Approximately four out of 10 credit unions make plans each year to issue dividends if markers are met, but only one in 10 end up doing it, and when it comes to patronage payouts, it’s even more rare for a credit union to tell its members the check is in the mail.

Earlier this year, Callahan surveyed credit union CEOs and CFOs regarding their patronage dividend attitudes and activity. There were 466 respondents to the survey, which included company clients and non-clients alike, represented an even mix of asset sizes and regions.

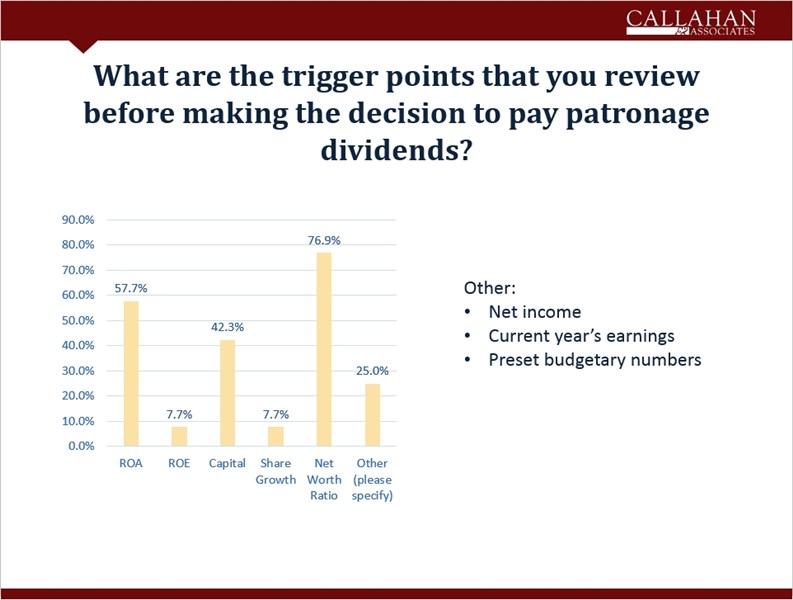

About 40% of the respondents say they do include the payouts in budget planning. The rest said they don’t include the patronage dividend as part of their annual budget. Instead, they make that decision based on the year behind, with net worth ratio, return on assets, and return on equity cited as the top trigger points to review before deciding whether to give back.

We have a net worth model with a low and high range of what we need. It considers multiple risks credit, liquidity, interest rate, strategic, etc. and if we are outside of that range on the high side, we need to return to more of our members.

Either way, only 2% of respondents reported using snail mail to deliver the dividends. The vast majority of respondents 91% use direct deposits. Other payout methods included rate rewards on certificates or a sweep to a delinquent loan account.

Financials forward and back play a large role in determining if and when to pay a patronage dividend, the Callahan survey found. Levels of capital was by far the single largest factor in considering the risk, with 60% of the respondents saying they considered that in their calculations.

We have a net worth model with a low and high range of what we need, one respondent wrote. It considers multiple risks credit, liquidity, interest rate, strategic, etc. and if we are outside of that range on the high side, we need to return more of our members.

Another commenter from a credit union in the $100 million to $250 million asset group says it issued a 2014 dividend based on total interest earned and paid.

We added them together so we would be rewarding those with large deposits as well as those with members with loans, the commenter says, adding that its core processor did the calculations and payouts and required little human intervention.

We did a bonus dividend several years ago. We had very little reaction from our members overall. Since it seemed to be such a non-event, we decided not to do it again, and have had no negative effects.

One credit union in the $500 million to $1 billion asset class says it did not issue a dividend this year but plans to in 2016.

We are spending most of this year developing a loyalty dividend program that will reward our members for their patronage, noted the respondent. This program will recognize multiple avenues of participation, including deposits, loans, and electronic transactions.

Why bother? That was the take from a manager at another credit union this one in the $50 million to $100 million asset group who observed, We did a bonus dividend several years ago. We had very little reaction from our members overall. Since it seemed to be such a non-event, we decided not to do it again, and have had no negative effects.

And why create a demand that’s not there? We’ve heard from some other credit unions that if they set up an expectation for that year-end dividend, members tend to get upset if they don’t do it again, the same commenter observes.

According to survey respondents, other cons include taking away capital that could be used to support future growth and disappointing members with an insignificant payout.

No Premium Placed On Payout Publicity

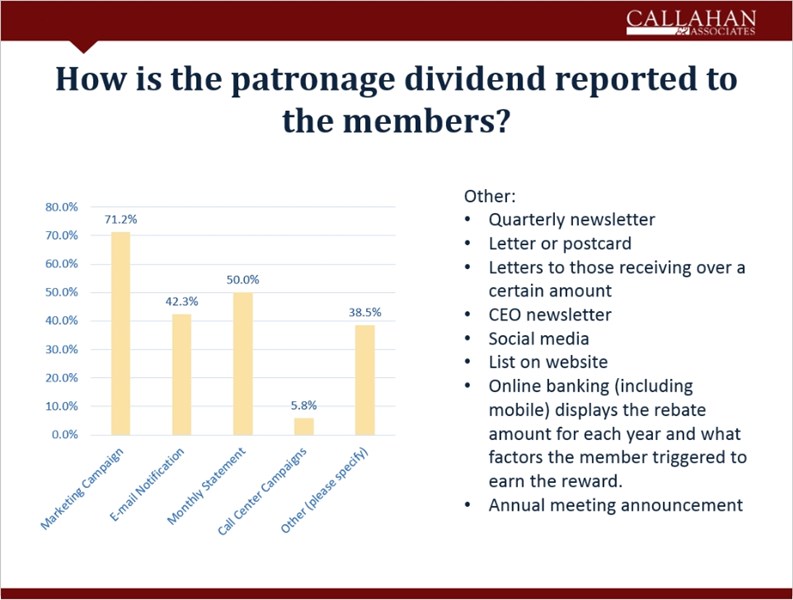

Despite the fact survey respondents listed building loyalty, good publicity, and a great way to promote the value of the cooperative among the pros in paying out a patronage dividend, they still did not generally place a high premium on promoting the dividend and its possibilities to members or the community.

Here are some other takeaways from the survey:

- 59% don’t provide a patronage dividend QA.

- 77% don’t provide a calculator for members to determine a possible dividend.

- 90% don’t discuss their patronage dividend with their regulator before implementing it.