![]()

Subscriber Package: Executives Insights For Business Continuity

Hope For The Best, Prepare For The Worst

Advice Learned After The Joplin Tornado

Build A Business Continuity Plan Based On Stakeholder Group

Begin Building A Business Continuity Plan By Talking To Peers

Get Help from Outsiders To Build A Business Continuity Plan

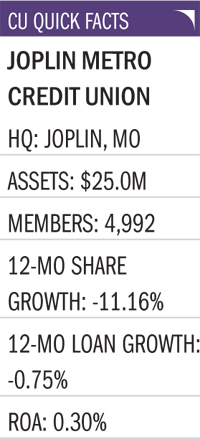

Joplin Metro Credit Union began as the credit union for Southwestern Bell Telephone in 1950 and now serves approximately 50 SEGs. It has $25 million in assets and 5,000 members. On May 22, 2011, an EF-5 tornado destroyed much of downtown Joplin, MO, and its neighborhoods. It passed between Joplin Metro Credit Union’s two branches, so neither building suffered structural damage. Both buildings lost electrical power and telephones but were open for business by Tuesday.

Joplin Metro CEO, Cindy Atteberry, and her husband took shelter in their home’s basement when the warnings sounded. The house collapsed, and it took Cindy and her husband half an hour to dig out of the totally destroyed structure. The Atteberrys emerged with only the clothes on their backs, and what the tornado did not destroy the rain that followed ruined. They have since rebuilt their home using homeowner insurance money.

Alicia, we know something about disaster, disaster recovery, and disaster plans here in Joplin. We also know more than we did before the devastating tornado struck.

Alicia, we know something about disaster, disaster recovery, and disaster plans here in Joplin. We also know more than we did before the devastating tornado struck.

Our credit union was down on Monday, but our data processing company was able to get debit card usage going Monday afternoon. We did not need to use a backup system called eVault, which stores information in the cloud, but it was available. The continuity of data was crucial because people had lost their checkbooks, wallets, purses, and cancelled checks, and they did not know the balances in their accounts. We did not charge a fee for people that wanted to stop payments during the month after the tornado.

We have only two branches, but we work closely with another credit union that operates out of Springfield, MO, approximately 70 miles away. We have identical data processing systems and this credit union was ready to help us. If our two buildings had been destroyed, the Springfield credit union could have seen us through the crisis, and our staff and members could have gone there.

Something you likely would not think of is to plan for a spike in deposits. We took in $6 million in one month after the tornado on account of insurance checks. It’s nice that members trusted us with their money, but our assets soared to $27 million. That had a big impact on both our ROA and capital ratio, the latter of which declined from 10% to 7%. We knew the insurance money was eventually going to leave, but it caused some problems while it was there. Our examiners took note, of course, and eventually we had to lower some of our savings rates to drive out some of the money. It went against all I believe as a credit union CEO, but we had to do it.

The continuity of data was crucial because people had lost their checkbooks, wallets, purses, and cancelled checks, and they did not know the balances in their accounts.

Something else you need to think about: It’s hard enough to get your credit union up and running after a disaster, but you also have to plan around major parts of your management team not being able to perform at full strength. My husband and I lost our house and all our possessions. On Monday it was hard for me to think about the credit union, but my management team was terrific and knew what to do. The team concept is vital; a CEO cannot do it alone. The team has to be ready and knowledgeable so if certain individuals are out of action, the team can still get the job of recovery done.

Alicia, we developed our plan by working with software. We did not hire a consultant, and I don’t think you need one either. Most small and medium-sized credit unions can construct a disaster plan by working with available software. You download it and enter the information and the procedures what you do, who calls whom, and so on. Your league can help you. So can your data processor.

If you have only one branch, then it’s important to work with a nearby credit union that has the same data processor as you. It’s a good idea even if you have more than one branch. As I said, our arrangement with the Springfield credit union could have been a big help if needed. Likewise, make sure you have a good relationship with your data processor because this company is going to count for a lot after a disaster.

Be prepared for communications disruptions. My vice president was talking to the data processor over her cell phone because the land lines were not working. The night of the tornado cell phones were out. The only way people could communicate was on Facebook.

Our tornado struck during nonworking hours, but you have to have a plan for dealing with a disaster when the credit union is open and members are in the lobby. You have to consider things such as locking doors, how to get staff and members to a safe place, and so forth.

You don’t need to have the board members involved in making the plan, although the board should review and approve it. Once you have your plan, re-examine it once a year. Make sure phone numbers, procedures, and team members are correct. We look over our plan as a management team and tweak it each year; mainly that just amounts to updating numbers.

Want to learn more? Click on the articles in the Subscriber Package below for a deeper dive into Executives Insights For Business Continuity .

![]()

Subscriber Package: Executives Insights For Business Continuity

Hope For The Best, Prepare For The Worst

Advice Learned After The Joplin Tornado

Build A Business Continuity Plan Based On Stakeholder Group

Begin Building A Business Continuity Plan By Talking To Peers

Get Help from Outsiders To Build A Business Continuity Plan