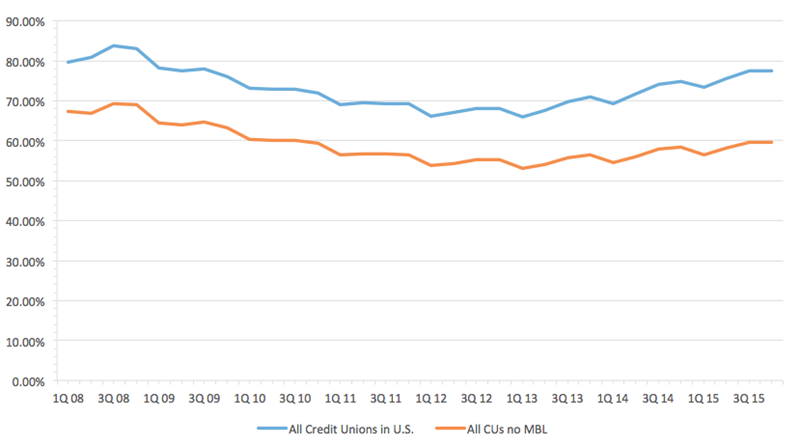

By many measures, 2015 was a landmark year for credit union lending. According to quarterly performance data reported by Callahan & Associates, first mortgage originations surged by 33.8% year-over-year, enabling credit unions to capture a record 8.5% market share. Consumer lending also grew, with new auto loans pacing the category at 16.8% growth. Credit unions ended the year at an average loan to share of 77.5%, the highest level since 2009.

LOAN-TO-SHARE RATIO

For all U.S. credit unions | Data as of 12.31.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

With all of this positive momentum, it is worth considering how top credit unions are able to grow their loan portfolio while handling the increase in volume efficiently and safely.

Digital Federal Credit Union, popularly known as DCU, ($6.8B, Marlborough, MA) has implemented several mortgage and consumer lending programs in recent years that have helped it to attain strong year-over-year loan growth of 8.77% in 2015, while maintaining a robust loan-to-share ratio of 103.62%.

CU QUICK FACTS

DIGITAL FEDERAL CREDIT UNION

Data as of 12.31.15

- HQ: Marlborough, MA

- ASSETS: $6.8B

- MEMBERS: 544,776

- BRANCHES: 23

- 12-MO SHARE GROWTH: 12.79%

- 12-MO LOAN GROWTH: 8.77%

- ROA: 1.18%

For DCU, it all comes down to its member-centric approach. This includes examining every step of the borrowing process to ensure it is easy and quick for the member and allows them to achieve their ultimate objective.

People aren’t shopping for a loan, says Debbie Taverna, vice president of consumer lending. They want to buy a car. They want to buy a home. The loan is just a means to get there.

DCU is the largest credit union headquartered in New England, and is in the top 20 nationwide. It serves more than a half-million members in all 50 states. Originally chartered to serve employees and family members of the Digital Equipment Corporation, the cooperative has a long history of serving a sophisticated and technologically savvy membership base.

Our focus has always been on the digital nature of lending, says Caleb Cook, vice president of mortgage lending. With our core membership coming from the technology field, they expect a high degree of technological innovation from their credit union.

DCU was one of the first credit unions to offer remote deposit capture through a mobile banking application and was an early champion of accepting e-signatures and electronic documents online.

These days, DCU’s focus is squarely on streamlining the loan application process for members. Here are a few ways that DCU is leading the way in mortgage and consumer lending.

A Member-Friendly Mortgage Process

For lenders, pre-approvals are among the most costly and resource-intensive steps in the mortgage process. Homebuyers often request a pre-approval before beginning the search for a new home, to determine for how large a mortgage they qualify.

DCU has created an end-to-end approved-to-funded process whereby it contacts every pre-approval applicant by phone within hours of application. A loan officer asks targeted questions to determine whether the member has an immediate need for financing or if they are just starting the home-buying process. The loan officer is then able to prioritize the request and place it within one of several follow-up buckets.

For members who are early in the process, DCU stays in regular contact via automated email, providing timely home-buying tips. Pre-approvals expire after 90 days, at which point the credit union needs to pull the homebuyer’s credit again. DCU sends members an email directing them to call or email the credit union for an updated pre-approval if desired. And an electronic interface with DCU’s customer relationship management (CRM) system automatically sets up task reminders in loan officers’ Outlook calendars reminding them to call the member at this key checkpoint.

Find your next partner in Callahan’s online Buyer’s Guide. Browse hundreds of supplier profiles by name, keyword, or service area.

