In a year unlike any other, some things remain the same. For instance, the providers that perennially dominate the credit union core processing market. This year, however, the technology they provide has played an even more crucial role in responding to new imperatives brought to the forefront by the coronavirus pandemic.

The best example of this is the emergence of virtual engagement as the new normal in conversions. The process has changed on the fly, and that mode of delivery once so heavily dependent on the in-person presence of a supplier’s team might be permanently altered.

Because of such dramatic changes in the way credit unions operate and interact with members including the standardizing of cloud-based core delivery and highly integrated ancillary solutions there’s more opportunity than ever fora credit union to find a suitable core fit across a wide range of providers.

The Big Players Still Dominate, But There Are Choices

While the giants still dominate core market share, there are 28 different core providers (offering 41 different platforms) available to choose from, and that’s just among competitors serving at least $400 million in aggregated assets, according to the analysis we did for the 2021 version of our Supplier Market Share Guide: Credit Union Core Processors.

3 Core Selection Best Practices

When choosing a core provider, some credit union best practices include:

- Analyze core processors that have clients similar to your credit union; check for gains made in relevant performance categories.

- Reach out to peers using your prospective core to solicit an unbiased review of the user experience.

- Develop core conversion guidelines, vendor management policies, and vendor risk-rating worksheets to make a smart decision and help ensure a smooth transition.

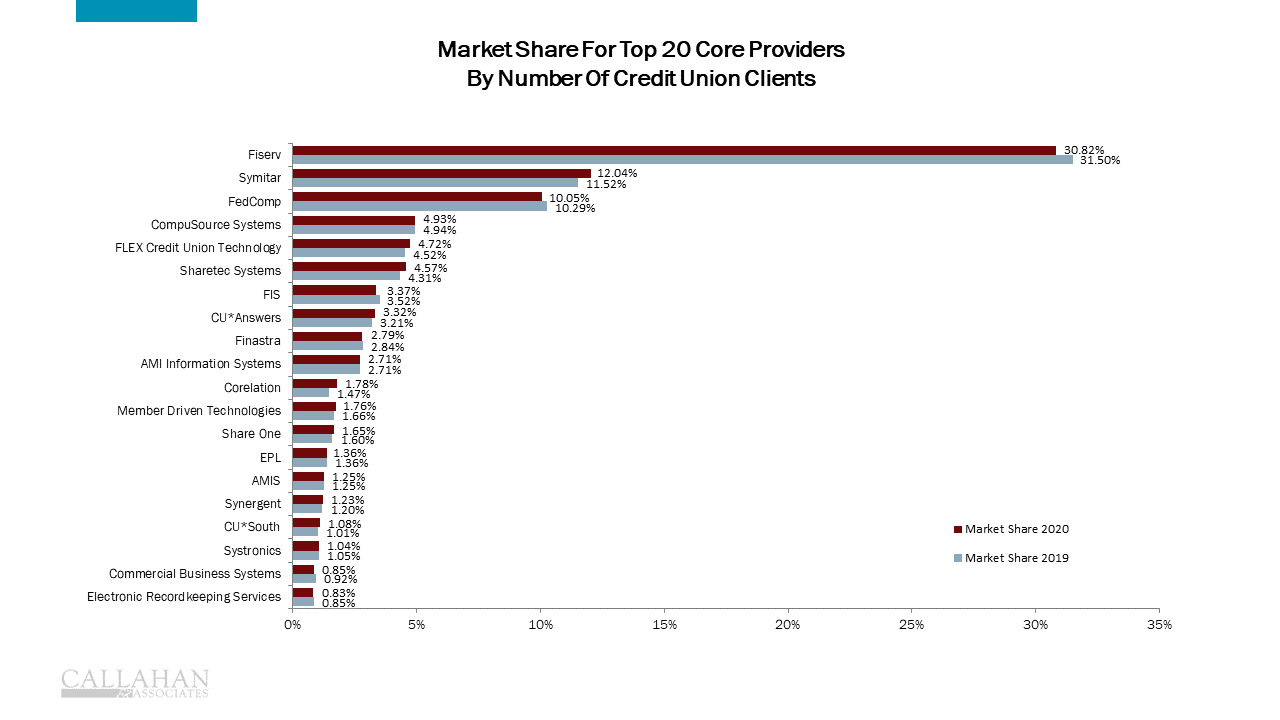

Fiserv is still the market leader, with 30.8% of industry-wide credit unions though this is a 68-basis point decrease from the year prior. They also lead the market in total credit union assets at 35.8% (down 66 basis points year over year).

