Volatility within the global economy and multiple rate cuts by the Federal Reserve this year cast doubt upon the future of the rate environment and have left financial institutions in a position of uncertainty. Liquidity pressures combined with a flattening yield curve have prompted institutions to move money into short-term investments of less than one year. An instable economy puts a premium on liquidity and the flexibility that comes with it, but that is a premium many market actors including credit unions have been willing to pay in 2019.

Key Points

- Investment balances at credit unions in the third quarter were up 8.2% annually to the highest third quarter total since 2013.

- Cash and investments with maturities of less than one year accounted for 51.6% of the portfolio. This is the highest third quarter concentration since 2009.

- An uptick in loan demand compelled credit unions to repurpose some of their cash balances. As such, the weighted average life of their investment portfolios increased to 1.91 years during the third quarter, still shorter than the average life of 2.10 years reported in the third quarter of 2018.

- Despite the two rate cuts in the third quarter, average investment yields reached 2.42% the highest since December of 2009.

Click the tabs below to view graphs.

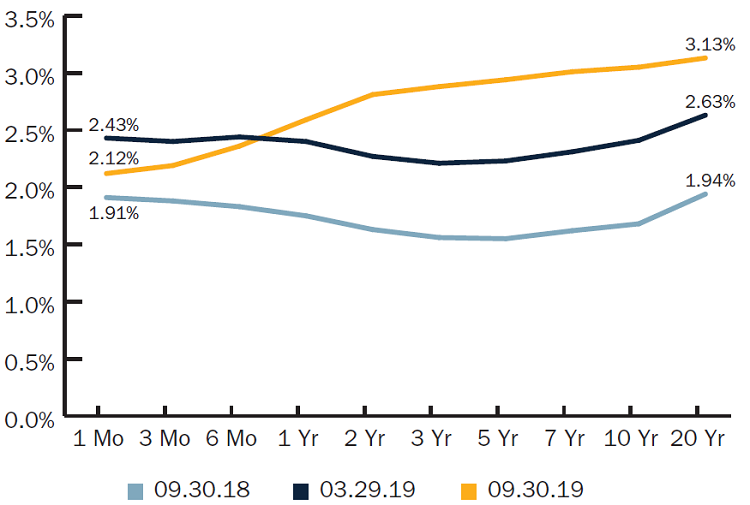

TREASURY YIELD CURVE RATES

TREASURY YIELD CURVE RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Following four rate hikes in 2018 and two cuts in 2019, the yield curve has flattened and at times inverted.

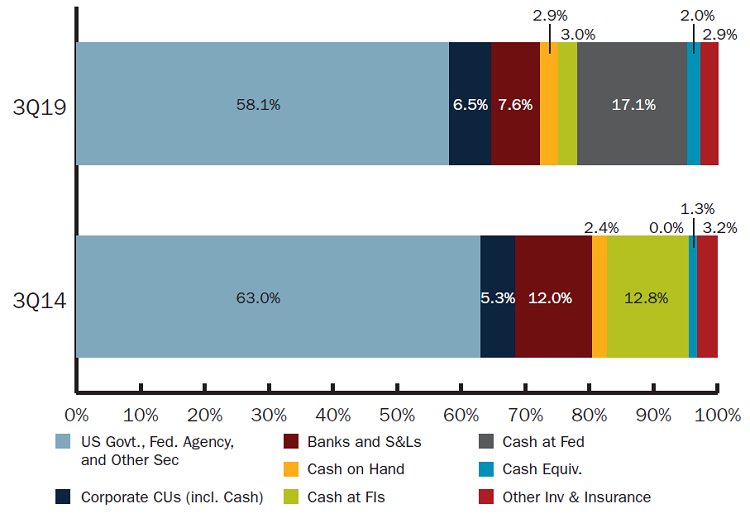

INVESTMENT COMPOSITION

INVESTMENT COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Government Agency’s share of the investment portfolio has declined over the past five years. Cash balances have grown from 16.5% to 25.0% of the portfolio.

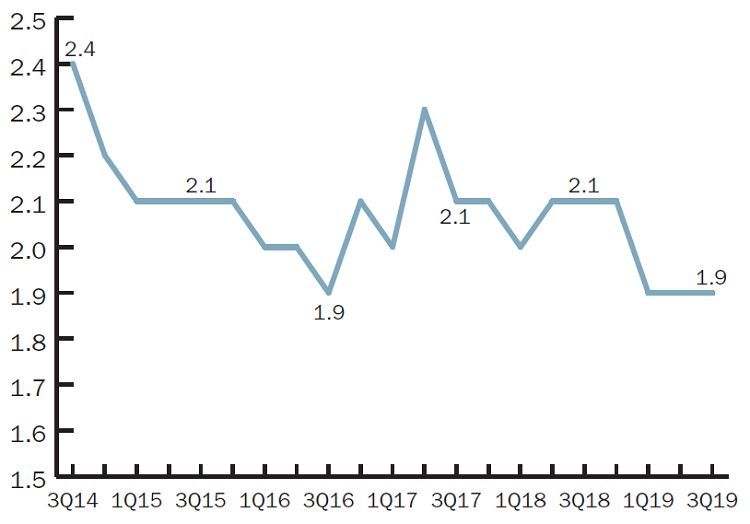

AVERAGE LIFE OF INVESTMENT PORTFOLIO

AVERAGE LIFE OF INVESTMENT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

An uptick in lending during the third quarter led to a seasonal decline in cash balances, which resulted in a slight increase in average maturity.

The Bottom Line

Financial institutions have originated $605.0 billion in mortgage loans nationwide so far in 2019, according to the Mortgage Bankers Association. Credit unions alone have booked $119.8 billion in first mortgages through the end of the third quarter, a 12.2% year-over-year increase. Declining rates have prompted consumers to turn their attention to refinancing opportunities. The resulting surge in first mortgage originations at credit unions in the third quarter pushed the industry’s share of the mortgage market up to 8.4% and helped reverse the year-to-date decline in originations set during the first six months of the year.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.