The challenge with pre-approvals is we invest a lot of work and money into helping our members; we deal with hundreds and thousands of these on a monthly basis, Cook says. There is no way our loan officers could stay in touch with all of these members on their own. To combat this, we use multiple tools and touchpoints: helping loan officers manage their pipeline through Outlook, informing them of the best time to re-contact a member, and generating automatic emails. It’s important to stay in front of our members throughout the entire process.

To efficiently manage this high-touch approach, DCU uses a combination of in-house and third-party technology systems.

And when it established its two-hour standard, DCU added a couple of positions to help contact pre-approval applicants. Importantly, the credit union included loan officers in the development of the process.

They understand why they are doing it, why it is so important to contact somebody within hours of application, Cook says. I think the people aspect is the most critical part.

Results have been impressive. DCU’s year-over-year conversions of pre-approvals to purchase mortgage loans have increased from roughly 15% of applicants to nearly 30%.

Don’t reinvent the wheel. Get rolling on important initiatives using documents, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to the credit union’s needs. Visit Callahan’s Executive Resource Center today.

We’ve seen tremendous results, Cook says. We saw our pull-through conversion rates on pre-approvals more than double. We are capturing more purchase loans. Just as importantly, inbound member phone calls have decreased; they don’t ever have to call us with questions because we are getting in touch at key moments of the pre-approval life cycle.

A Loan That Rewards Good Payment History

Mortgage lending is not the only area where DCU is trying new approaches. Several years ago the credit union implemented a payments rewards program that allows members who are not already receiving DCU’s best rate to earn a lower rate over the life of their loan by making regular, on-time payments. For instance, if a member makes payments on time for three consecutive months, the credit union reduces the interest rate by 25 basis points.

People aren’t shopping for a loan. They want to buy a car. They want to buy a home. The loan is just a means to get there.

Over the life of the loan, members have the opportunity to reduce their interest rate to the best rate or up to 1.50%, a significant savings. Monthly payments are fixed, but a decreasing interest rate allows the member to pay off the loan sooner.

The payments reward program helps members maintain a strong credit profile, improve their credit history, and earn lower interest rates on their loans. And although any member applying for a secured consumer loan such as auto, boat, or RV is eligible, the program is designed for members with less-than-pristine or minimal credit history.

It is a good relationship builder, Taverna says. It certainly has helped us with retaining loans, especially in a decreasing rate environment where members might otherwise seek to refinance their loans as their credit improves. Above all, it’s about giving back to our members.

Helping Members Help Themselves

A third product, DCU’s credit builder loan, helps members with financial challenges rebuild their credit rating.

According to third quarter 2015 performance data, 22.5% of credit unions offer credit builder loans, or nearly one in four, and those credit unions serve more than 44 million members.

At DCU, the credit union approves loans up to $3,000 and deposits the funds directly into a member’s share savings account. It then encourages members to schedule automated monthly payments to establish a positive payment history and help rebuild their credit over time.

Typically, a member will reach out to us for help, Taverna says. Maybe they have had credit challenges in the past, and we can offer them this product to help re-establish their credit.

DCU has offered both payments rewards and the credit builder loan for several years. Executives cite improvements in member retention as well as in individual members’ financial positions.

In fact, despite its streamlined processing, a growing reliance on pre-approvals and automated decisioning, and products targeted to members with less-than-perfect credit, DCU has not experienced any notable decline in loan quality. At year-end, 5300 Call Report data showed the credit union’s delinquency was 0.60% and net charge-offs were holding steady at 0.34%.

How Do You Compare?

Check out DCU’s performance profile, then build your own peer group comparisons at Search & Analyze on CreditUnions.com.

Removing Friction

DCU has some advice for credit unions of all sizes that want to broaden their product offerings and improve service standards in both mortgage and consumer lending.

Remove the friction from the process, Cook says. Don’t ask the member for information you don’t need or use. Do the heavy lifting for the member, and make it easy for them to get the loan.

DCU has spent a lot of effort and time on streamlining the loan application process at every touchpoint. According to Taverna, the credit union currently pre-approves approximately 60% of its membership for auto loans. Once a member accepts the pre-approved offer, DCU needs only three or four discrete pieces of information to process the request.

It seems really simple, but I think that’s where a lot of credit unions face a challenge, Cook says. If you sit down and walk through the process of how a member applies for a loan, you would find a lot of friction. We’ve removed as much of that as possible to drill down to the information we actually use in the decision-making process.

You Might Also Enjoy

-

3 Ways To Offer Auto Draft Pre-Approvals

-

Lending Highlights From Third Quarter 2015

-

A Strategy To Reward Members For Positive Behavior

-

Tips To Make Better Automatic Loan Decisions