Credit unions grappling with increasing turnover of top executives should analyze their compensation policies and ensure their pay packages, including long-term and short-term rewards programs, are competitive with what their peers offer.

About 35% of credit union CEOs are expected to retire in the next five to seven years, and another 20% of top executives will likely change positions, according to a survey from Executive Compensation Solutions, a compensation consulting firm based in Convina, CA.

We’re anticipating a lot more movement in the next several years as the baby boomer wave retires, says Don Curristan, an owner of the firm. There’s going to be a continued demand for higher level of talent.

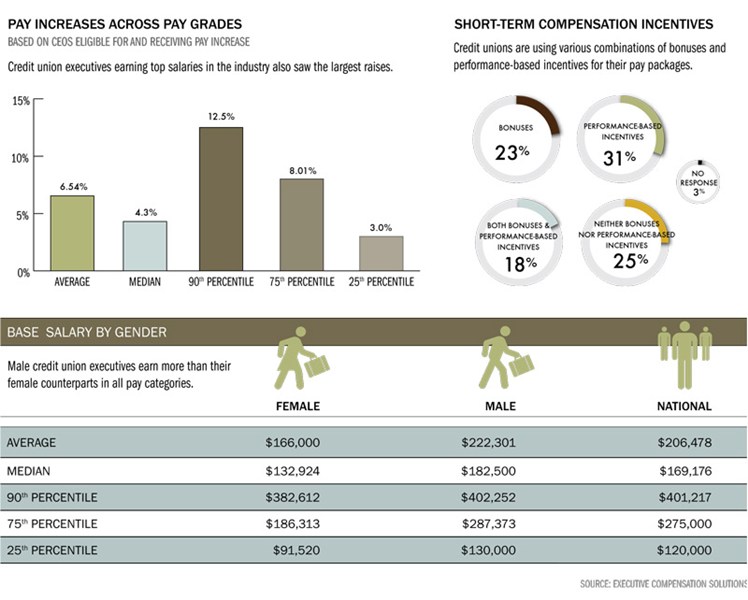

The average U.S. employee’s salary increased 2.2% as compensation for credit union CEOs increased 6.4% per year from 2006 to 2011, according to the 2011 Credit Union Executives Society survey of 467 credit unions. Overall average CEO compensation averaged $261,478 in 2011. Compensations ranged from $85,694 for credit unions with between $20 million and $29.9 million in assets and $496,385 for credit unions with assets of more than $1 billion.

To draw or retain quality executives, credit unions must ensure they have a written philosophy on compensation goals, Curristan says. That philosophy should articulate in what percentile the credit union would like its executives’ base pay to land and where comprehensive pay, including incentive rewards and benefits, should be. For example, many credit unions aim to have executive base pay land in the 50thpercentile of their peers’ salaries, with the total compensation having the potential to land in the 75th percentile if the executive performs well.

Credit unions need to have a strategy in place, Curristan says. They don’t want to be reactionary here. Some credit unions have already thought about what steps they want to take. They might not implement the actual strategyimmediately, but they’ve thought it.

Pay Parameters

There are four main components of compensation: base pay, short-term bonuses, long-term bonuses, and fringe benefits. Credit unions should look at a compensation package comprehensively, rather than taking it piecemeal.

The growth rate of executive base compensation has been slowing in recent years, according to ECS’s survey. When the recession hit, credit unions reacted by pulling back on pay increases, even if their financials were healthy, Curristan says. But compensation has become more important at credit unions in recent years for a variety of reasons.

There is greater competition for talent outside of traditional venues. Historically, credit unions would grow their talent from within their ranks. If they did tap outside talent, they turned to other credit unions to lure hires. But in the past 10 to15 years, more credit unions are looking outside the credit union movement for talent.

4 steps to a Brag-Worthy Workplace

4 steps to a Brag-Worthy Workplace

Competitives compensation is not just about the paycheck. Read More.

This makes compensation even more important because you’re dealing with folks who have access to different kinds of compensation that you don’t typically see within credit unions: equity grants and stock options, Curristan says.

Expectations for Executives

Henry Wirz, CEO of SAFE Credit Union($1.9B, North Highlands, CA), has had his salary published on the front page of the local newspaper’s business section for the past two years.Like many CEOs, Wirz’s salary is noted on 990 forms that are public record, and his name makes the list of highest-paid executives in the Sacramento region. But Wirz is comfortable in the release of such information because SAFE’s boardsets his salary based on the same guidelines as the rest of the staff and evaluates his performance and pay annually.

They have me conduct a self-evaluation, and they set clear and measurable goals that are built around our budget, which I’m responsible for, Wirz says. The credit union’s board of directors also sets personal goals including member satisfaction goals and employee satisfaction goals for Wirz and at the end of the yearhe receives feedback on them.

Best Practice

Best Practice

Form a committee to develop a strategy for compensation. This will help prepare you for turnover.

Establish a compensation philosophy, which is different than a policy. It’s a roadmap that describes your values and allows you to think big picture on the elements of compensation. Write it out for future boards to follow.

He is evaluated on growth in member shares and loans as well as how the credit union faired in its budget and predictions for all measures of net income. He says the process allows him to comment and shape the goals. In fact, he says other credit unions could do well by paying extra attention to executive compensation.

The M’ in CAMEL is the weakest part of the CAMEL rating, Wirz says. If we were doing a better job of evaluating the performance of management in credit unions, we could significantly improve not only safety and soundnessbut also financial performance, member satisfaction, and employee satisfaction.

The CAMEL rating system an acronym that stands for capital, asset quality, management, earnings, and liability is used by the National Credit Union Administration to evaluate the financial health of credit unions.

Wirz says CEO and senior management evaluations are not often given adequate emphasis and attention. Instead, the board evaluates management based on a kind derived measure. So, if the credit union is doing well in the board’s assessment, then the board concludes the executive must be fostering good management.

I don’t think you can make that a simple correlation, Wirz says. Unless you set goals upfront and make them challenging, results don’t say anything. It seems to me all too often credit unions haven’t set the destination or don’t have a map of how to get there.