CU QUICK FACTS

USALLIANCE

Data as of 03.31.15

HQ: Rye, NY

ASSETS: $1.2B

MEMBERS: 92,262

BRANCHES: 22

12-MO SHARE GROWTH: 11.7%

12-MO LOAN GROWTH: 18.6%

ROA: 0.94%

Several years ago, USALLIANCE Financial faced a challenge familiar to many credit unions: how to compete with larger financial institutions in its markets and meet members’ growing demand for world-class service and convenient access in the digital channel.

To solve this problem, the New York-based credit union sought out creative partnerships with several financial technology (FinTech) startup companies to offer services and delivery channels rivaling those of even the largest banking institutions in the country.

USALLIANCE ($1.2B, Rye, NY) operates 21 branches in the New York and Boston metro areas and serves a field of membership that includes both select employee groups (SEGs) and community areas. Today, USALLIANCE has a geographically and demographically diverse member base, but with roots as an IBM credit union, it also carries a 50-year history of technological sophistication. ContentMiddleAd

That tradition continues to influence the cooperative’s mission and service philosophy. The organization’s CEO is an innovation advocate with a background in IT, and the current chief information officer joined USALLIANCE after a stint at Memento Security, a bank fraud detection startup that FIS acquired in 2012.

Kevin Randall, CIO, USALLIANCE

Our technology roots go way back, says Kevin Randall, CIO of USALLIANCE. Our CEO was a CIO previously and a regulator before that, so we bring a lot of focus to not only innovation but also risk management, which go hand-in-hand.

A Collection Of Capabilities That Meet Members’ Needs

According to Randall, USALLIANCE approaches innovation as a collection of capabilities, where new services build upon existing functionality and every potential offering is viewed through the lens of the member.

We search for startups that either directly add value to our members within our current set of products or services or help us push our limits in thinking outside the box, Randall says.

Early-stage startups, in particular, often value close collaboration with their customer base, perhaps more than larger, more mature technology firms. Randall experienced this mindset first-hand during his time at Memento.

I distinctly remember our earliest customers helping shape our product, Randall says. They got so much expertise and value out of that relationship and they had expertise we didn’t necessarily have, so it was mutual. Ultimately, it was about everybody trying to solve problems together.

At USALLIANCE, Randall has built on this approach to partner with early-stage startups such as Micronotes. Micronotes uses automated interviews within a financial institution’s digital channels to model the interactive and personal experience that a member has with a representative in a branch. The credit union has already deployed the functionality within its online banking platform and will soon offer it through mobile as well.

Micronotes grew out of the MIT community. They were trying to solve an engagement problem.

Micronotes grew out of the MIT community, Randall says. They were trying to solve an engagement problem; in a branch you can have a conversation with a member, learn about them, and provide recommendations on products and services that are a good fit for their needs. Online it’s hard to have those conversations.

The credit union has used Micronotes as not only a member engagement but also a member survey tool. For example, USALLIANCE used the platform to ask members if they would be interested in either chat or interactive video functionality within the mobile banking platform. Based on the response, USALLIANCE learned that chat was the overwhelming favorite among members surveyed, information that has helped to set future direction in its mobile development strategy.

Randall and his team also attend financial industry technology conferences like Finovate to connect with early- to mid-stage FinTech startups with potentially iterative concepts. Finovate holds U.S. conferences in New York and San Francisco each year. Randall discovered Gro Solutions at one such conference a few years ago and today employs the technology in its loan origination and membership applications through both online and mobile channels.

Find your next partner in Callahan’s online Buyers Guide. Browse hundreds of supplier profiles by name, keyword, or service area.

Thanks to its collaborative relationship with Gro, USALLIANCE can allow members to authenticate their ID by taking a picture of their driver’s license, functionality that is fully integrated into the mobile banking app.

A Culture Based On Innovation

Maintaining an internal culture focused on innovation and collaboration calls for the hiring and development of a special breed of professionals. For Randall, this means recruiting people who are creative and passionate about solving problems.

At USALLIANCE’s new headquarters in suburban Westchester County, NY, every conference room has whiteboard walls. Aside from the practical applications, such touches symbolize the organization’s culture of innovation and encourage staff to think about the organization’s purpose and capabilities in new ways.

USALLIANCE uses the Gartner bi-modal IT model, which the global consulting firm describes on its website as the practice of managing two separate, coherent modes of IT delivery, one focused on stability and the other on agility. Mode 1 is traditional and sequential, emphasizing safety and accuracy. Mode 2 is exploratory and nonlinear, emphasizing agility and speed.

