The specialized nature of business lending makes it an area where credit unions might find themselves starting over from scratch. That’s the case at Mazuma Credit Union ($557.5M, Overland Park, KS), which has undertaken a staff do-over in business lending and services in the past few years.

Leading the effort is chief lending officer Dan Engelhard, who took on the role in 2012 after more than a decade with the credit union. At the time, Mazuma was reinventing itself and moving its headquarters out of downtown Kansas City, MO, to the upscale suburb of Overland Park, KS.

CU QUICK FACTS

MAZUMA CREDIT UNION

Data as of 12.31.15

- HQ: Overland Park, KS

- ASSETS: $557.5M

- MEMBERS: 57,811

- BRANCHES: 9

- 12-MO SHARE GROWTH: 10.55%

- 12-MO LOAN GROWTH: 14.14%

- ROA: 0.50%

There, the credit union’s loan originators are using existing contacts and making new ones to concentrate on owner-occupied real estate and equipment financing opportunities.

We’ve found some good referral sources from larger banks that simply don’t want to deal with some of the smaller deals, Engelhard says.

They credit union is now re-building a business loan portfolio that had grown as large as $46.5 million in 2012 but was deemed too risky and not local enough. Mazuma gutted the portfolio to approximately $13 million and the new team has already rebuilt it to more than $15 million, with more on the way.

MEMBER BUSINESS LOAN GROWTH

For all U.S. credit unions | Data as of 12.31.15

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

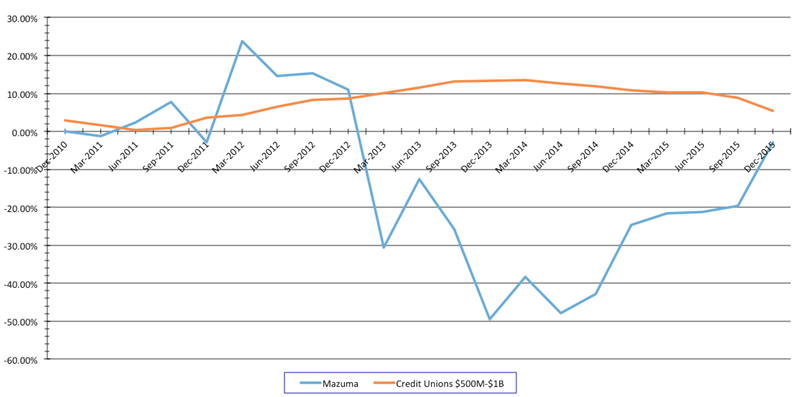

This loan growth chart shows how Mazuma Credit Union’s business lending portfolio was emptied and now is being replenished by a new team of lenders with a very different focus.

We have seen some consistent loan growth in recent months and our pipeline is healthy, a result of a focused calling program by our loan originators, Engelhard says. We have not opened the throttle yet but are quickly moving into position to take advantage of market opportunities. We anticipate growing business loans at least 15% in 2016.

Member business lending is top-of-mind or close to it for many credit unions this year. Get more perspective in this CU Broadcast interview with Sam Taft, director of industry analysis at Callahan Associates.

Here, Engelhard shares experiences and best practices in building a new member business lending operation.

|

| Dan Engelhard, Chief Lending Officer, Mazuma Credit Union |

Why did Mazuma build a new team of business lenders from scratch? What does it look like?

Dan Engelhard: When I took over the business area in 2012, our existing portfolio was troubled and we had to have a complete turn-around. To position ourselves for future growth, we built an entire new business lending team consisting of loan officers, loan resolution specialists, and business loan coordinators. We have now transitioned from a cleanup operation to a growth focus under the guidance of a vice president-level executive who oversees two loan originators, one business loan coordinator, and one underwriter.

How different is business lending from consumer lending?

DE: How businesses borrow money is different from how consumers borrow, so understanding the need, matching the solution with that need, and determining how it will be repaid can look very different.

Business loans are usually shorter and carry higher interest rates. There is little follow-up and ongoing loan maintenance on consumer loans once originated, but business loans require intentional actions to monitor business activities and performance, with formal periodic reviews.

Cash flow analysis and ability to repay the debt is important on both types of loans, but additional analysis on business loans including profitability, liquidity, growth, and leverage positions all add to the complexities of a business loan transaction. All of those items have different considerations depending on the type of business and industry.

Is it hard for a lending professional to go from one to the other?

DE: Lending is lending, if you have the lending mindset you can make the transition from one to the other, or back and forth. Experience can come into play more on the business lending side as there are more complexities to consider, but neither side is rocket science.

Many lenders develop a preference and even specialize in particular industries or lending type, but lending is lending and selling is selling. You must understand the differences and additional complexities in business lending or you are destined for trouble. That’s one of the reasons the NCUA has a two-year minimum experience requirement for business lending.

We started with the business team scattered across three different branch locations but have now consolidated operations into one location. That gives the team a stronger sense of teamwork.

How did you deploy your new team?

DE: We experienced more success in a department setting versus deploying the team in the branch network. We started with the business team scattered across three different branch locations but have now consolidated operations into one location. That gives the team a stronger sense of teamwork, enhances consistency of communication and direction, and increases collaboration.

What would be a few bulleted’ best practices for building a team from scratch?

- First, focus on hiring sales-oriented originators, preferably with existing contacts.

- Talent typically comes from the banking world, so as you onboard these recovering bankers (I am one!) ensure you spend time training them on NCUA 723. (The regulator’s rules for business lending.) Business lending in the banking world and the credit union world are different. You must understand 723 or not so good things will happen.

- Regarding NCUA 723, engage your examiners if you have any questions or need clarifications. We’ve found examiners to be very open to clarifying discussions prior to origination so that we’re all on the same page. That helps mitigate examiner criticism after origination.

- Address your business continuity plans. Many credit union operations are small, so turnovers and absences can impact operations and portfolio health, especially if they’re extensive. Ensure you have contingency operations in place.

- Ensure your loan approval limits are appropriate and commensurate with the risk. Structuring your roles to ensure separation of duties is important. Having the sales team (your loan officers) completing their own underwriting and giving them approval authority can lead to problems.

You Might Also Enjoy

- How To Build A Staff Centered On Sales

- Leaders In Salary And Benefits Per Full-Time Employee

- Strategies To Set Up Shop In A New Market

- Ent Federal Credit Union’s Guide To Process Improvement