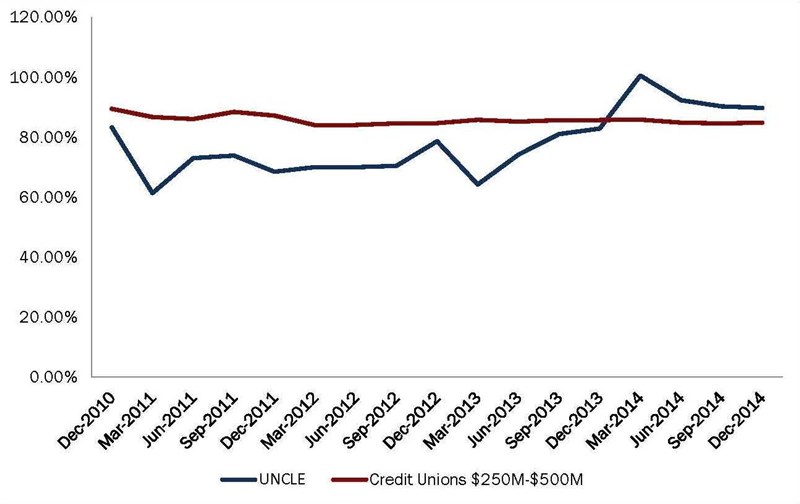

In the first quarter of 2014,UNCLE Credit Union’s($295.2M, Livermore, CA) efficiency ratio topped 100%. The measure of how much the credit union spends to create $1 of revenue was higher than both state and asset-based peer averages of 80.49% and 85.83% respectively, according to Callahan & Associates data.

A large part of this investment has taken the form of management-level leadership training. In 2011, the credit union established sales quotas for branch managers, which the credit union refers to as financial center managers, and implementedmanagement-led projects designed to generate revenue and cut costs.

Revenue has been a factor for us over the past couple of years, says Dree Johnson, director of retail banking at UNCLE. We’ve had to reinvest in our infrastructure after some hard times.

In the short-term, the investment has paid dividends. As of the fourth quarter 2014, the 23,800 member cooperative headquartered on the eastern edge of California’s San Francisco Bay Area has dropped its efficiency ratio to 89.76% and has increasedloans by 27.62% year-over-year.

CU QUICK FACTS

uncle Credit Union

data as of 12.31.14

- HQ: Livermore, CA

- ASSETS: $295.2M

- MEMBERS: 23,820

- BRANCHES: 4

- 12-MO SHARE GROWTH: 6.41%

- 12-MO LOAN GROWTH: 27.62%

Quotas Drive Accountability

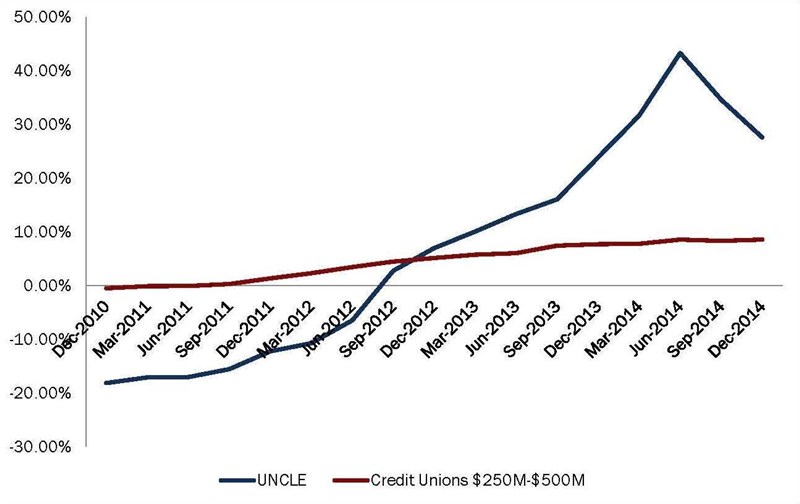

That’s a stark contrast to three years ago. In the fourth quarter of 2011, UNCLE posted negative loan growth of -12.23%. Its annualized loan originations per employee of nearly $380,000 lagged behind the $820,000 average recorded by peers in the$250 million to $500 million asset range.

To turn around this performance and boost leadership skills and accountability among its management level team, UNCLE instituted financial center manager sales goals.

The sales goals really hold the financial center manager accountable, Johnson says. They’re coaching, following up, training, and providing feedback and recognition surrounding our expectation of needs-based cross-selling.

