Top-Level Takeaways

-

Encouraging feedback on its Yelp pages helped Financial Partners move up the social site’s search algorithm.

-

For credit unions looking to improve their Yelp presence, Financial Partners suggests institutions be responsive to anything that happens, good or bad. And to respond quickly.

Financial Partners Credit Union ($1.3B, Downey, CA) has 11 branches stretching across California, from San Diego to San Francisco, with locations in smallercities and towns along the way.

To establish a personal connection in individual communities, the credit union posts daily on its social media accounts, which include Facebook, Instagram, Twitter, and Yelp.

CU QUICK FACTS

Financial Partners FCU

Data as of 06.30.17

HQ:Downey, CA

ASSETS:$1.3B

MEMBERS:75,039

BRANCHES:11

12-MO SHARE GROWTH:6.0%

12-MO LOAN GROWTH:2.3%

ROA:0.39%

It’s a great way to show our brand in its various aspects,says Ryan Jesena,director of marketing at Financial Partners.These are tools to communicate with our members what’s going on.

In the past year-and-a-half, the credit union has doubled down on crowd-sourced review platform Yelp to increase its local brand and visibility. In this Q&A, Jesena discusses why Yelp is different from other social platforms, how the credit union trackspositive and negative reviews, and how the credit union keeps up with the ever-changing Yelp search algorithm.

How are Yelp members different from those who would find you on other social channels?

RJ: We find that Yelp members are more engaged. They are more willing to write a long review of what the credit union is doing right, or strip it down and write a critical review for what the credit union is doing wrong. Yelp memberswill take the time to do that. Facebook is more quick hitting. Users there are not going into the same level of depth in reviews.

Ryan Jesena, Director of Marketing, Financial Partners Credit Union

What has Financial Partners tried to do with Yelp?

RJ:We’re trying to evolve the channel. Before I got here, as many businesses see, Yelp was a complaint box. We want to change that. People still have that option, but we also want to encourage our members to acknowledge and celebratethe successes they have had with us.

So, we created specific Yelp business pages for each one of our branches. In branch queues, we have ads encouraging our members to check-in to the branch page on Yelp. If they do check-in, we give them a gift, whether it’s a pen or an iPhone wallet or something simple we have in the branch. ContentMiddleAd

What led you to view Yelp as something that could grow your visibility?

RJ: Most people aren’t aware they can review their financial institution. Most people use Yelp for restaurants and food. We want members to review us, especially when something important happens like when they get an autoloan, a credit card, or a mortgage. These are landmark moments in a member’s life we want to capture as a part of our social media presence.

Why check-ins, specifically?

RJ: A check-in is the simplest and easiest task a member can do when they come into our branches. It signifies they are at the branch and allows them to rate us between one and five.

It’s simple: I withdrew some money, I checked in, I got a pen.

It’s awesome. And, it reminds members that we do have a Yelp page.

What do more check-ins do for the credit union? Make it more visible for searchers?

RJ: When members come in and rate the credit union, the Yelp search algorithm ranks us higher on the search listings. And we keep track of that. Our Yelp success is in tracking all our branches for how they appear in their market forcertain keywords financial services, bank, and credit union.

We let our branch managers know where they rank in their community, so they know the efforts they need to make to improve their Yelp score or to continue their good work.

Yelp is strict in the sense that if the business receives too many reviews in one day or one week, Yelp will exclude some from the business’s score. How you get reviews must feel natural, otherwise Yelp’s algorithm will remove or exclude thosereviews you get although they may be legitimate.

