and end-to-end customer engagement, thereby boosting member satisfaction, retention, and growth.

With this transformation in mind, credit unions can embrace modern solutions by exploring these platforms firsthand to confidently navigate challenges, fortify trust, aligning smoothly with a customer-centric perspective.

Delve deeper and elevate your approach to content support and knowledge management, ensuring seamless and impactful member experiences. Explore more at engageware.com and redefine the future of your credit union engagement.