Managing people is difficult in and of itself, but quantifying employees’ contributions and efficiencies can be downright daunting. Staffing costs are typically a credit union’s largest operating expense; therefore, tracking the performance of the workforce is crucial. This selection of benchmarks handpicked for the human resources professional helps gauge a workforce’s productivity and ties that productivity into the performance of the credit union.

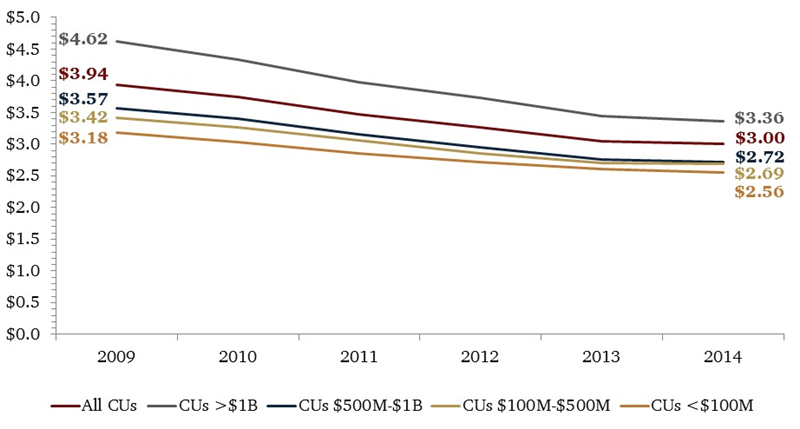

1. $ Revenue Per $ Salary And Benefits

Definition: This ratio divides total revenue by employee compensation and benefits. The revenue per salary and benefits national average as of year-end 2014 is $3.00.

| Total Revenue |

| Employee Compensation and Benefits |

$ Revenue per $ Salary and Benefits

Data as of Dec. 31

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

This ratio evaluates the credit union’s total employee compensation relative to its total revenue. Credit unions in metropolitan areas or areas with a high cost of living tend to post lower ratios because the cost to hire and retain talent is higher than in rural areas. For example, the average $ of revenue per $ of salary and benefits for credit unions in California is $2.83, whereas in Mississippi it is $3.28.

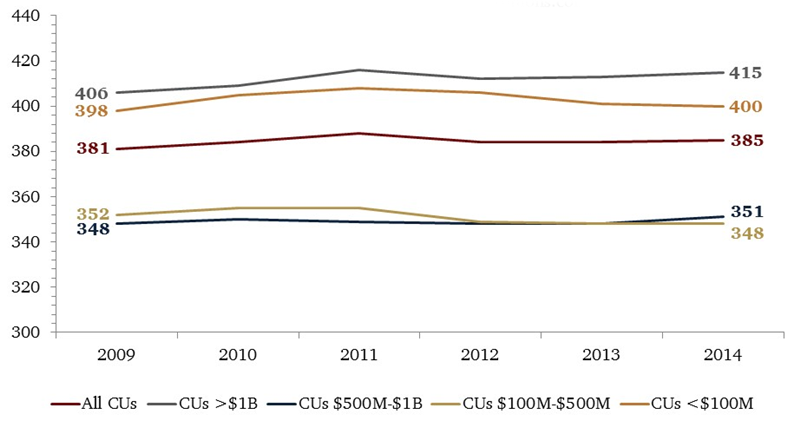

2. Members Per Employee

Definition: Members per employee divides the number of members by the number of full-time equivalent employees. The member per employee national average as of year-end 2014 is 385.

| Current Members |

| Full-Time Employees |

Members per Employee

Data as of Dec. 31

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

The members per employee ratio measures the productivity of the credit union’s employee base. In theory, a higher ratio means a credit union is more productive, but other factors also play a part. When examining the ratio, credit unions should also consider product penetration rates, members per branch location, the geographic distribution of the membership, and field of membership requirements. Strategic factors that impact the ratio include organizational service level goals, growth, and product and technology development.