Symitar follows behind at 12.0% of total credit union client market share, still well behind but up 52 basis points from last year. Symitar clients also tend to skew larger, as the Jack Henry & Associates subsidiary holds 33.0% of industry assets, anincrease of 91 basis points this year.

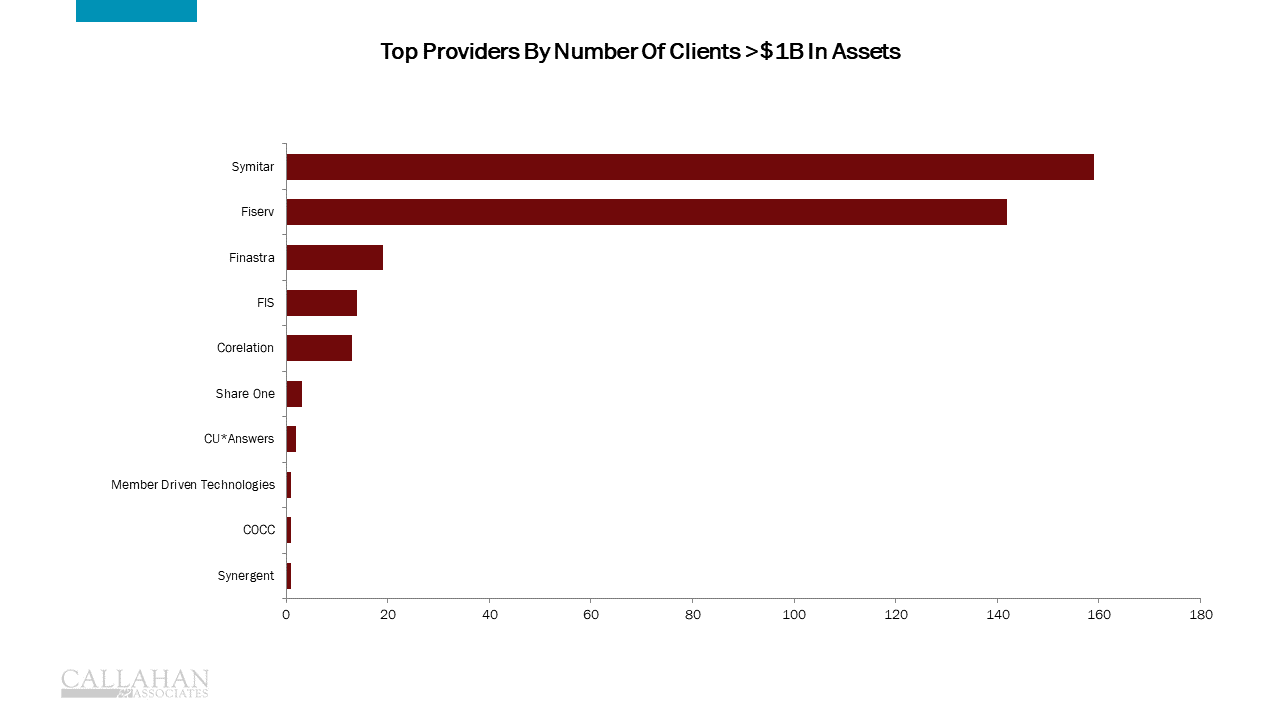

Symitar serves more of the industry’s largest credit unions, working with the highest total (159) of credit unions over $1 billion in assets of any core provider, while Fiserv has 142 of the billion-dollar cooperatives, and they both increased their base among that asset class in the past year.

