CU QUICK FACTS

Infinity FCU

Data as of 09.30.18

HQ:Westbrook, ME

ASSETS: $349.2M

MEMBERS: 17,487

BRANCHES:4

12-MO SHARE GROWTH: 9.8%

12-MO LOAN GROWTH: 6.2%

ROA: 0.25%

Since its founding in 1921, Infinity Federal Credit Union ($349.2M, Westbrook, ME) has embraced change.

The first credit union in the state of Maine began as Telephone Workers Credit Union of Maine. Later, the cooperative expanded geographically into New Hampshire to become Telco of New England Federal Credit Union. Today, Infinity is a community-based cooperative serving Cumberland and York counties and the city of Bangor. It no longer operates in New Hampshire, opting instead to focus on its goal of eventually serving more members than any other credit union in the state of Maine.

ContentMiddleAd

We have one of the larger fields of membership in the state, with the two biggest counties and the city of Bangor, says Kathy Guillory, Infinity’s director of marketing. There’s a lot of opportunity here.

Clockwise from the top left: Telephone Workers Credit Union of Maine (1981); Telco of New England FCU (1982-1994); Infinity FCU (1995-2015), Infinity FCU (2016-present).

But Maine is a state that is changing quickly, and Infinity puts in the work to remain relevant.

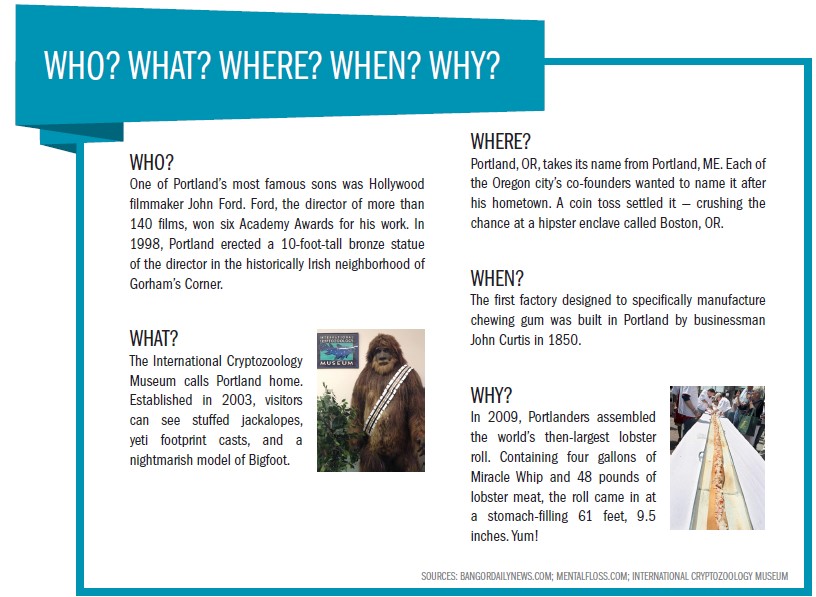

The Pine Tree State is known for its natural beauty and lobster-rich cuisine. Tourism plays a large part in the state’s economy the slogan Vacationland has appeared on Maine’s license plate since the 1930s. To wit, the service industry employs more Mainers than any other industry in the state. In 2017, 36.7 million visitors spent $6 billion in the state, up from 27.9 million and $4.9 billion in 2012. And in the fall of 2018, Bon Apptit named Portland, ME, its 2018 Restaurant City of the Year.

Talk That Talk

Mainers have words and phrases all their own. Here are a few people from away should know before they go leaf peeping.

- Apiece: A vague way to measure distance.

- Bean’s: L.L. Bean. Headquartered apiece from Portland in Freeport.

- Bug: Lobster

- The County: Aroostook County, the northernmost county in the state.

- From away: Not from Maine.

- Leaf peeper: Out-of-staters who come in the fall to look at the foliage.

- Mayonnaise: What you put on a lobster roll.

- Steamers: Clams.

But there’s another side to Maine. There’s the rugged True Mainers who call the state home and who face pressing concerns.

