Behavior is the brand at Element Federal Credit Union ($30.5M, Charleston, WV), where social action combines with engaged service to increase membership and deepen relationships.

The West Virginia credit union uses very little traditional marketing and advertising, choosing instead to build business and brand recognition with equitable lending practices that are cognizant of the area’s economic needs, hyper-local environmental and charitable efforts, social media, and an abiding attachment to the state it calls home.

We serve West Virginia, says Linda Bodie, president/CEO of the 4,671-member credit union who goes by the less-common title of chief innovator. This is our home. This is who we are. We’re committed to their future andours, financially and socially. We care about their finances and the community we share.

Building Brand In Multiple Ways

Explore Element’s website and it looks like a textbook example of the power of behavioral economics,appealing to consumers’ self- and communal interests with its mix of products and services, personality and personalities. Features include local happenings along with members posting pictures of themselves and their cats and other loved beingsand landmarks. Not just posting pictures, but even putting them on their instant-issue debit cards, if they’d like. Creating their own brand, in a sense, under the Element umbrella.

Element members can brand their plastic with personalized images, such as this debit card that displays the artwork of CEO Linda Bodie’s daughter.

CU QUICK FACTS

ELEMENT FEDERAL CREDIT UNION

Data as of 09.30.15

- HQ: Charleston, WV

- ASSETS: $30.52M

- MEMBERS: 4,671

- BRANCHES: 3

- 12-MO SHARE GROWTH: 8.78%

- 12-MO LOAN GROWTH: 7.70%

- ROA: 0.65%

Other efforts include partnering with its core processor CU*Answers on a debit-swipe program that ponies up a nickel to a charity each time the member uses it. The credit union asks members to suggest a beneficiary and can typically raiseapproximately $200 to $300 a month. That’s a big help to organizations like the Kanawha-Charleston Human Association, a particularly popular choice. The program also yielded this case study from CU*Answers.

Recycling the water bottles that arrived by the thousands in Charleston after a massive toxic contamination of the city water supply was another effort that gained attention.

We partnered with the city to pick up all the bottles that members and non-members were bringing us, Bodie says. We created awareness and did something to help make our community a better place. You don’t have to do big things allthe time. Just do something.

Element also strays from strict reliance on credit scoring to offer loans to young couples, people experiencing divorces and health hardships, and any member who poses a good risk. Delinquencies are a natural consequence of this, but Bodie builds thatinto the budget and says the trade-off is worth it in the longtime relationships forged.

Creating a new generation of lifelong members also involves creating electronic processes whenever possible. Don’t make a young person fill out a paper application or stand in line to deposit a check, Bodie says.

Element’s philosophy of making the credit union easy to use extends to deposit forms for younger members.

Younger consumers particularly seem to respond to those digital and in-person efforts to make Element their choice.

Most of these young adults have never experienced anything like this before, Bodie says. They come to us with the traditional banking mentality and then after they experience what we can do for them and with them, they come back. That’sthe power of a cooperative, people working together and not against one another.

It’s also emotions and economic decisions coming together, in an approach that hews with this observation from Peter Noel Murray, a consumer psychology practitioner, in a column about behavioral economics in Psychology Today: Most people believe that the choices they make result from a rational analysis of available alternatives. In reality, however, emotions greatly influence and, in manycases, even determine our decisions.

Making The Element Choice

To define our brand and expectations and act on that, first we had to establish who we are, who do we want to serve, and how we want to serve them, says Bodie, who joined the credit union in 1998. We knew, for sustainability, we hadto focus on young adults.

It begins with meeting them where they are.

Our members are getting younger and younger, little by little, and we serve our members in creative ways, Bodie says. They can text us, Skype us, FaceTime us, Facebook message us. Whatever their communication channels, we’re there.

Element also emphasizes interactions that build person-to-person trust. We’re hoping to get our members into traditional lending and saving products, Bodie says. Products that can brand a consumer a member for a lifetime.

The average age of credit union members nationwide was 48.5 in 2014, according to CUNA. Bodie says the average age of members who have joined her credit union in thepast year is 38.5.

We’re very high touch and high-tech, Bodie says. We’re building our brand around providing both. We’re a business that works to meet both our members’ needs and desires for a better financial life and for making thisplace we all love a better place to live.

But that outreach requires investment. Although Element doesn’t use traditional advertising, its marketing expense per member was $11 in third quarter 2015, more in line with the $13 per member for all credit unions in the United States than the $7per member for the average credit union in Element’s asset-based peer group.

How Do You Compare?

Check out Element’s performance profile.

Element also invests in people. The credit union has 16 full-time employees, compared with 10 for the average $20 million to $50 million credit union and posted a 16.89% jump in average salaries and benefits from the same quarter last year. That compareswith 1.41% for its peer group and an average 3.87% for all American credit unions. That jump raised the average for each FTE to $42,714 at Element, well below the peer average of $54,251 and the $68,450 in average salaries and benefits per employeefor the nation’s 6,092 credit unions as a whole.