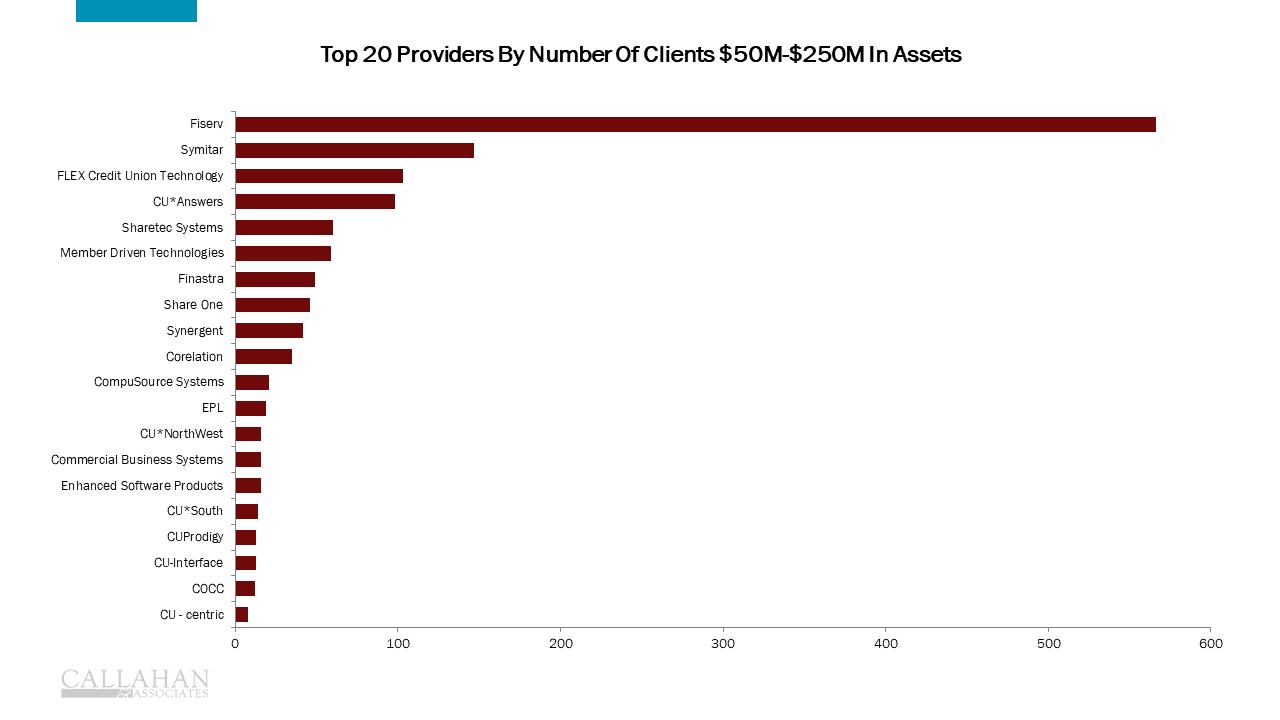

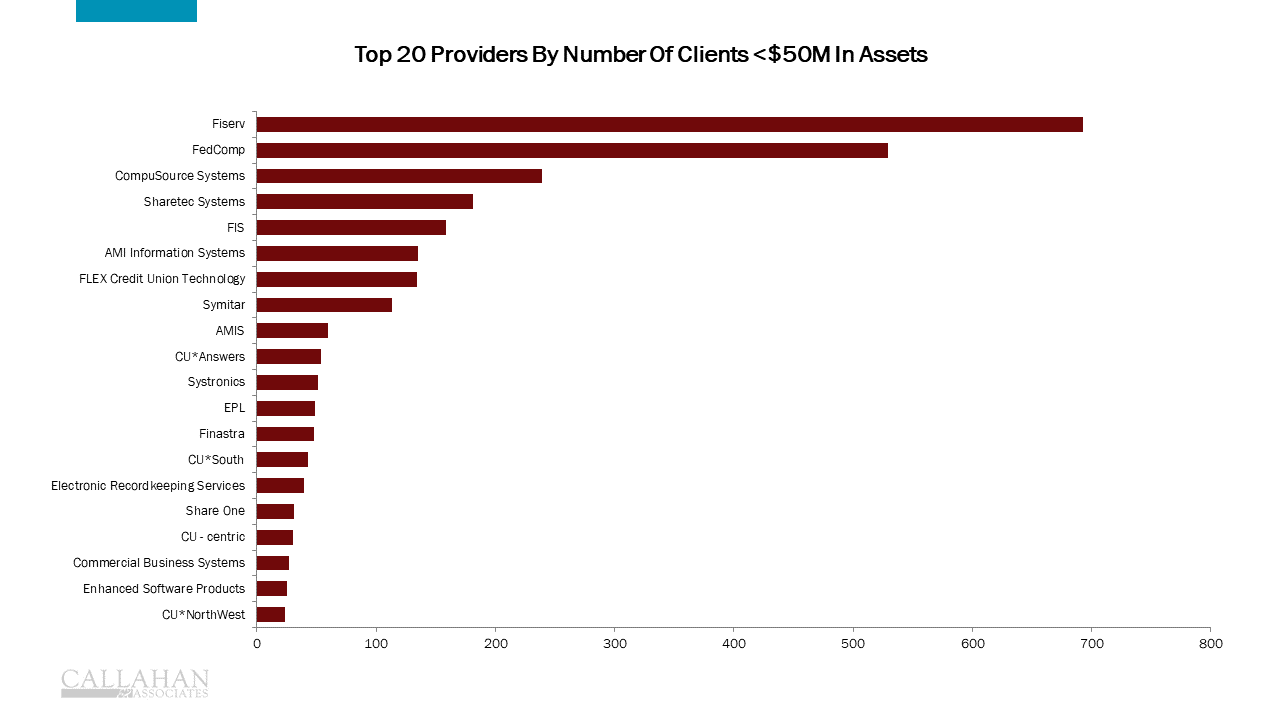

Meanwhile, smaller credit unions use a much wider array of providers, led by FedComp, which maintains its niche as a dominant vendor for the smallest credit unions, holding the second spot in number of credit unions under $50 million in assets, just behind Fiserv. Let’s take a closer look at what happened since we did last year’s core market guide.

Core Conversion? Callahan Has You Covered.

Callahan has resources to help you before, during, and after your core conversion. Learn how to get access to industry data analytics, data process market share information, and credit union-donated tactical conversion documents.

Fiserv Loses The Most From Shrinking Base, While Corelation Adds The Most

There are 150 fewer credit unions as of June 2020 5,425 than there were as of June 2019, and more than half of those merged or closed cooperatives were Fiserv clients in the lower asset ranges.

That was while 11 of the 28 providers (again, serving at least $400 million in total assets) gained clients year-over-year, and 17 lost clients, evidence of both overall industry consolidation and increasing opportunity in the market for smaller providers.

To wit, Corelation gained the most credit union clients year-over-year, up 14 to 94. Corelation’s market share also grew 31 basis points to 1.78%. Symitar reported the second most growth in credit union clientele, adding 10.

Meanwhile, Symitar’s Episys solution continues to be the leading single platform in both clients and assets, with 672 credit unions (holding 34.8% of industry assets) across three providers Member Driven Technologies (93), Synergent (65),and Symitar itself (514).

FedComp has 530 total credit unions, all but one with less than $100 million in assets, and Fiserv’s large family of platforms is led by Portico, third overall with 346 clients.

As for total assets under management (and their average size per institution), the top six are Fiserv ($633.5 billion, $389.6 million), Symitar ($583.6 billion, $919 million), FIS ($224.3 billion, $1.3 billion), Corelation ($62.1 billion, $660.6 million),Finastra ($60.4 billion, $411.2 million), and CU*Answers ($24.1 billion, $137.6 million).