Maine is the ninth least populous state in the nation, and since 2010, it has been one of the slowest growing. The resident median age is 44.6, the highest among all 50 states. Maine has a historically low unemployment rate it was 3.3% as of September 2018 and a Department of Labor study projects Maine’s workforce will shrink by one-third in the next 10 years.

We’ve got a shrinking workforce, and one of our top concerns in Maine is our aging population, says CEO Liz Hayes, a native Minnesotan who took the helm at Infinity in 2014. We’ve got growing companies without the workforce we need. It’s difficult to attract new people for a number of reasons, including the weather. We’re not California, we need to come up with creative ways to attract young people to our state. Thankfully, businesses and the community are coming together to do just that.

BEST PRACTICE: SHOW AND TELL

To compete for top talent, Infinity FCU offers referral bonuses and other workplace benefits. It also promotes the fact it has been named a Best Place to Work in Maine for each of the past seven years. We love our jobs, and it shows, says Barbara Bartlett, chief HR officer.

With the exception of Bangor and its suburbs, northern Maine loses population and exhibits higher rates of unemployment compared to southern Maine. In fact, southern Maine’s population growth keeps the state from negative population growth overall. Southern Maine includes Cumberland and York counties the geographic areas Infinity serves however, as New Mainers and people from away move into Portland and its surrounding communities, the cost of living has risen.

Most of my friends have left Portland, says Ryan Wing, Infinity’s director of IT and a native Mainer. I’m glad it’s thriving, but it’s harder to afford for people who grew up here.

Together, all these regional shifts have changed the way Infinity handles its business.

Click the tabs below to view graphs.

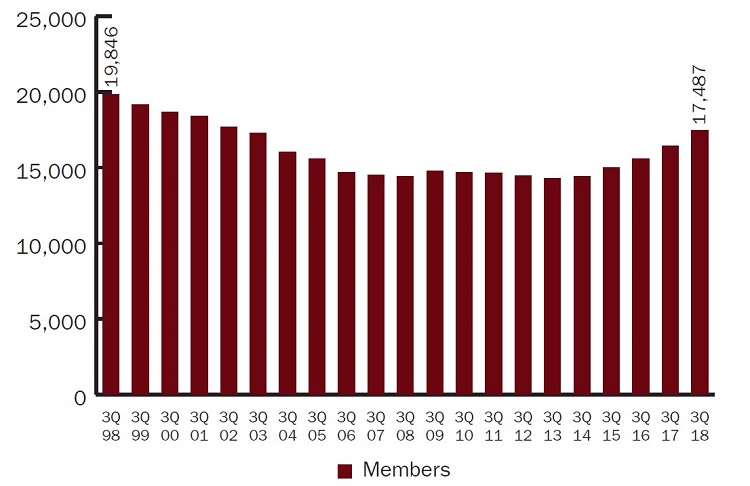

MEMBERSHIP

MEMBERSHIP

FOR INFINITY FCU | DATA AS OF 09.30.18

Total membership at Infinity FCU started to decline in the late 1990s. A renewed focus on serving more members than any other credit union in Maine has underpinned a rebound in in the roster.

Source: Callahan & Associates.

