In today’s branching environment, credit unions are looking to better technology to help them improve member service, increase efficiency, and reduce costs. In Watertown, NY, $205 million Northern Credit Union achieved gains in service and efficiency by introducing 16 Smart Offices in May of 2014 at its seven branch locations.

Smart offices allow members to complete account and loan applications with representatives via video conferencing and other technological connections. In the first quarter of 2015, smart office transactions represented 55% of all new accounts opened and59% of approved loan applications at Northern.

When you look at the evolution of the ATM, [smart offices] are taking it to the next level, says Denise Lariviere, vice president of member solutions at the credit union.

CU QUICK FACTS

Northern Credit Union

data as of 3.31.15

- HQ: Watertown, NY

- ASSETS: $205.0M

- MEMBERS: 28,593

- BRANCHES: 7

- 12-MO SHARE GROWTH: 2.69%

- 12-MO LOAN GROWTH: -0.52%

How It Looks

Northern decided to introduce smart offices in 2011, but it took three years to price, build, and fully implement them. Located within the branch, smart offices are fitted with two-way video communication and each contains a television, a personal computer,a printer, a signature pad, and a scanner. Northern uses Cisco for video conferencing and a software called Bomgar for remote PC support that allows staff to access loan documents and other materials. Even when pulling up documents, the member neverloses sight of the credit union representative.

Northern’s smart office set-up. Picture courtesty of Northern Credit Union.

Fixed costs include construction of cabinetry, television, and computer equipment, which can range from $10,000 – $20,000 per smart office. Additional costs include a prepaid yearly service charge of $38,850, which covers support for each office.

Beyond member services, Northern uses smart offices for remote training and conferences with branch leadership.

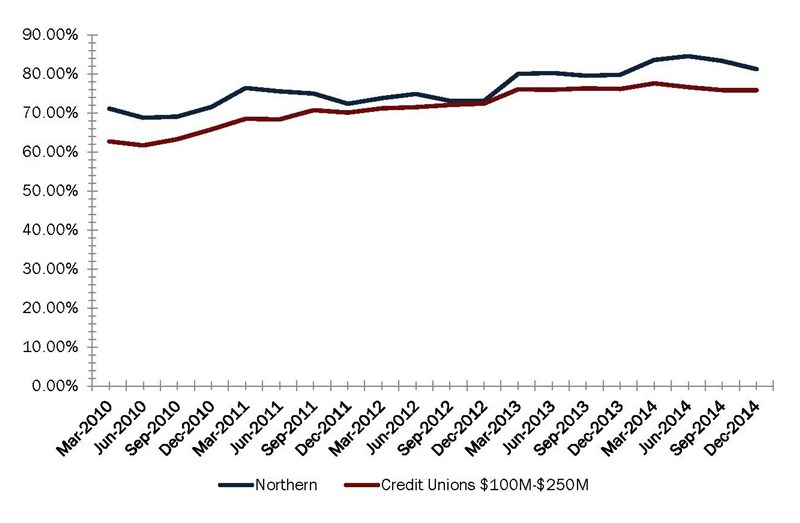

Over the course of 2014, according to Callahan & Associates Peer-to-Peer data, Northern has seen a slight increase in operating expense to $12,530,000 as of fourth quarter 2014, a 3% increase year-over-year. But its operating expense as a percentage oftotal income has lowered as well, to 81%, closer to its asset-based peer average of 75.8%.

total operating expenses

Data As of March 31, 2015

‘ Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analyticsby Callahan & Associates

operating expenses/ total income

Data As of March 31, 2015

‘ Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analyticsby Callahan & Associates

How It Works

Credit union employees greet members when they enter a branch to determine the reason for their visit. If it requires an office session and all on-site representatives are tied up, the greeter directs the member to one of five smart office professionals,who are briefed on the member request through an instant messaging software system called Spark.

The term people use to describe it is different,’ Lariviere says. But after going through it, they see it’s just as easy as in-person transactions to get the service.

For reporting and sales, branches still own member relationships and branch staff still receives the credit or incentive for interactions that occur there. Branch managers and employees consider smart office professionals a part of the branch team, andthus use them to meet service goals. According to Lariviere, it’s become a symbiotic relationship.

Maybe I send more people to smart office this afternoon because in the branch I need to take some business calls and I don’t want to dissatisfy my members while I’m away, she says. The member service is still there. Ijust might reach out to smart office more today than I did yesterday.

Credit Union Benefits, Staff Benefits, Member Benefits

By the third quarter of 2013, Northern’s efficiency ratio was 101%, well above asset-based peer average of 88.64%. As a way to increase efficiency,the smart office has undoubtedly helped the credit union improve. By fourth quarter 2014, Northern’s efficiency ratio was down to 93.2%, now much closer to its asset-based peer’s ratio of 87.22%.

efficiency ratio

Data As of March 31, 2015

‘ Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analyticsby Callahan & Associates

The smart office concept works best when the professionals who staff them are universally trained. Northern took five sales people from across the institution the most capable, highest level sales people, according to Lariviere with experience in home loan mortgage originations, credit, business, and financial investments solutions, and made them smart office professionals in the summer of 2014.

It’s remarkable to see how seamless service is, Lariviere says. You know whatever the member needs, this professional has the skills and ability to have that interaction.

Northern’s most qualified and well-versed salespeople are handling more than 50% of account and loan applications. Smart office professionals are able to serve a wider swath of membership than they were before, from just one market to all seven,without sacrificing relationships they had previously built.

Once professionals became acclimated to it, they found the ability to serve more people, Lariviere says. They were more focused, they had the ability to build relationships on a higher level, and they found it more rewarding.

In addition to benefitting member service, smart offices create staffing efficiencies that are especially important during peak times, when professionals can handle complex requests and free up tellers to handle other transactions.

If smart office professionals are available, we can beam them up and offer assistance without needing to schedule it, Lariviere says.

And Northern also sees greater efficiency with regard to cost. Although Northern pays its smart office professionals slightly more than other representatives, they save the credit union the cost of three full-time employees annually, with benefits.

For members, smart offices offer high-quality service with lower wait times. Northern does not currently track lobby wait times but is looking to implement tracking in the next several months. For now, Lariviere cannot say exactly how wait times haveimproved, but the credit union has observed a difference.

It’s remarkable to see how seamless service is. You know whatever the member needs, this professional has the skills and ability to have that interaction.

Moving forward, Northern sees the application for this technology in self-service branches. However, before it will seriously consider that option, it must improve its queuing technology to the point that smart office professionals know a member is waitingin a specific location. Northern admits it is not there yet, but says the potential for a self-service facility is immense.

We can expand our network and still provide that live individual that members look for, Lariviere says. I see the opportunity for branch individuals to elevate their relationship building and do more business development outside ofthe brick-and-mortar while smart office professionals are there to serve members that come into the branch.