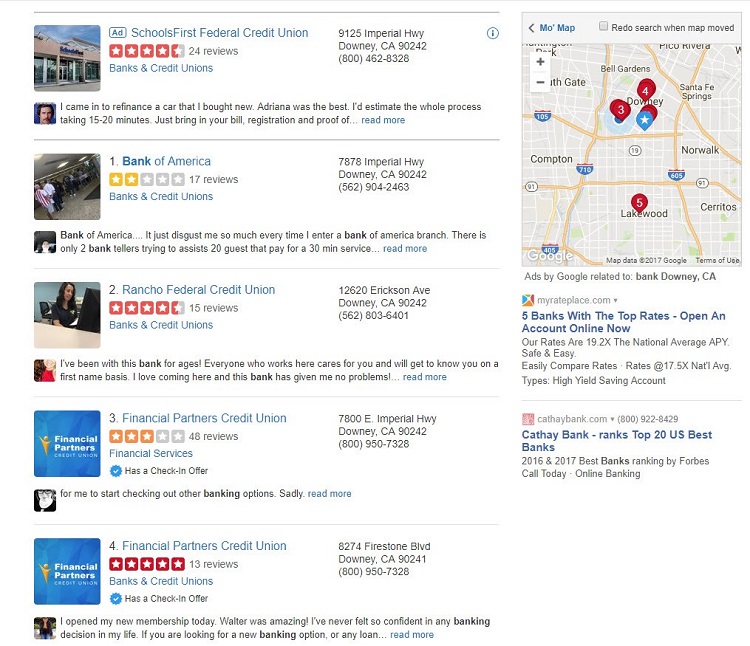

When searching for Bank in Downey, CA, Financial Partners appear third and fourth on the list. A year-and-a-half ago, the credit union wouldn’t have been on this list, says Jesena.

What happens when a member checks-in with a negative review?

RJ: Our whole team everyone from our vice president to our social media team gets an email notice when anyone leaves a review on our Yelp page, and we respond to it as soon as possible.

Timing is important. When most people leave a complaint, they are in the middle of something they are not happy about, or they are not getting the response they want from the branch or customer service representatives. In our response, we might not have the answers or be specific in what we can provide them because we don’t have access to their accounts, but at least we can make them feel good that someone is listening.

We let our branch managers know where they rank in their community, so they know the efforts they need to make to improve their Yelp score or to continue their good work.

Do you then send those reviews to the branch where they originated?

RJ: Marketing provides the customer service response on Yelp. But if the name matches something in our database, we send the complaint to the branch manager and have them respond to it.

Do you track reviews and their resolution?

RJ: Yes. We track them on two levels.

One, we track the reviews that have a detractor or a complaint and see if it gets resolved. If it’s resolved, we ask the member if they want to write a follow-up to the negative review, which Yelp allows.

Two,if it’s a promoter, someone who was happy with our services, we encourage them to continue rating us or to submit a photo. If they got a new car or a new home, we try to get them to add a picture whether it’s the keys to theirhome or a picture of them in their car. Photos are very effective in enhancing our social presence on Yelp.

Financial Partners has focused on Yelp for 18 months. Have branches climbed in search results?

RJ: We track how each branch trends up or down and compare it to previous years. In 2017, half our branches have ticked up in the rankings. It has been a struggle for others because they are in a competitive market with credit unionsor financial institutions that just have a lot of reviews. We take that into account as well. Some communities are just not going to have the same competition, so you might not have to do as much for the credit union’s Yelp score to reach thefirst page.

We put together monthly reports for our vice presidents and branch managers to make them aware of where they stand, where they are trending, and the good or bad reviews they receive.

Any other Yelp best practices?

RJ: Yelp can be tricky because it changes its algorithms and doesn’t tell businesses. It’s a moving target. Once you think you’ve got it and you’ve reached the top of the Yelp rankings, it will change its algorithm and you’ll have to adjust.

I recommend that anyone who wants to improve their Yelp presence be responsive to anything that happens, good or bad. Make sure to respond quickly. The Yelp algorithm reads those response times. It reads when you respond and how you respond. If a reviewerchanges their review after a positive experience, Yelp makes the proper adjustments. It might not happen immediately, but Yelp is good at getting the essence of your institution right.

This interview has been edited and condensed.