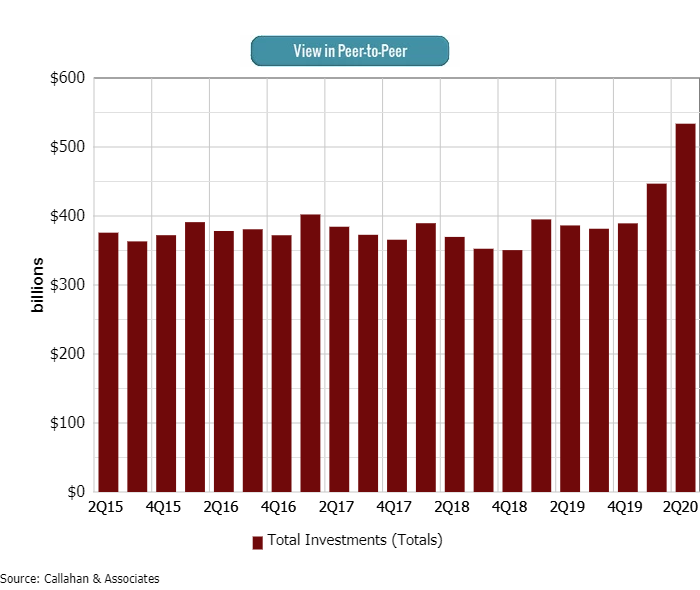

As of June 30, 2020, credit unions held $533.8 billion in investments that’s up 19.2%, or $85.7 billion, from one quarter and is the largest quarterly dollar increase on record. Notably, portfolio growth from the first to second quarters has been negative since 2011. Not so this year, which underscores the highly unusual dynamics at play in 2020 as well as the sheer volume of liquidity coming into credit unions.

The economic uncertainty related to COVID-19 continued to encourage significant share inflows as members sought safe havens for their assets. Total deposits increased 8.1% from March 31, 2020, and 16.2% from June 30, 2019.

The deposit accounts with the largest growth have also shifted drastically in 2020, reflecting consumer sentiment and the rate environment. Core deposits which includes checking, savings, and money market accounts accounted for 105.0% of inflows. How did core deposit growth top 100%? Certificate accounts contracted.

There’s more to read. Click here to download Trust For Credit Unions second quarter report, which covers investment balances as well as composition, maturity, yield, and more.

The balance sheet for the industry expanded accordingly. Total credit union assets increased 6.6% quarterly and 14.8% year-over-year. Similar to the first quarter, lagging consumer loan growth notably a contraction in new vehicle lending and limited used auto growth resulted in relatively smaller loan portfolio growth, which pushed investment balances higher. On an annual basis, loan portfolios expanded 6.4% with the continued boom in real estate lending powering growth. First mortgage originations have risen 93.8% over the past 12 months, marking the largest funding total through mid-year on record.

TOTAL INVESTMENTS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

The $85.7 billion jump in the credit union investment portfolio from the first to the second quarter of 2020 is the largest quarterly dollar increase on record.

Sam Taft is the AVP of Analytics at Callahan & Associates. He also leads the business development efforts for the Trust for Credit Unions family of mutual funds, of which Callahan Financial Services (a broker dealer subsidiary of Callahan & Associates) is the distributor.