There are more than 20 other competitors with at least $1 billion in total assets, competing to serve a credit union space that is shrinking in number of institutions but increasing in membership, loans, and shares. Together, these suppliers and theirclients continue to leverage advances in technology to provide synergy to their operations and enhanced products and services to their members.

This article initially appeared on Credit Union Times.

Fiserv maintains its hold as the most dominant player in the market, but Symitar and others maintained positive momentum.

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates

Symitar outpaces Fiserv in the race to capture market share amongst the largest credit unions.

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates

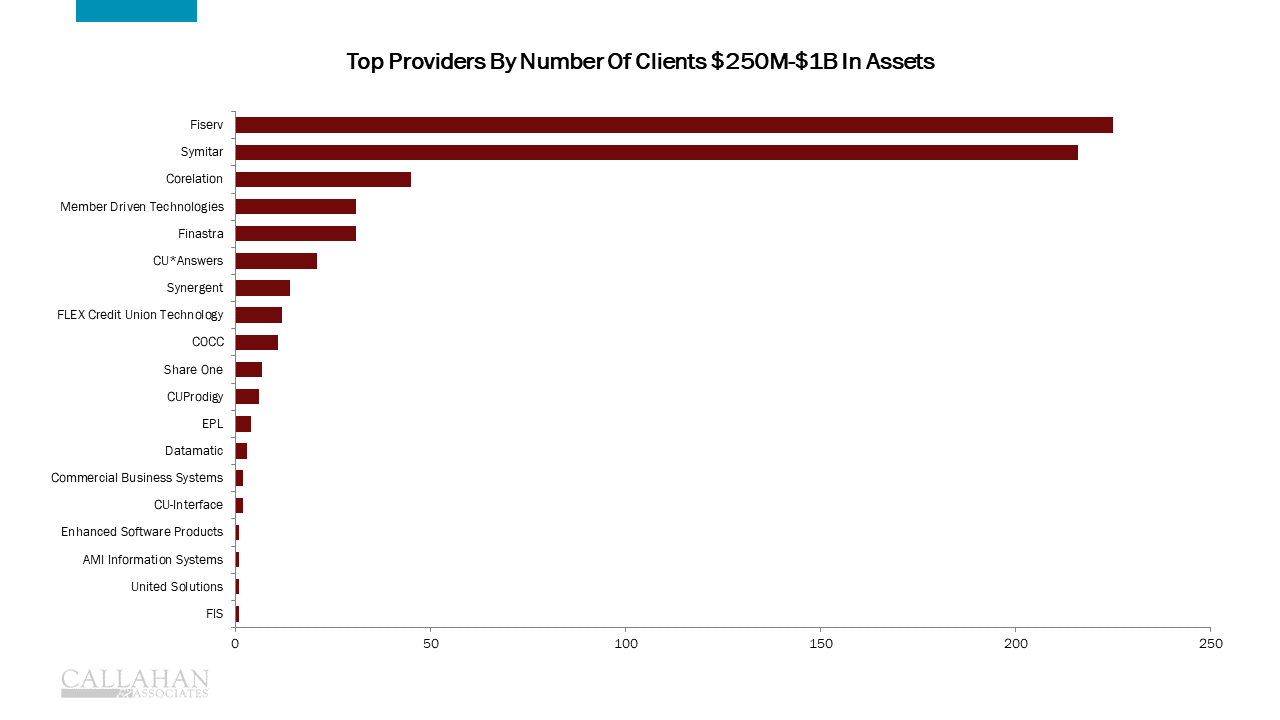

Corelation maintains a notable share of the upper-mid-size credit union market

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates

Fiserv has a dominant hold on the credit union market under $250M in assets.

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates

FedComp remains the top alternative to Fiserv for the nation’s thousands of credit unions under $50M in assets.

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

SOURCE: Callahan & Associates