Credit unions reported a net increase of 35 branches in the past year and operated 21,012 branches nationwide as of June 30, 2017. The credit union membership base expanded 4.3% year-over-year to 110.6 million. With membership growth outpacing branch growth, credit unions served 204 more members per branch as of mid-year than in 2016. For second quarter 2017, credit unions served an average of 5,265 members per branch.

As member demand for financial technology increases and branch traffic decreases, credit unions looked to scale back the square footage of branches and placed a greater focus on incorporating technology into daily operations. As of second quarter 2017, credit unions reported 16,141 ATM locations, down 607 from June 2016. This can be attributed to shared ATM strategies and increased online and mobile initiatives. Credit unions offer convenience through an array of channels outside of ATMs.

In second quarter 2017, 77.2% of credit unions reported offering online banking, whereas 56.9% of credit unions reported serving members through mobile banking. The most popular electronic service provided by credit unions is e-statements. Just shy of 70% of credit unions reported offering this option as of June 30, 2017. Other common electronic services include bill pay, new member applications, and new loan applications. At mid-year, 64.6% of credit unions offered bill pay, and 37.3% and 51.4% of credit unions across the nations offered new member and loan applications, respectively. ContentMiddleAd

As more members are on the go, remote deposit capture is becoming increasingly popular among credit unions. This service expanded 6.0% annually, and 36.4% of credit unions reported providing RDC. The technology allows members to make deposits without stopping at a branch or ATM. Expanding this service is another way credit unions are increasing convenience and value for their members.

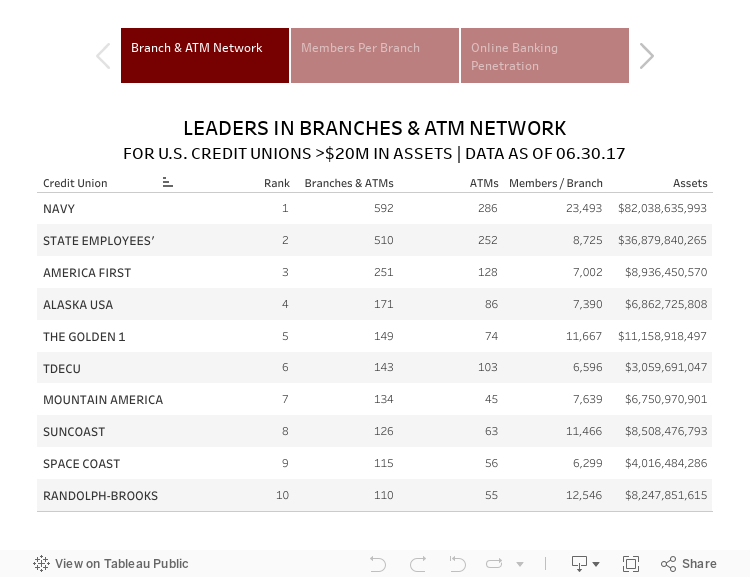

Click through the tabs below to see the top 10 credit unions in each leader table.

var divElement=document.getElementById(‘viz1514309903139’); var vizElement=divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’750px’; vizElement.style.height=’577px’; var scriptElement=document.createElement(‘script’); scriptElement.src=’https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

var divElement=document.getElementById(‘viz1514309903139’); var vizElement=divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’750px’; vizElement.style.height=’577px’; var scriptElement=document.createElement(‘script’); scriptElement.src=’https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

See the rest of these tables and explore dozens more along with hundreds of pages of credit union performance data in the 2018 Callahan Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

CASE STUDY

Growing Earnings Through Different Revenue Streams

Dupaco Community Credit Union | Dubuque, IA | Assets: $1.6B | Members: 100,156

In 2015, Dupaco Community Credit Union opened a branch near a local community college in the western suburbs of Dubuque, IA.

Dupaco values its brick-and-mortar presence, especially in high-visibility locations. But in this suburban branch, Dupaco wanted to try something different. Its total branch transactions were up over past years and member growth was strong, but branchtransactions per household were declining compared to the national average.

So, instead of opening a traditional transactional branch, Dupaco opened its first Learning Lab, a branch designed to solve a member’s personal financial challenges.

If members didn’t like it, then they drive into town to conduct their financial business, says David Klavitter, the credit union’s senior vice president of marketing and public relations.

The credit union planned its branch of the future with one question in mind: How can a branch act in a member’s best interest?

The answer was to create a location that relies less on transactions and more on conversations, a place where members come to work with the institution to solve their financial challenges.

Floor space is flexible and furnishings make the branch feel less like a credit union and more like a retail environment. In fact, learning labs have no traditional teller lines or pods. Instead, Dupaco operates eight ITMs across its three labs. However,credit union greeters do welcome members and make them feel comfortable in the new branch environment.

We still need somebody to engage members and guide them to where they need to go, Klavitter says.

Other in-person branch staff focus on conversations and financial counseling.

The result of Dupaco’s learning lab concept is immediate Dupaco-ized engagement with members, Klavitter says.

Additionally, the ITMs have allowed the credit union to expand operating hours in lab locations by one hour in the morning and one at night. The credit union is still looking for other ways to improve services in these branches.

That’s why it’s called a Learning Lab,’ Klavitter says. Our members are learning about their money and we’re learning how best to help members understand their money.

Read The Whole Story

How Do You Compare?

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer analytics. More insightful performance comparisons start here.