Efficiency ratio

Data As of December 31, 2014

Callahan & Associates | www.creditunions.com

Source: Callahan & Associates’ Peer-to-Peer Analytics

When it launched the quota program, UNCLE recalibrated the financial center manager review process. Today, branch production accounts for roughly two-thirds of a managers’ total performance. Behavior, collaboration, product knowledge, and communicationtogether comprise slightly less then one-third of the yearly performance review. This weighting, Johnson says, serves to inspire financial center managers.

Branch production is a motivating factor, she says.

Performance goals align within each branch. Front-line employees have the same goal as assigned to the manager, though their goal is broken down into percentages based on the number of full-time branch employees.

Initially, the credit union set conservative performance goals, says Johnson. Primarily, it wanted to increase branch production in the form of ancillary product sales, membership growth, consumer loan growth, and both mortgage and investmentreferrals 15% from 2011. Total loans at the credit union grew approximately 7% in 2012. As of fourth quarter 2014, total loans have increased nearly 70%.

Expectations have risen in accordance.

Within three years we were able to ratchet up the goals, Johnson says. They’ve surpassed their numbers every year.

loan growth

Data As of December 31, 2014

Callahan & Associates | www.creditunions.com

Source: Callahan & Associates’ Peer-to-Peer Analytics

To complement the credit union’s new sales approach, employees at UNCLE’s four branches dedicated nine months of training last year to become financial consultants. Employees now have the skills and training to enter loan applications into itssystem and open various accounts, among other responsibilities.

Having a team that doesn’t simply handle transactions has opened up cross-selling possibilities. UNCLE’s average member relationship has grown more than 12% year-over-year versus the 3.9% average reported by its asset-based peers.

Because they have this sales goal, they’re motivated to profile the account when a member comes in and see what else they can offer, Johnson says.

Financial Center Managers Generate Revenue And Cut Costs

Branch-level accountability was the primary driver behind UNCLE’s new initiative. As such, over the course of 2015, each one of Johnson’s direct reports her four financial center managers and contact center manager will createand execute a project that either generates revenue or cuts costs.

Designing their own programs will not only help keep financial center managers engaged and accountable but also challenge them to train and develop valuable skill sets.

My objective was to give [managers] an opportunity to lead a project and know the components that go into them, Johnson says.

According to Johnson, that includes scheduling meetings, creating agendas and timelines, and identifying skill sets as well as recognizing the key players that have these skill sets, assigning them tasks, and holding them accountable.

The initiative is new for 2015, but starting this year, one direct report will pitch a project idea to Johnson at the onset of every quarter. The manager is then responsible for making it operational one month after her approval. The first initiativeis set to launch at the end of April; the four other projects will be staggered over the course of the year.

It’s an opportunity for them to show what they’re made of.

Because each project requires the manager to pull together a team of back-office and branch employees, managers must take care to create minimal overlap. If, for example, the project requires someone from the credit union’s finance and IT departments,and its contact center, managers must be mindful to manage the workloads of others.

Time is a factor for everyone, says Johnson, who anticipates these projects will account for 10-15% of an employee’s regular workload.

Manager In Action

In Tracy, CA, UNCLE’s financial center manager, Janice Silveira suggested shared branching as her 2015 revenue project. Historically, UNCLE has been a shared branch issuer. Recent internal discussions, however, have focused on whether becoming anacquirer i.e., bringing non-members in for transactions and getting paid a premium by the network can generate revenue.

The Tracy branch provides a perfect test case for a shared branching profitability experiment, which the financial center manager pitched for her project on March 1 with the goal to launch by the end of April. The Tracy branch serves mostly commuters,which creates slower periods of lobby traffic. In becoming a shared branch acquirer, the branch can maintain staff efficiency while earning additional income.How much revenue the branch generates will determine whether the credit union will further explore shared branching at its other locations. Johnson declined to provide specific goalsbut says the credit union budgeted with conservative projections.

Going forward, Johnson says she’d like to see managers address two topics: a campaign to enroll members in e-statements and a way to encourage members to opt into overdraft protection as laid out in Regulation E.

If we can get financial center managers involved in running campaigns where we focus on educating members about their overdraft options and ensuring they select some type of overdraft protection, we can not only protect our members, but the endresult will likely increase Courtesy Pay fee income for the organization, she says.

As excited as Johnson is to see the financial benefits the projects present, she is just as excited to see how increased responsibility and accountability will develop the professional skills of her direct reports and benefit the institution.

I’m giving them an opportunity to try something new, to build their confidence, to expand their resumes, and to support me and my boss’s efforts to drive projects forward, Johnson says. It’s an opportunity for themto show what they’re made of.