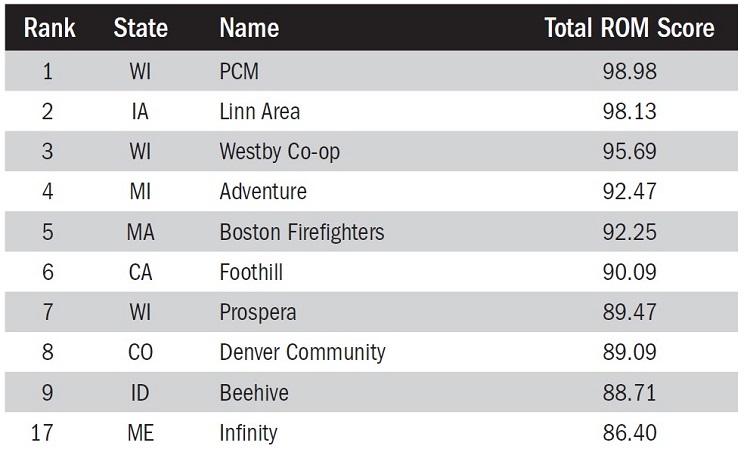

RETURN OF THE MEMBER

RETURN OF THE MEMBER

FOR CREDIT UNIONS $250M-$500M | DATA AS OF 09.30.18

Infinity ranks 17th among credit unions in its asset-based peer group and No. 1 in Maine in Callahan’s proprietary member value metric. By implementing a member-first decisioning filter, the credit union’s ROM has jumped nearly 30 spots since 2014.

Source: Callahan & Associates.

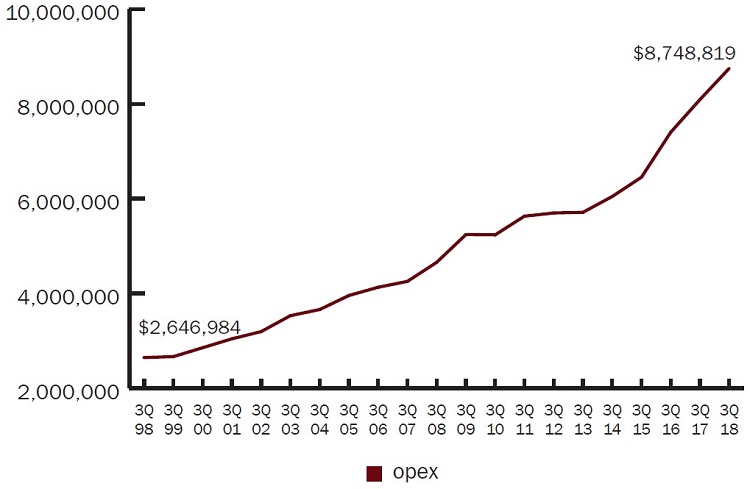

OPERATING EXPENSES

OPERATING EXPENSES

FOR INFINITY FCU | DATA AS OF 09.30.18

Operating expenses at Infinity have steadily risen in the past decade. They have continued to rise as the credit union focuses on adding staff, branches, and expertise in the name of member service.

Source: Callahan & Associates.

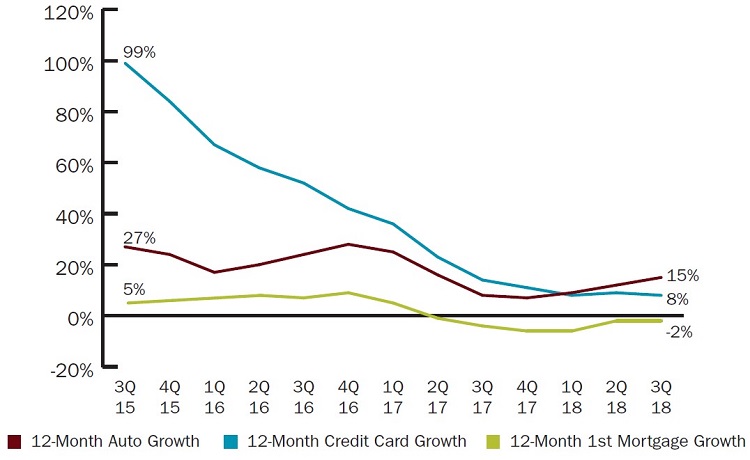

PRODUCT LOAN GROWTH

PRODUCT LOAN GROWTH

FOR INFINITY FCU | DATA AS OF 09.30.18

By 2014, Infinity’s loan portfolio was heavily concentrated in first mortgages. Starting in midyear 2017, the cooperative has been selling the mortgages it originates to jump-start an otherwise dormant consumer portfolio.

Source: Callahan & Associates.