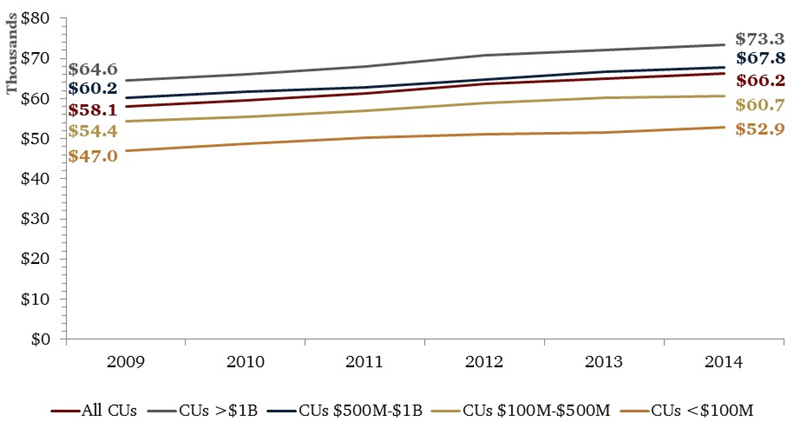

3. Salaries And Benefits Per Employee

Definition: Salaries and benefits per employee divides annualized employee compensation and benefits by the number of full-time equivalent employees. The salaries and benefits per employee national average as of year-end 2014 is $66,189.

| Annualized Employee Compensation And Benefits |

| Full-Time Employees |

Salaries and Benefits per Employee

Data as of Dec. 31

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

Many factors among them location, employee productivity, the board of director’s philosophy toward compensation and benefits, and the credit union’s organizational structure affect the average salary and benefits paid per employee. Credit unions with productive operations tend to have fewer employees who earn higher salaries. So although the average cost per employee might be elevated, the overall cost to staff the credit union can be less than peers. For example, a Georgia credit union ($191M in assets) has an efficiency ratio of 59.0% (in essence, the credit union must spend $0.59 to earn $1.0 of revenue), and an average salary and benefits per employee of $132,518, with 10 employees. In comparison, credit unions in the $150M-$250M asset peer group had average efficiency ratios, salary and benefits per employee, and headcounts of 81.8%, $62,569, and 59, respectively.

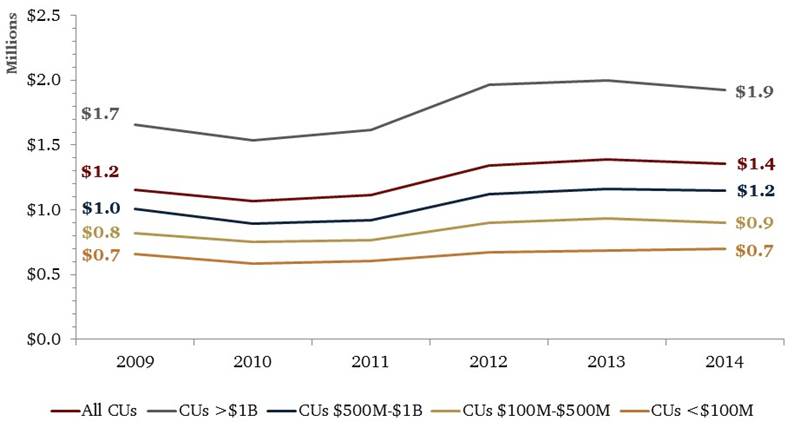

4. Loan Originations Per Employee

Definition: Loan originations per employee divides the annualized amount of loans originated by the credit union’s number of full-time equivalent employees. National average (as of year-end 2014): $1,357,952.

| Annualized Loan Originations ($) |

| Full-Time Equivalent Employees (#) |

Loan Originations per Employee

Data as of Dec. 31

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

High loan originations per employee ratios indicate employees excel at generating member loans. The loan component of this performance measure is a reflection of the credit union’s lending philosophy, employee training programs, and the members’ propensity to borrow. In general, credit unions with significant consumer lending operations, specifically indirect automotive, will have higher loan originations per employee ratios due to the increased volume associated with consumer and indirect lending.

Superior Analysis At Your Fingertips

Benchmark performance, build peer groups, run reports, and more with Callahan’s data software.

You Might Also Enjoy

- 5 Ratios Every CEO Must Know

- 3 Ratios Every COO Must Know

- 5 Ratios Every CLO Should Know

- 4 Ratios All Staff Should Know