According to Randall, One of our two IT groups innovates through efficiency and scale and the other group innovates through creation and mixing and matching software and capabilities.

The Gartner model emphasizes risk management along with creativity and innovation. USALLIANCE takes this to heart and employs a rigorous due diligence process with all of its new partners.

Interestingly, we find those early-stage startups are more nimble and open to meeting our due diligence requests.

In earlier-stage companies, credit unions are under greater pressure to manage the risks more aggressively, Randall says. Interestingly, we find those early-stage startups are more nimble and open to meeting our due diligence requests, whereas with some of the more established, larger companies, it can take a while to get those requests in motion.

According to Randall, newer FinTech companies are very aware of the importance of information security in today’s environment. Even if they do not directly offer solutions in that arena, it has become standard to offer information security components as part of their platforms.

When you view demos at conferences, often vendors will mention the built-in security right from the start, the CIO says. In general, these companies are well prepared to respond to risk management and vendor due diligence requests.

Many startups focus specifically on the challenges of fraud prevention and information security and can help financial institutions improve their defenses in those areas. For example, Gro Solutions uses smartphones’ built-in GPS capabilities to help minimize identity theft and fraud during the loan application and account opening process.

If a member submits a New York license in their application, the Gro platform has the ability to recognize that the request is being initiated in California, Randall says. That is a fraud prevention measure you wouldn’t have with an application submitted through the mail or even through standard internet applications.

Member Value. Positive Growth.

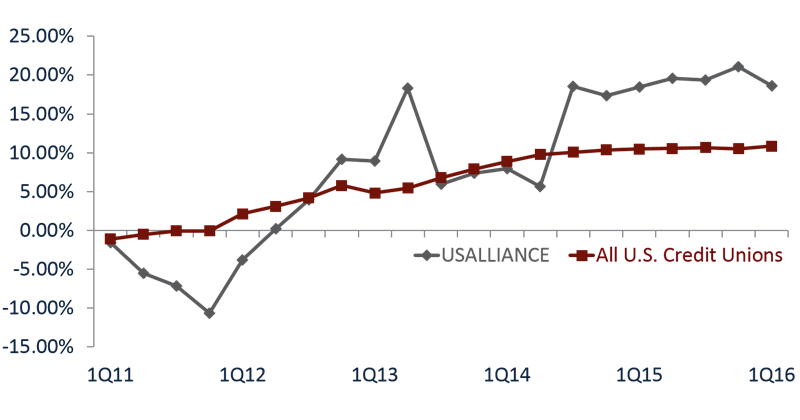

USALLIANCE’s focus on technological innovation has been a factor in the credit union’s strong growth in recent years.

For first quarter 2016, the credit union posted 16.13% year-over-year growth in membership. By comparison, the average for the industry average was 4.45%, the average for credit unions with more than $1 billion in assets was 3.56%, and the average for credit unions in New York was 2.38%. Loan growth at USALLIANCE has also been strong. Its three-year average trend tops 15% and it posted YOY growth of 18.59% in first quarter 2016. This again bests the average for the industry (11.18%), peers (8.83%), and the state (9.51%).

MEMBER GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.15

Source: Callahan & Associates.

LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.15

Source: Callahan & Associates.

According to Randall, roughly one-third of the cooperative’s new members who have joined in the past four years are in the millennial or younger demographic. Prior to 2012, that figure trended around 12%.

Some of this growth can be attributed to USALLIANCE’s recent mergers and its expansion into the Boston-area market. But USALLIANCE’s embrace of the new should not be discounted.

How Do You Compare?

Check out the performance profile of USALLIANCE on Search & Analyze. Then build your own peer group and browse performance reports for more insightful comparisons.

For credit unions that are looking to develop collaborative startup relationships, Randall offers some advice. Most critically, he emphasizes the importance of understanding members’ needs and innovating solutions that meet them.

You have to have a clear understanding of what the value proposition is and what it means to your members, Randall says. If you’re excited about the technology but it doesn’t align with your members’ needs, it ends up being a lot of work without the rewards. We make sure any new technology we adopt aligns with our business strategy and adds value to our members. It’s not just innovation for innovation’s sake.

You Might Also Enjoy

-

How A Little Innovation Helps Coastal FCU Support Budding Businesses

-

How In-House Apps Jumpstarted A Technology Venture For Greylock FCU

-

The Price Of Innovation In Louisiana