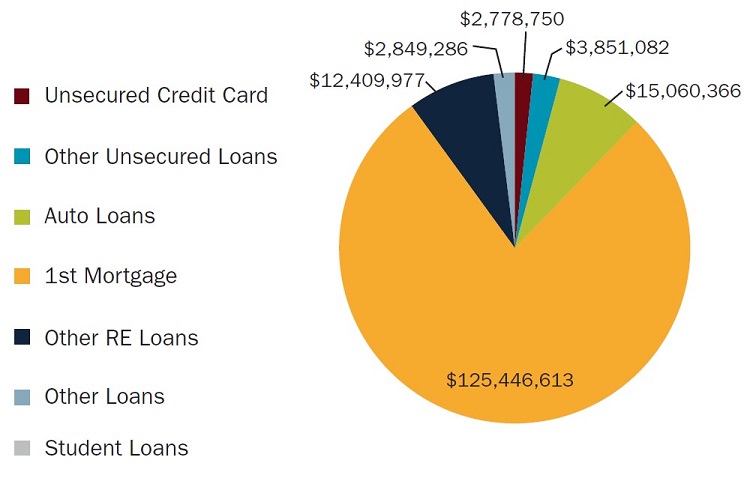

LOAN COMPOSITION (2013)

LOAN COMPOSITION

FOR INFINITY FCU | DATA AS OF 09.30.13

Infinity was historically a risk-adverse lender that focused overwhelmingly on first mortgages to A-credit borrowers, likely to the detriment of other credit-worthy members in need. You can have too many mortgages, says CFO Mike O’Brien.

Source: Callahan & Associates.

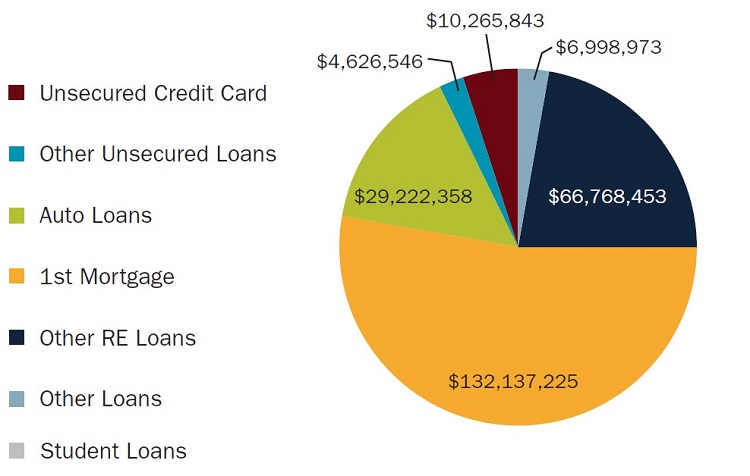

LOAN COMPOSITION (2018)

LOAN COMPOSITION

FOR INFINITY FCU | DATA AS OF 09.30.18

Infinity’s recent focus on consumer lending underscores a new philosophy toward risk and service. We’re going to lower investments and first mortgages, says CFO Mike O’Brien. We’re going to reinvest that in consumer loans.

Source: Callahan & Associates.

True Mainers, New Mainers, And People From Away

There are no states like Maine. It’s remote and sparsely populated. The winters bring nor’easters while the summers are mild. Picturesque and untamed mountains, forests, and coastlines dot the landscape. It can be a difficult place to live.

There are people, and rightly so, who don’t want to lose the identity of what makes Maine special, Hayes says. There’s a deep, quiet pride.

There’s also a strangeness. Like the woman Hayes saw skateboarding home from the grocery store in a work skirt and Bean Boots. Or the bat control servicemen who show up on house calls with no gear other than a pillowcase. These are True Mainers, who carry Maine roots several generations deep and like to do things the way they’ve always been done. But Maine’s economic future might ultimately depend on New Mainers (immigrants) and people from away (those who relocate from within the United States).

In southern Maine, one of the largest New Mainer groups since the turn of the century has been immigrants from Somalia, though in recent years the influx has grown more diverse with new arrivals from Iraq, Ethiopia, and the Democratic Republic of the Congo. Four years ago, one of the credit union’s senior branch managers, Rachna Bhatia, noted an opportunity in the New Mainers coming into Infinity branches to open accounts.

