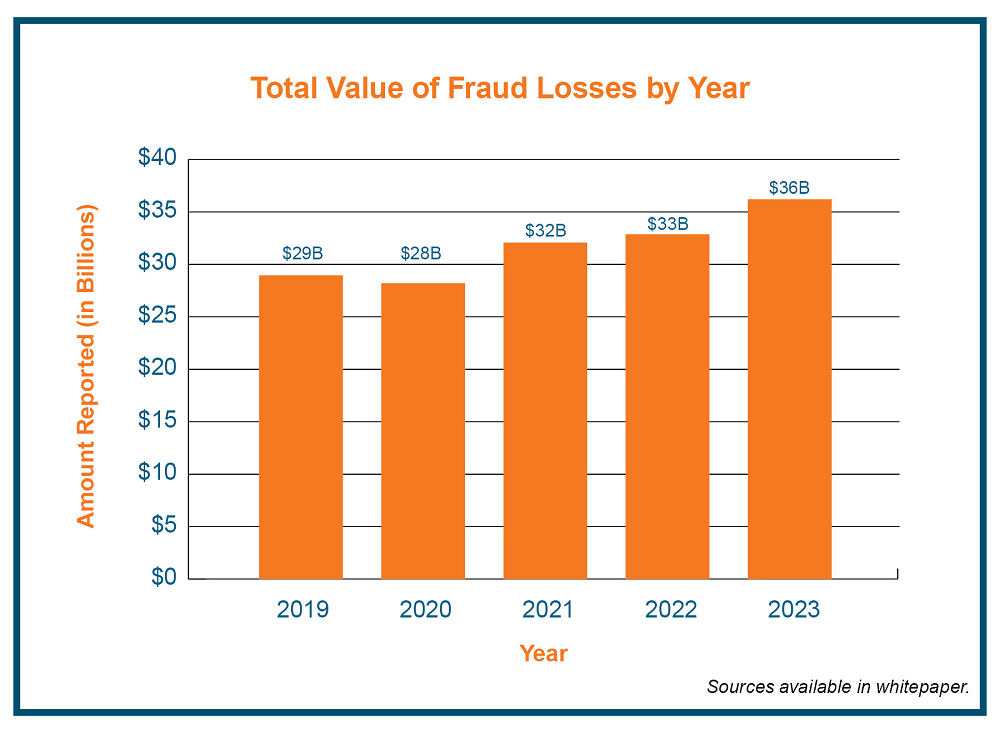

Credit card and cardmember information are a key target for cybercriminals due to their high value, and the stakes could not be higher for credit unions to protect members and remain profitable. From 2022 to 2023, fraud losses increased by more than $3 billion, continuing an upward trend during the past three years.

Fraud doesn’t just happen at the point of sale. Cybercriminals are successfully creating fake accounts at financial institutions. Charges that occur through those accounts then become charge-offs when the fake customer fails to pay.

Because of additional loss provisioning due to the full implementation of CECL, credit unions must allocate more money to cover expected losses. Challenges such as this can burden profitability, requiring senior leaders to provide additional oversight to effectively manage risk, expense, and capital.

Depleting gains take away from the investment financial institutions can dedicate to enhanced security, new technology, and fraud protection. A recent report said smaller financial institutions have doubled their investments in digital transformation from $200,000 per one billion in assets to $425,000 from 2021 to 2023.

Failure to effectively address cyber threats not only results in financial risk but also carries significant reputational and regulatory risk that could harm a credit union’s core business.

Beyond education and awareness, ensuring the payment solutions offered to members employ robust fraud detection and enhanced security helps mitigate instances of data exposure and loss.

Improving operating efficiencies, profitability, and cardmember protection are a few of the benefits of outsourcing credit card issuing to a trusted partner. The right partnership can alleviate the need to invest in ongoing technology and fraud protection updates in-house, which can be costly and complicated.

The Elan program employs state-of-the-art fraud protection and security to make sure its partners’ data, and their cardmembers, remain safe.

“The amount of required investment Elan continues to make in technology and human resources to detect, monitor, and block fraud is not replicable for many of our partners and thus is a priority for us,” shared John Owens, general manager of Elan Credit Card. “We are able to point to the success our team has had in stopping fraud events from occurring while still providing a seamless experience for members to complete credit applications and purchases.”

If your credit union would like to learn more about the technology Elan uses to fight fraud, and the new payment solutions of our agent credit card program, contact us today.

As an Elan partner, you can focus on what is most important, serving members.