Deposit growth and member engagement require heightened focus for credit unions in 2024. Although credit unions reported positive loan growth in 2023 and the beginning of 2024, they also faced a challenge in deposits. This situation poses a potential long-term challenge unless credit unions effectively attract and engage millennial and Gen Z members.

Remarkably, the average credit union member is in their mid-50s, and around 75% of credit union deposits currently originate from older members. The deposit market share is dominated by the 20 largest banks, and credit unions are losing the battle for the younger members since the younger generations prefer offerings from national banks. This is where the CUNA (aka America’s Credit Unions) award-winning platform, Spiral, comes in.

Spiral empowers credit unions to reach millennial and Gen-Z members through personalized digital banking and community impact. How does Spiral accomplish this? Its products seamlessly integrate with digital banking and core systems, allowing credit unions to unlock highly requested, powerful features that align with the values of younger members. Credit unions can leverage Spiral to help their members on their personal finance journey, empower them to contribute to their own financial wellbeing, and easily support causes that are close to their hearts — all from the convenience of their banking accounts.

Benefits For Credit Unions And Their Members

Spiral brings innovative solutions to the forefront that directly address some of the most common goals shared among credit unions. These objectives include:

-

- Elevated deposit growth and card usage.

- Enhanced member engagement.

- Increased revenue.

- Top of wallet and primary financial institution status.

- Improved financial health among members.

- Deepening relationships with existing members.

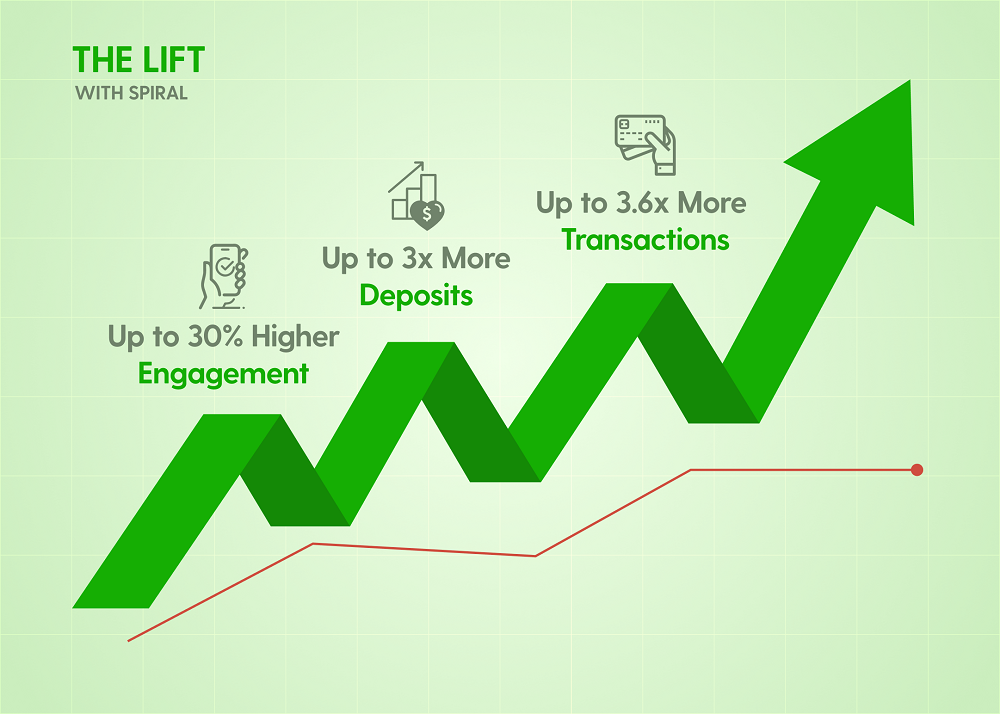

Within the first 90 days of account opening, individuals who used Spiral’s features had:

-

- Up to 3X higher deposits.

- Up to 30% increase in digital engagement.

- Up to 3.6X increase in monthly card transactions.

In addition, Spiral noticed up to a 65% reduction in digital account acquisition cost for a fully funded account. Within the first few months of introducing Spiral products, it was acknowledged as a fintech leader for the advancement of credit unions by winning the “Best-in-Show” award at CUNA’s Operations & Member Experience Council Conference.

How Does It Integrate?

Spiral has established partnerships with the leading digital banking and core systems such as Jack Henry, Q2, Lumin Digital, NCR, and others, allowing their credit unions to seamlessly unlock Spiral’s turnkey products within their own banking environments in no time.

When a credit union partners with Spiral, they can choose from the following solutions.

- Everyday Impact ™

- Enables members to round up purchases to save for important life events as well as to achieve community impact with each purchase to causes of their choice.

- Giving Center

- Enables members to manage all of their charitable giving through their credit union and easily donate to their favorite charities, local or national.

- Allows credit unions to raise funds for local charities and attract nonprofit business members.

- Giving Accounts

- Enable credit unions to offer tax beneficial Donor Advised Fund Accounts.

Spiral offers a wide range of impact areas for credit unions to choose from so they align with their mission and the communities they serve — whether it’s planting trees, feeding the hungry, or supplying clean water to those in need. Spiral’s network, which includes more than 1,000 nonprofits, coordinates connections between credit unions and nonprofits to ensure streamlined relationships and successful implementation.

The Future Of Credit Unions

Adapting to ever-changing member behaviors and technological advancements will only help credit unions achieve their deposit growth goal, contribute to the financial wellbeing of their members, and make a positive impact on their communities. That is why so many credit unions and other community financial institutions are prioritizing platforms like Spiral to increase their deposit growth and win the battle for the younger, more engaged members.

By implementing these types of digital experiences, credit unions are amplifying and strengthening their common mission of people helping people and empowering their members to achieve financial wellness and make an impact in their community through everyday banking.

What’s Next?

Spiral is on a mission to empower more credit unions to grow deposits and increase engagement through personalized banking and community impact, contributing to a better world.

Interested in learning how to partner with Spiral? Visit Spiral.us.