Top-Level Takeaways

-

Element FCU is building on a long record of innovation by offering customized banking portal pages for business members.

-

The first business to take advantage of the service was a state agency that wanted specific digital fee payment functionality.

CU QUICK FACTS

ELEMENT FCU

Data as of 06.30.20

HQ: Charleston, WV

ASSETS: $53.3M

MEMBERS: 4,396

BRANCHES:3

12-MO SHARE GROWTH: 57.6%

12-MO LOAN GROWTH: 0.2%

ROA: 0.93%

Element Federal Credit Union($53.3M, Charleston, WV) has launched a simple but effective, and easily replicable, way to better serve its business members: Customizable landing pagesthat serve as a portal into the credit union’s business banking services.

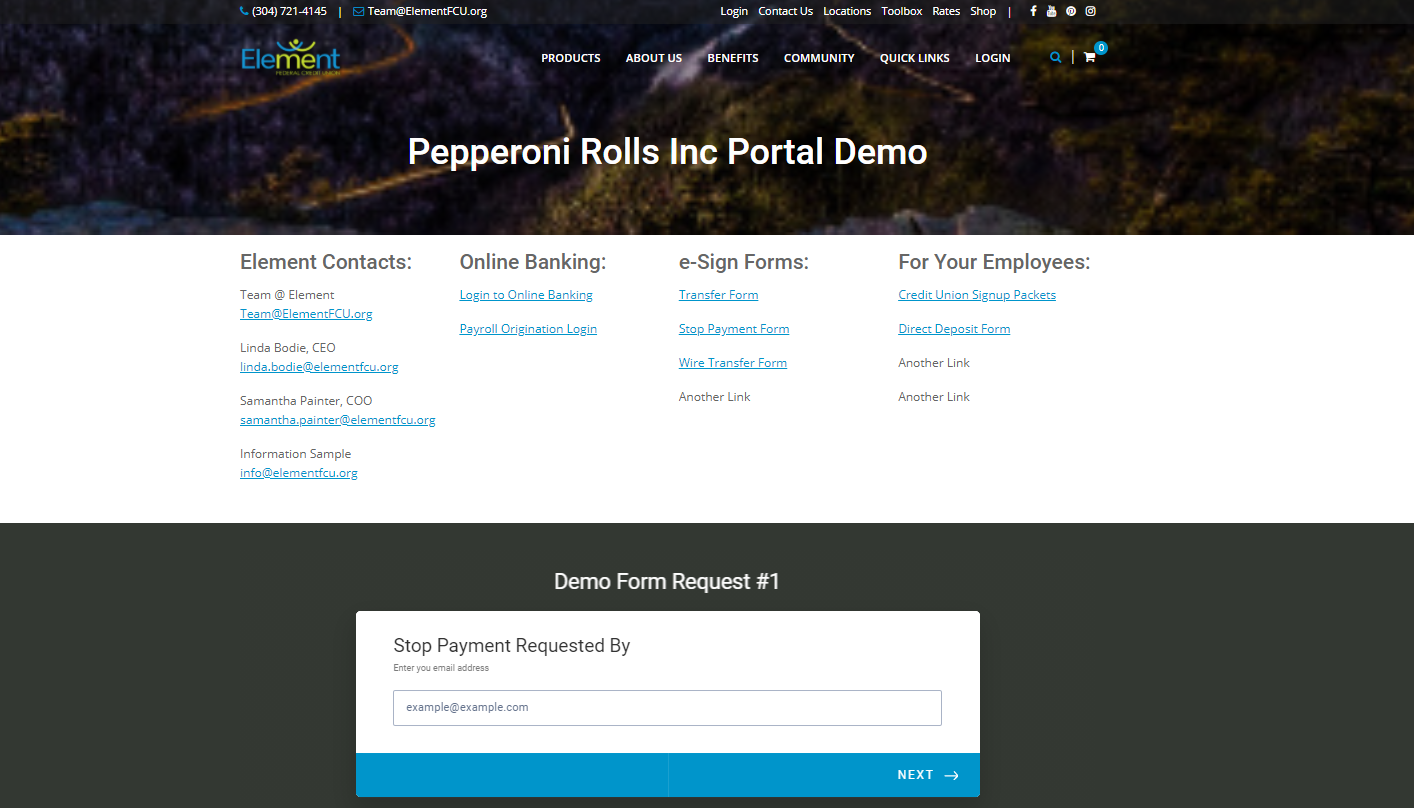

The landing pages feature direct links to credit union contacts, online banking services, e-sign and other forms, and whatever else the SEG might want that Element can provide.

The first business member to take advantage of the new offering is a state agency that already is an enamored user of its portal. The agency is new to business banking at Element and needed a way to digitally handle fees for a new service. It got that when the page went live in July.

They love the portal, says Linda Bodie, Element’s CEO since 1998. It allows them to find everything they need in one place. They were pleasantly surprised at how customized it was and even provided input on the content they wanted.

Element uses a sample landing page to show businesses how they can customize their portals with easily added or deleted links to products and services.

A Record Of Innovation

This is not the first time Element has creatively served members and in doing so differentiated itself from much larger competition. For example, Bodie’s shop then named WV United Federal Credit Union became the first financial institutionto accept checks deposited via iPhone when the $11 million operation nudged out USAA as first to the finish line with mobile RDC in 2009.

Linda Bodie, CEO, Element Federal Credit Union

We were offering electronic check deposits before smartphones were a thing, Bodie says. Members could use a flatbed scanner to scan and send their check image to us for deposit. When the iPhone and app store were invented, we took it to the next level and deployed the world’s first remote deposit capture app.

Having an innovative mindset and competitive spunk and actually trying things are traits that separate us from others, Bodie adds. Small numbers don’t matter; just doing it’ does.

That Was Then, This Was Easy

Although customizable, the business banking portal pages are not tech-intensive.

I think I spent two hours creating and designing the page, Bodie says. It’s just a web page. If you can create a web page, you can do this.

Element already had created custom landing pages for some market segments and SEGs, but the new portals take it to a new level of customization for and engagement with the member.

If you plan to create something like this, definitely involve the business in the planning process, Bodie says. It’s critical to identify their needs, their employees who will be involved in the relationship, and all of the pieces to plug in for the business as well as the credit union.

Dont reinvent the wheel. Get rolling on important initiatives using documents, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to your needs. See what we have for you in the Callahan Policy Exchange.

Pushing The Portal Pedal To The Metal

Bodie plans to pitch the portal idea to existing as well as potential business members and SEGs. There are several reasons doing so would benefit members and the cooperative alike.

It’s a great way to keep communication and information simple and well organized for all parties involved, the CEO says. And, it helps us differentiate from others.

Along with simply improving service, that quest for differentiation also helps drive innovation at Element. It might be easier to follow the road muchtraveled, in this case by simply offering a website with the standard links and resources, but that’s not always acceptable at Element.

I look for ways to solve problems and create value, to do things differently and exceed expected norms, Bodie says. After all, if we’re just like everyone else, why would people want to join our credit union?