Subscriber Package: Executives Insights For Business Continuity,Hope For The Best, Prepare For The Worst

Advice Learned After The Joplin TornadoBuild A Business Continuity Plan Based On Stakeholder Group Begin Building A Business Continuity Plan By Talking To PeersGet Help from Outsiders To Build A Business Continuity Plan

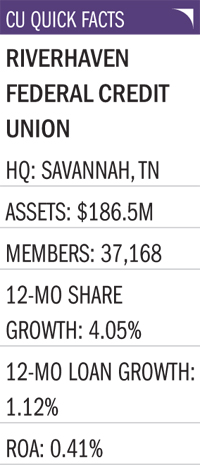

Editor’s Note: Alicia Henryand Riverhaven Federal Credit Union are not real. CreditUnions.com presents this fictional situation as a fable around which real CEOs offer candid advice and insights.

Editor’s Note: Alicia Henryand Riverhaven Federal Credit Union are not real. CreditUnions.com presents this fictional situation as a fable around which real CEOs offer candid advice and insights.

Alicia Henry, CEO of Riverhaven Federal Credit Union in south-central Tennessee, watched news coverage of Hurricane Sandy and swallowed hard. Two things were clear to her: Natural disasters were more frequent than in the past 100-year storms seemed to be coming every two or three years now and destruction and suffering could not be accurately predicted either in locality or extent.

When Henry stepped into the CEO role, her senior staff briefed her on the credit union’s emergency response plan.That was three years ago, and the plan was outdated even then. The credit union’s equipment was more extensive and expensive than was accounted for in the plan. A far higher percentage of members now communicated with the credit union through Internet, mobile, and other wireless devices. And the credit union had opened several additional branches.

But it wasn’t just the age of the plan that concerned Henry. Staff members with little training in disaster management had designed the plan, and it just didn’t adequately address how the credit union should proceed in different scenarios.For example, some disasters allowed for several days of preparation while others cropped up suddenly. Hurricanes that spun up through Mississippi and Alabama at least allowed a few days’ notice to brace for flooding and power outages, and drought conditions could predict forest fires. But tornadoes offered little notice as the Joplin, MO, disaster shockingly demonstrated and earthquakes none at all. Having grown up in Memphis, Henry was aware some of the nation’s most powerful earthquakes had struck in the central United States. What’s more, Riverhaven’s headquarters overlooked low land alongside the Tennessee River. It was a beautiful area that was, unfortunately, subject to flooding.

There were several kinds of calamities that could potentially strike any of Riverhaven’s nine locations at any time. The credit union’s branches were scattered through the small communities of its region. No one was particularly larger than the others, though, and Henry felt such decentralization might be helpful in a disaster that affected only a portion of the Riverhaven area.

There were several kinds of calamities that could potentially strike any of Riverhaven’s nine locations at any time. The credit union’s branches were scattered through the small communities of its region. No one was particularly larger than the others, though, and Henry felt such decentralization might be helpful in a disaster that affected only a portion of the Riverhaven area.

Henry knew she had taken a complacent, perhaps lackadaisical, approach to updating the credit union’s business continuity plan, but she was now determined to devise a workable plan the credit union could put into place to meet a range of situations,whether natural or man-made. Of course, creating and implementing an effective, comprehensive plan required more than a simple phone call or a few discussions. She had to consider the whole condition of the credit union.

Riverhaven was a mid-sized institution with a community charter for select counties in south-central Tennessee and northern Mississippi and Alabama. Riverhaven had always been more closely bound to Memphis than to Chattanooga, where the Tennessee League is located, and had never been particularly active in league work. In fact, it was rather isolated from other credit unions physically and fraternally.

Henry knew the sluggish economy was going to make it more difficult for her to convince the board of the necessity of diverting resources to create an updated plan, especially if she couldn’t show an immediate, positive effect on the bottom line. As CEO, Henry made Riverhaven’s mobile banking a priority, and she was proud members now had account access. The credit union was currently working on a mobile payments system; however, it was months away from roll out. Could she weave any of the mobile banking work into a disaster preparation plan?

Despite its strength Riverhaven’s capital ratio was 10% and its provision for loan loss was more than 100% Henry was worried about the credit union’s bottom line in a widespread disaster. A major hurricane traveling north from the Gulf Coast would cause flooding and power outages over Riverhaven’s entire area. Increased local business failures would not bode well for Riverhaven, as it had a substantial MBL portfolio of small businesses.

How should Henry and Riverhaven proceed? What should she prioritize? To whom should she reach out and what questions should she ask? Should she engage a consultant? If so, how should she choose one? How should she determine what to spend? Was there any immediate benefit to such a project for example, could a disaster communications plan provide for overall improved communications or could a data backup plan deliver new efficiencies to the general operating system? How can she measure how effective the end plan is? How often should Riverhaven test and revisit its plan? How expensive is testing? What can Riverhaven learn from other credit unions that have suffered through disasters?

Alicia looked away from the television and out of her office window. She could see a collection of office buildings and beyond that a stretch of river, fields, and forest. It all seemed so tranquil now. But so had the southern New Jersey Shore in mid-October. What would Riverhaven do if the region suddenly looked like the Jersey Shore or parts of Staten Island post-Hurricane Sandy? She felt she owed her membership as much in the way of preparation as she could muster. So how should she go about doing it?

Want to learn more? Click on the articles in the Subscriber Package below for a deeper dive into Executives Insights For Business Continuity .

Subscriber Package: Executives Insights For Business Continuity Hope For The Best, Prepare For The Worst

Advice Learned After The Joplin Tornado Build A Business Continuity Plan Based On Stakeholder GroupBegin Building A Business Continuity Plan By Talking To PeersGet Help from Outsiders To Build A Business Continuity Plan