State Employees Credit Union ($40.9B, Raleigh, NC) is the nation’s second-largest credit union. Its 267-branch network stretches across the state and touches all 100 Tar Heel counties. The credit union is based in the state capital of Raleigh, but it offers good jobs in rural communities such as Kinston, Swan Quarter, Snow Hill, Yadkinville, and Robbinsville.

These jobs, however, extend beyond the traditional branch-based positions. That’s because more than 45 of those 267 branches also host call center called Member Services Support at SECU activities. This operational strategy allows SECU to maximize its existing resources and footprint as well as provide employment in economically struggling parts of North Carolina.

SECU has a long history of investing in communities through its support of hospice facilities, teacher housing, and other similar projects. But, Hamrick notes, the credit union is able to provide that support through the SECU Foundation, which is funded from a $1 optional deferred service fee on the credit union’s checking accounts.

This Member Services Support center strategy continues in SECU’s tradition of community support, but it also has a real impact on the credit union’s bottom line.

“Our decision to locate Member Services Support centers around the state and target higher unemployment areas has been more of a strategic business decision,” says Jennifer Hamrick, the credit union’s executive vice president for organizational support. “We were at capacity in our Raleigh location and we had older branches that had third stories we were not using for member daytime traffic.”

So, SECU began expanding its Member Services Support center operation beyond Raleigh in 2009. The credit union tested the concept of remote locations in two branches for a year or so before adding additional locations.

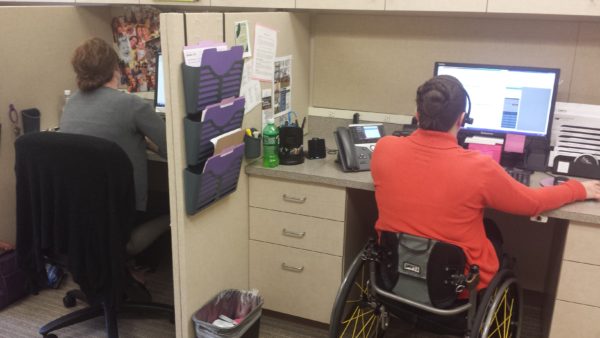

Today, more than 600 of the approximately 7,000 SECU employees work in Member Services Support center jobs, with operations ranging in size from five to nearly 60 employees. There are six separate centers in cities around the Tarheel State as well as staff taking calls routed through the credit union’s VoIP network in approximately 40 other branches in communities large and small. According to Hamrick, callers have no idea their call is not being answered in Raleigh.

And that’s OK. Members conduct their business, Member Services Support center reps have jobs, and the credit union saves money. It’s a benefit to all parties.

“Using our existing branch presence relieves us of the need to build expensive standalone buildings just to answer phone calls,” Hamrick continues. “And we hope targeting these areas for those jobs will result in lower turnover than we experience in urban areas.”

Member Service Support staffers take calls from SECU’s toll-free number as well as online messages. However, managers at local branches oversee the employees’ performance and work schedules, which include night and weekend hours.

“We’re ensuring our members’ needs are met 24/7 while creating jobs in areas of the state that need it the most,” Hamrick says.

Update: Statistical data within this article has been updated for 2019. SECU’s Member Services Support center model continues to evolve as the organization works to enhance and modify its strategy for continued success.