Infinity Federal Credit Union($297.3M, Portland, ME) replaced its chief lending officer in 2009, the credit union had to look elsewhere for a source of income during the lengthy hiring process.

Fortunately, Infinity had a wealth of internal investment knowledge.

CFO Mike O’Brien has now been with the credit union for 15 years and has an additional 10 years of bank experience. He also holds his CPA license as well as several additional investment licenses.

CU QUICK FACTS

infinity federal credit union

Data as of 09.30.15

- HQ: Portland, ME

- ASSETS: $297.3M

- MEMBERS: 14,984

- BRANCHES: 4

- 12-MO SHARE GROWTH: 11.15%

- 12-MO LOAN GROWTH: 17.45%

- ROA: 0.68%

Although the credit union had been making money off its investments for a number of years prior to the CLO’s departure, the portfolio has grown significantly in the past five years.

Since 2010, the credit union has generated $10.4 million in net income, including $5.8 million in gains from selling securities, O’Brien says. As of third quarter 2015, the credit union held $84 million in investments, according to Callahan’s Peer-To-Peer software.

We planned to reduce investments as the loans grew, O’Brien says. But the loan volume did not come, until recently, so we’ve stuck to our investment strategy.

Infinity’s Investment Strategy

Infinity invests in three different tiers that are all backed by the government meaning it only buys and sells with Ginnie Mae, Fannie Mae, or Freddie Mac.

O’Brien calls the first tier vanilla, mortgage-backed securities (MBS). The credit union purchases $1 million to $3 million in MBS to use primarily for investment income and cash flow. The securities provide monthly paydowns and Infinity can usethem as collateral to borrow from the Federal Reserve and the Federal Home Loan Bank of Boston.

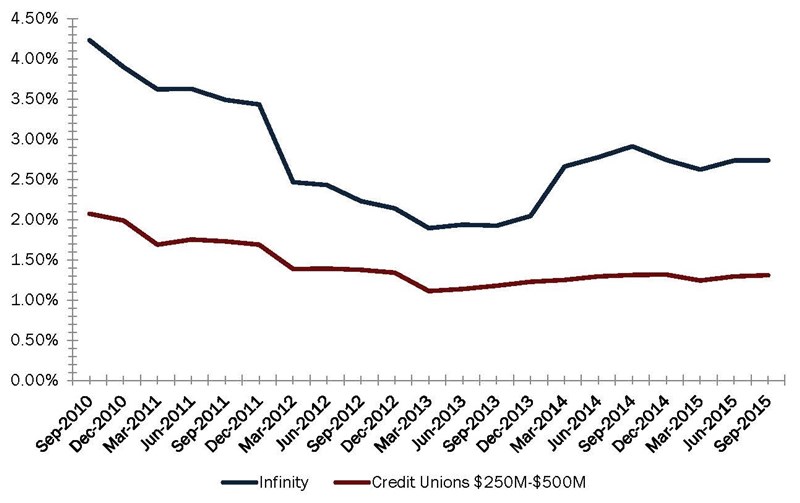

YIELD ON INVESTMENTS

For all U.S. credit unions | Data as of 09.30.15 Callahan & Associates | www.creditunions.com

Source:Peer-to-Peer Analytics by Callahan & Associates

Infinity’s 2.74% average yield on investment far outpaces the 1.31% yield of its asset-based peers.

The second tier is made up of poorer-quality MBS. Loans in this tier of securities include interest-only mortgages written before 2008 and current HARP loans. O’Brien reads through the securities’ prospectus and identifies those he thinksare likely to default on government-backed securities that default, Infinity gets paid dollar-for-dollar on the face value.

O’Brien looks for securities priced roughly $0.89 to $0.96 on the dollar, thus earning $0.04 to $0.11 on each dollar of default.

These are safe investments if you take the time to read the prospectus, O’Brien says. A lot of people don’t want to read it, but I do. You can learn a lot about the securities.

The third investment tier is odd lots MBS of smaller sizes and prices. Infinity generally purchases lots that range from $10,000 to $150,000. If the credit union buys enough of them, it can repackage them as a larger portfolio with higher pricing,thereby earning points on the dollar.

For example, the credit union can buy a Ginnie Mae MBS for $0.98 on the dollar, spending $980,000 for a security with a face value of $1,000,000. Or, it can buy 100 $10,000 odd lots for $0.95 on the dollar, repackage those 100 odd lots into a single MBS,sell that larger MBS at $0.98 on the dollar, and earn $0.03 on every dollar it sells or $30,000.

The duration of the investments Infinity purchases changes constantly due to the high number of transactions. The credit union buys and sells hundreds of these odd lots every month; twice Infinity sold more than 1,000 total in a single month.

