Credit unions that issue credit cards today face multiple sources of fraud risks such as external criminal fraud, cyber fraud, identity theft, internal breaches, and stolen credit card numbers. According to CUNA’s survey on the Home Depot breach, more than 7 million debit and credit cards were affected at an average cost per card of $8.02, including reissuing new cards, fraud, additional staffing, member notification, and accountmonitoring.

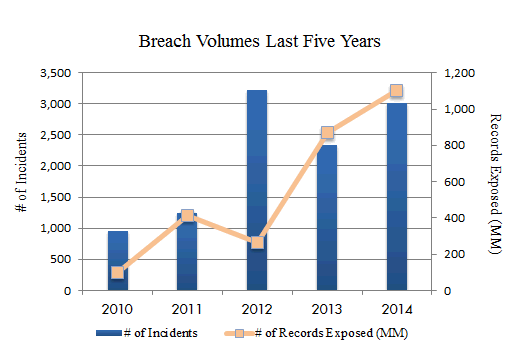

Source: 2014 Data Breach Trends;published 02.15 by Risk Based Security, Inc.

Fraud and related card security issues have dominated the headlines recently. Everyone knows someone who has had their personal information compromised. How have cardmember expectations changed during this period?

Expectations Regarding Tools And Technology

Credit unions need to select the right tools and technologies to give members confidence in the security provided on card products. Credit cards with EMV chips will be a near term expectation from your cardmembers. Getting EMV cards out to your membersbefore your competition helps protect your payment relationship with that cardmember. A credit union does not want to seem slow acting to protect their members’ information.

Aite Group researchers forecast 70% of credit cards and 41% of debit cards will be EMV enabled by the end of 2015. A credit union slow to convertto EMV cards could run the risk of being adversely impacted by higher amounts of counterfeit fraud, as they would be an easier target for financial criminals.

Tokenization and digital wallets represent another set of technologies growing in importance to cardmembers. Apple Pay, Samsung Pay, and Google Wallet have all introduced solutions to the market or have announced solutions that roll out in the near future.Creating the capability to support multiple tokenization solutions will be crucial for a credit union, as this path will allow cardmembers to select the product they are most comfortable using.

A credit union without a tokenized digital wallet in place leaves its cardmembers open to a higher risk of identity theft, as non-tokenized transactions in a merchant’s data repository are at greater risk of account number theft in the event ofa data breach.

Real-Time Communication

To help cardmembers feel comfortable using your card products, develop a proactive and transparent communication framework relative to security measures and updates when a security issue arises. These communications start at the card level.Your credit union can benefit greatly by having a system with the ability to send a text or email whenever the card is used. These options allow cardmembers to feel empowered with the ability to notice fraud on their card in a timely manner.

Proactively communicating your credit union’s long-term strategy and educating cardmembers about fraud risks increases comfort with your card in their wallets. Proactively answering questions regarding the timing of EMV rollout, chip-and-PINversus chip-and-signature, and the timing of introducing mobile wallets helps cardmembers stay knowledgeable and engaged. Dedicating room on your website or in other media to help educate cardmembers on how to look for fraud, best practices in securitymeasures and what to do if they suspect fraud builds engagement with certain demographic segments.

Quick Responses

Fraud and security breaches, potentially externally or internally, will inevitably happen. Having a defined response strategy expedites a credit union’s ability to deal with these unfortunate events. This documentation may include timing of a plasticsreissue, leverage on-going monitoring tools, how to prioritize communications, and drafts of key memos. Responses will vary depending on severity of the breach issue, but communicating that strategy quickly and clearly to members can help preventdecreased engagement or attrition.

Approximately 13 million consumers annually are hit with identity fraud, according to Javelin Strategy & Research.Today, many card issuers strive to allow cardmembers to report and resolve situations surrounding a fraudulent charge in one phone call. Also, when a fraud block is placed on a card, the most streamlined processes allow that block to beremoved via an interactive voice response (IVR) system once the cardholder confirms the validity of the charge. A quick response to cardmember fraud goes a long way to securing that relationship for the future.

Looking Into The Future

Fraud is here to stay. While fraud prevention is not the most important factor in cardmembers’ credit card selection, mishandling a fraud event can drastically change cardmember behavior. To avoid decreased usage or worse, attrition it is importantto be prepared. Aite Group reports that recent surveys have suggested that a large portion of cardmembers have switched their financial institution partner after a fraud event if they do not feel satisfied with the action taken. By implementing somebest practices which include some of the items discussed above, your credit union can be well prepared to protect the member experience even during unfortunate times.

For almost 50 years, Elan has delivered best-in-class credit card products and service to its valued credit union partners. Today, Elan helps nearly 300 credit unions manage the changing fraud landscape, using the strategies mentioned above, along with many other industry-leading trends. Year after year, our partners remain pleased with the Elan solution, as Elan has seen a more than 96% renewal rate. For more information, call 1-800-223-7009 or visit www.cupartnership.com.