By The Numbers

Element’s share growth was 8.78% year-over-year in third quarter 2015, more than three times the 2.54% for the average credit union of $20 million to $50 million in assets for that quarter, and the 2.45% for the average West Virginia credit unionof any size. The national average for all 6,092 federally insured credit unions was 6.22%.

SHARE GROWTH

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source:Peer-to-Peer Analytics by Callahan & Associates

Element’s share growth far outpaces that of the industry as a whole and its own asset-based peer group.

Loan growth at Element was 7.70% for the third quarter, compared with 3.90% for its asset-based peer group, and 11.12% for all credit unions.

Element’s average member relationship at the end of September was $11,294, a 7.85% jump year-over-year compared with a 3.31% growth in its asset-based peer group, 3.89% on average for all West Virginia credit unions, and 3.97% on average for all creditunions nationwide.

The payoff in that increased investment in people and technology also showed in the $3.29 in revenue for each dollar spent on benefits and salaries Element posted in the past quarter, compared with $2.58 for its peer group and $2.98 for all credit unions.Loan income per FTE in third quarter 2015 was $78,079, compared with $67,737 for the average $20 million to $50 million credit union and $97,370 for all credit unions nationwide, regardless of size.

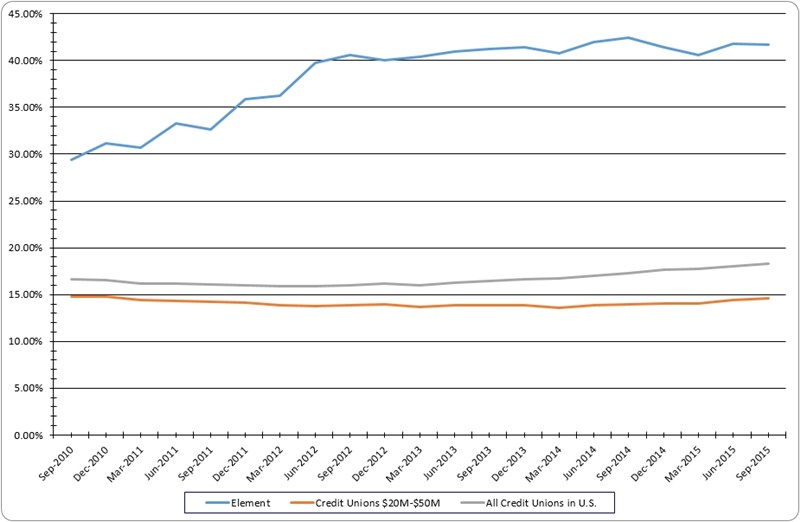

Element’s auto loan penetration was 41.70% at the end of September, more than double the average credit union penetration rate nationally of 18.31% and nearly triple that of the 14.62% for the average credit union in the $20 million to $50 millionasset group. That’s in the top 1% of the 1,146 credit unions in that group.

AUTO LOAN PENETRATION

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Element is in the top 15 for auto loan penetration among the 1,146 credit unions with $20 million to $50 million in assets.

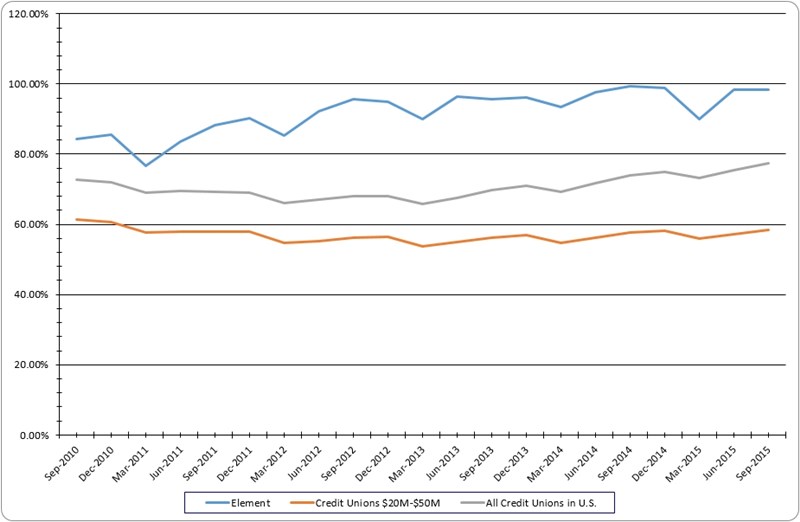

The West Virginia credit union is at 98.38% loans-to-shares in third quarter 2015, nearly 90% higher than the average of 58.32% in its asset-based peer group. The national average for all U.S. credit unions at the end of September was 77.53%.

We’re nearly loaned out, and isn’t that what it’s all about? Bodie says. Auto loans are about as crucial a product there is that you can provide a member.

That’s why Element staffers watch for opportunities, such as a pulled credit report, to offer money-saving options.

LOAN-To-SHARE

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Element was 98.38% loaned out in third quarter 2015; that puts it in the top 3% for its asset-based peer group.

We tell them, ‘Look, we can save you $100 a month,’ Bodies says. They’ll trust us again next time we cross-sell, and that’s how you build a long-term friendship and business relationship.

You Might Also Enjoy

- A Brand That Meets Past With Present

- The Elements Of A New Brand