We don’t own bonds that only pay interest until maturity or when called, O’Brien says. Only bonds that pay monthly principal and interest.

Risk, Accounting, And Board Support

Infinity has identified six benchmarks it must meet to make its investment strategy a success.

First, and beyond all others, Infinity needs the support of its board. Without board support, O’Brien couldn’t make the decisions he needs to make in the timeframe in which he needs to make them.

Second, the credit union must appease its regulator. The NCUA closely examines Infinity’s investment strategy every year, O’Brien says. The agency initially challenged the credit union, but Infinity defended its position through asset-liability preparation and meticulous documentation on every trade.

The NCUA has been fair with us over the years, O’Brien says. But it also examines the heck out of us annually.

Third, Infinity requires a quick and efficient accounting on its trades. The credit union has three employees in its accounting department two who work on investments in addition to other responsibilities. The accounting process for each trade is time consuming, as there are many trades and moving pieces. The credit union must take the security out of safekeeping, settle wires, make journal entries, and complete other documentation.

Fourth, Infinity needs free safekeeping for its investments. The credit union uses Raymond James for safekeeping, as its former safekeeping vendor charged up to $80,000 per year, unnecessarily eating into investment earnings.

Fifth, O’Brien must be current on investment prices and have strong broker relationships. He’s known two brokers one at Stifel Nicholas, the other at Raymond James for more than 15 years and estimates he’s completed morethan 10,000 trades with each. These relationships are mutually beneficial, as brokers work on commission and appreciate how quickly O’Brien approves trades.

Find your next partner in Callahan’s online Buyer’s Guide.Browse hundreds of supplier profiles by name, keyword, or service area.

Many brokers don’t want to do the number of tiny trades we do, he says. But I can give them an answer in minutes. I’m up on where the market is, so if I feel like it’s a good deal, I’ll do it.

Sixth, the credit union must accept the time commitment. O’Brien estimates he spends 35% of his time on all aspects of the investment process, from working with his accounts to staying current on pricing and communicating with his brokers.

It’s a ton of work, O’Brien says. I’ve discussed this strategy with credit unions and most don’t have either the time or expertise to do it. I’m lucky.

The Future Of Investments

In October 2014, Liz Hayes took the helm at Infinity, replacing a CEO who had been in the position for nearly 30 years.

She’s very aggressive and we are growing loans quickly, O’Brien says.

As a course of action, the credit union has kick started lending again, and as of third quarter 2015, Infinity had increased loans 17.45% year-over-year, representing a new high in total loan volume.

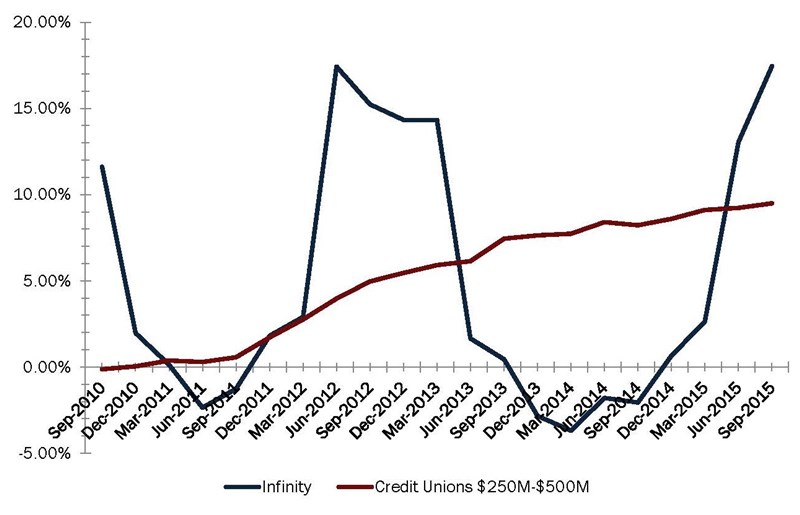

LOAN GROWTH

For all U.S. credit unions | Data as of 09.30.15 Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

For the past two quarters, Infinity has posted double digit loan growth. As of third quarter 2015, its year-over-year growth rate of 17.45% bests asset-based peer average.

O’Brien is pleased with the loan growth, as it represents a deepening relationship with Infinity’s membership and falls in line with the institution’s goals.

Our goal was always to grow loans, he says. And until we did, we were going to take advantage of investments.

And in the future, O’Brien foresees investments holding steady in terms of total balances.

Ten years from now we will be considerably bigger in asset size, O’Brien says. But we would like to have the same amount in investments.

You Might Also Enjoy

- How To Buy A Participation Loan

- Earnings Performance By The Numbers (3Q 2015)

- 3 Strategies To Manage Liquidity

- How Firefighters First Credit Union Plans To Hit $1 Million In Net Income