The ongoing digitization of consumer and retail banking thrown into overdrive during the pandemic continues to expand with new advances in mobile, chat, and AI technology. Credit unions are understandably eager to expand their omnichannel offerings, particularly as doing so has the potential to improve member satisfaction as well as operational efficiency — not to mention relieving some of the stress on their workforce due to the tight labor market.

But is the acceleration toward greater digital banking in danger of leaving some credit union members behind? The simple answer is, yes – and that’s due to nature of the technology adoption curve. There will be early adopters, the early majority, the late majority, and the laggards. Catering to members in all stages of adoption is essential for credit unions — especially assisting the late majority and laggards in their adoption of your credit union’s digital offerings.

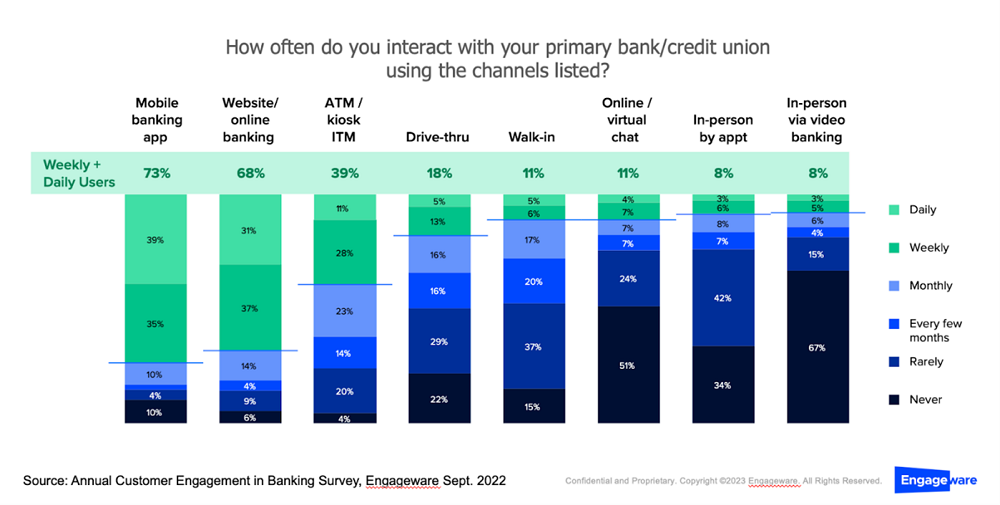

According to the ENGAGE 2023: Customer Engagement in Banking Annual Trends Report, driving digital adoption is top of mind for credit unions. Indeed, 43% of credit union and banking professionals reported that — when it comes to improving member engagement across the board — digital channels are their top priority. Which makes sense, given the majority of banking customers interact with their primary financial institution’s mobile banking and online banking channels on a daily or weekly basis.

Like most consumers, credit union members are giving mixed signals — with some pushing for more digital options but others still resistant to change. For credit union leaders, this means it’s critical to find the right balance between expanding digital services and maintaining the human touch and personal service your members are looking for.

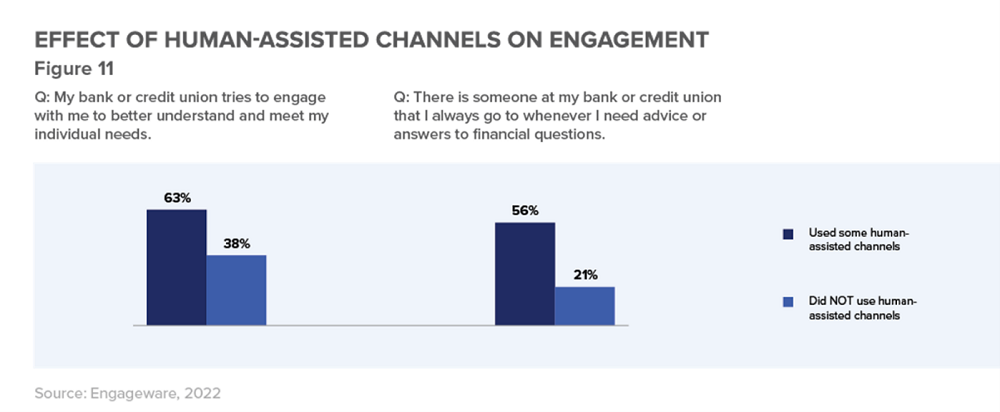

Human and digital channels must ultimately work together. Our Engage 2023 research has found customers who use both human-assisted and digital channels are much more likely to agree that their FI tries to engage with them to better understand and meet their needs. They were also much more likely to say there is someone at their credit union or bank that they can go to whenever they need financial advice.

The key to increasing digital adoption without sacrificing the human touch is to find the right balance and synergy across all channels. This requires rethinking what support is needed, providing ample educational resources and employee training, enabling members to serve themselves more efficiently across some channels, and easing their ability to access human assistance in others.

Here are five tips for credit unions looking to increase digital adoption while delivering the same high-quality relationship banking.

- Meet members where they prefer to bank. Members have different preferences for banking channels and letting them self-select based on their transaction type and personal preferences will increase their engagement. Credit unions should provide clear education for members on the best use of channels while giving them the choice of where to connect.

- Ensure maximum consistency across channels. Members should get the same answers and service levels regardless of their channel. Credit unions should support all of their banking channels in a consistent way, whether human or digital, to create a more consistent member experience.

- Make every channel a path to an answer. Credit unions should provide seamless handoffs among channels to increase comfort levels and improve member satisfaction. Credit unions should create seamless transitions that lead to single-call resolutions. This looks like transferring information input into an automated chatbot or support ticket over to a live agent.

- Focus on education and awareness. Credit unions should educate members and employees about the benefits of digital banking and make them aware of the options available to them. Your frontline employees are your digital advocates. Members are more likely to adopt digital channels if they understand how they work and what benefits they offer — as guided by your frontline.

- Don’t lose sight of the human touch. Although greater digitization of basic banking functionality can increase efficiency and reduce costs, credit unions should not forget that many people choose credit unions specifically for their more human touch. Credit unions should continue to build relationships and trust with their members, especially when their transactions are complicated or involve large sums of money. To optimize your staff levels and availability of personnel, consider appointment scheduling, which routes members to the correct resource for 1-to-1 service and expertise.

To drive both adoption and satisfaction, credit unions must balance digital services with the human touch. Find and maintain the right balance, and you will increase digital adoption without losing the high-quality relationship banking your members expect.

To learn more about the functionality needed to provide world-class member experience across all channels, go to engageware.com/.