Top-Level Takeaways

-

Elements Financial takes in approximately $100 million every year during the first quarter.

-

The credit union tries to hold half of the new deposits for 90 days.

-

Wealth management services contribute more than 10% to Elements Financial’s net income.

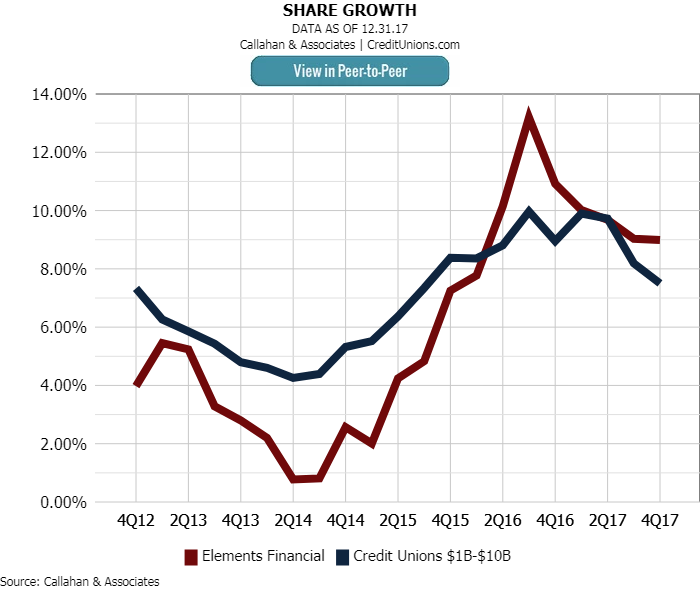

Strong deposits from a well-compensated core SEG drive a two-pronged strategy for member service at Elements Financial Federal Credit Union $1.5B, Indianapolis, IN).

CU QUICK FACTS

Elements Financial FCU

Data as of 12.31.17

HQ: Indianapolis, IN

ASSETS: $1.5B

MEMBERS: 96,460

BRANCHES: 6

12-MO SHARE GROWTH: 9.0%

12-MO LOAN GROWTH: 4.6%

ROA: 0.56%

Approximately 40,000 Elements members are affiliated with the credit union’s founding select employee group, drug maker Eli Lilly. The other 53,000 members are from the hundred or so other SEGs the credit union serves.

Each year in March, Eli Lilly pays out a management bonus. Credit union members deposit more than $100 million of that bonus on average at Elements. The credit union uses the influx of cash to fund loans throughout the year, and it has earmarked the spring as an opportune time to market its robust wealth management program.

We’re fortunate that year after year, so many Lilly members trust us with their semi-monthly payroll and their annual bonus, says Chris Sibila, the credit union’s executive vice president and chief information officer.

ContentMiddleAd

According to Sibila, the credit union offers attractive products and interest rates to encourage members to keep that new money in checking and savings ― which also includes tax refunds and normal first-quarter deposit growth. If 50% of that new money is still in checking and savings after 90 days, it will stick and become the new normal balance for those members.

And for the past two years, members have done just that.

We believe that’s better for our members because as rates rise, they benefit sooner and their money is liquid if they need it in an emergency versus locking up money in fixed rate certificates. says Sibila, who joined Elements Financial in October 2014 after 25 years in banking that included stints with Citi and Fifth Third. It also is better for our balance sheet management because we do not have to use external sources to fund loans.

Click through the two charts below to see the effect of deposit strategies at Elements Financial.

Higher interest on checking and savings accounts drives core deposit growth at Elements Financial.

Several CD specials in 2014 and 2015 attracted interest in share certificates as the credit union aggressively sought deposits to fund lending.

The annual surge of deposits and long history of good-paying jobs from the company that first sponsored the credit union in 1930 has also made for a favorable environment for investments.

Wealth management enables us to provide cradle-to-grave’ solutions, says Matt Snively, who has been senior vice president of wealth management at the Indiana credit union for more than a dozen years. We can serve a member with a 529 at the start of their life, serve them with traditional deposit and loan solutions in the middle, and provide retirement and estate planning for those later years.

Chris Sibila, EVP/CIO, Elements Financial FCU

Elements Financial currently has $630 million in assets under management, including approximately $410 million in an advised assets program that generates fee income. In 2017, wealth management generated nearly $800,000 of the credit union’s net income that’s more than 10% of the $7.7 million total in net income in earned for the year.

That wealth management income is also reliable.

Approximately 80% of total revenue from wealth management is derived from fee-based advisory services, Snively says. And around 90% of our total revenue from that program is recurring income.

Two of the credit union’s seven branches one at the Lilly Corporate Center and one at the Lilly Technology Center have in-house wealth advisors. The credit union’s other six advisors, three registered sales assistants, and program manager are based at Elements Financial’s own headquarters.

Matt Snively, SVP of Wealth Management, Elements Financial FCU

Snively says only the two branch advisors get referrals from the credit union. The other six work from existing client referrals and their own prospecting. Elements Financial operates its wealth management services as a dual employee program with LPL Financial, which also handles managed accounts.

Find your next solution in the Callahan Associates online Buyer’s Guide. Browse hundreds of supplier profiles by name, keyword, or service area.

Elements Financial has been offering investment services since 1997, and the original advisor, Bruce Evans, is still on board. The credit union also offers higher-end services through its private client services program, with higher savings and checking rates, premium card options, and come-to-you options for face-to-face meetings.

According to Snively, credit unions must treat wealth management programs as a core offering, not as an ancillary product, if they want the programs to succeed.

Senior leadership should see wealth management as a solution that receives equal time in the overall sales marketing effort, the SVP says.

Elements Financial added a dedicated marketing specialist for wealth management two years ago and now uses white boards in branches, direct mail, email, web, and employee education as awareness channels. The financial advisors educate branch staff and the marketing department as well as offer seminars with members and prospective members. In 2017 the advisors conducted 75 of these sessions.

Meanwhile, the branches made more than 1,000 referrals last year, and there’s still room to grow. Only 3% of the credit union’s members use the credit union’s wealth management program, but it generates more than 10% of the credit union’s net income.

Our wealth management program offers members a terrific mechanism to help them reach their long-term goals, Snively says. And it’s always great to find sources of non-interest income.