BEST PRACTICE: SPEAK THE LANGUAGE

As New Mainers move in, Infinity has likewise expanded the languages spoken among its employees. Right now, it’s up to 11, including Somali, Russian, and French.

Because the banking system is different here, they didn’t understand the terms of the loan or they didn’t have the right identification to match our procedures, Bhatia says.

Infinity reworked its procedures to make signing up for an account more accessible. For example, the credit union no longer requires a passport. Additionally, it designed loans to help cover the cost of becoming a U.S. citizen and to make a security deposit on housing. Infinity sets a maximum limit of $1,500 on the security deposit loan and allows borrowers eight months to find a job before the 12-month loan term kicks in. Since introducing that product in February, Infinity has made 20 of those loans, says Kandy Moreau, Infinity’s chief lending officer.

As a longer-term strategy, Bhatia connected with several local organizations, including ProsperityME and the Intercultural Community Center, that ease a New Mainer’s transition into the country and focus on improving the lives of immigrants. The credit union has built strong relationships with these and other immigrant-focused organizations and now offers financial education and translation assistance. The work helps New Mainers better understand their financial options in a new country and allows the credit union to promote itself to new communities of potential members.

We’re able to say that we’re equipped to help your community, Bhatia says.

More Members, More Relationships

With nearly $350 million in assets, Infinity is the fifth-largest credit union in Maine. However, a spate of mergers is changing the makeup of the region’s financial cooperatives.

In late 2017, Ocean Communities Federal Credit Union ($170M, Biddeford, ME) merged into Northeast Credit Union ($1.4B, Portsmouth, NH), extending the billion-dollar cooperative’s geographic reach into Cumberland and York counties as well as several others. In February 2018, Atlantic Federal Credit Union ($376.1M, Brunswick, ME) and York County Federal Credit Union ($316.5M, Sanford, ME) announced their intention to merge, which will create the largest state-headquartered credit union in Maine.

That’s changing the landscape in Maine, Moreau says. And I think we may see a few more.

Infinity is growing well in its own right, however. The credit union’s third quarter member growth of 6.49% far outpaces state and asset-based peer averages of 4.05% and 3.20%, respectively. And these are not empty memberships. Infinity’s average member relationship was more than $26,000, nearly $10,000 more than both state and peer averages as of Sept. 30.

Our focus is on serving more members while building those relationships, CEO Hayes says.

Admittedly, serving more members than any credit union in Maine is a tough task, but Hayes believes Infinity can do it. In late 2016, the credit union launched a low-balance rewards checking account that encourages high levels of engagement. It has also established a small business services team. In addition, the credit union plans to open a new branch every 18-24 months.

However, Infinity has no plans to enter indirect lending Hayes is not a fan from a business, financial, or cooperative model perspective but the credit union might be open to the right merger if approached with caution. Mergers are never as simple as they seem on the surface, Hayes says, because they can wreak havoc on organizational culture and strategic direction.

But if there is a conversation out there about merging, I want to be at the table, the CEO says.

Of course, any merger or other opportunity would have to align with the twin cultural and strategic pillars that Hayes has built. From establishing a decision-making system called MOE which stands for member-organization-employee to incentivizing deeper relationships, Infinity is building a culture of empowerment where member participation is the fuel that makes the cooperative run.

BEST PRACTICE: EMPOWER DECISION-MAKERS

Infinity strongly believes in the MOE framework. As long as employees consider the member-organization-employee, they are empowered to make tough decisions.

It will likely take Infinity years to hit its goal of serving more members than any other credit union in the state, if it’s ever able to. As of the third quarter of 2018, Infinity had nearly 17,500 members 16th in the state and more than 20,000 off the top spot. But even if it doesn’t hit that lofty goal, Hayes believes setting this strategic direction provides a clear benefit to members and employees of Infinity today, tomorrow, and beyond.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.

Wait, There’s More!

This is just one section of the Anatomy Of Infinity Federal Credit Union series that appears in Credit Union Strategy & Performance. Read the whole discussion today.