The line between personal wellbeing and professional performance is blurry at best. As organizations rethink what it means to support their people, conversations around mental health, financial stability, and work-life balance have moved from the peripheral to become a central consideration for how companies attract and retain talent.

According to Gallup, employees that feel their organizations care about their wellbeing are 4.4 times as likely to be engaged at work and 73% less likely to feel burned out. Recognizing this shift, Y-12 Credit Union ($2.7, Oak Ridge, TN) saw an opportunity to support not only area employers but the broader East Tennessee workforce.

“Behind every desk is a real person,” says Alicia Strange, director of community and public relations at Y-12 Credit Union. “As a credit union, we asked ourselves how we could help beyond what we were already doing.”

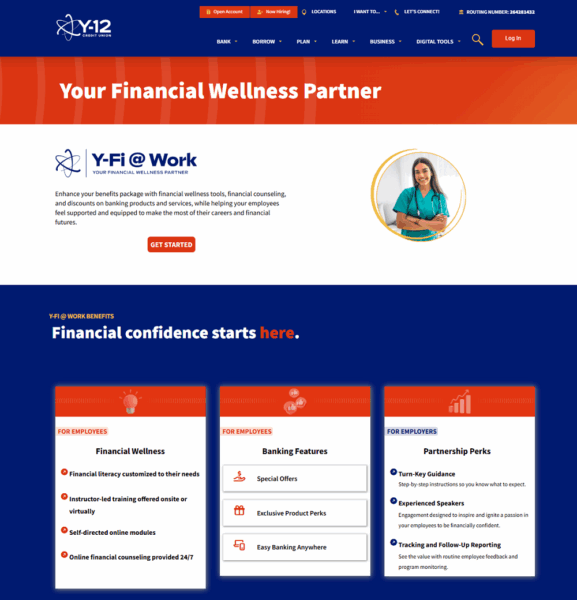

In 2023, the cooperative launched Y-Fi @ Work, a comprehensive financial education program that takes training directly to worksites. Taught by the credit union’s certified financial counselors, the program is 100% free and participants can participate virtually or in-person.

Financial Wellness For Every Workforce

The Tennessee cooperative launched Y-Fi @ Work in mid-2023 with a team of three employees and promoted the program primarily through its digital platforms, local chambers of commerce, and other grassroots efforts.

“Chambers were a great way to connect directly with businesses,” Strange says. “We canvassed companies throughout East Tennessee — automotive, engineering, it didn’t matter. We just shared how we could help.”

The credit union positions the program as an easy perk to offer employees. Topics include common staples like budgeting and debt reduction that Y-12 Credit Union tailors for different employers. According to Strange, her team works closely with HR departments to understand what’s most relevant to their people.

“For example, a manufacturing company might have different concerns than those in the healthcare industry,” the director says. “We also offer one-on-one sessions if someone wants privacy. It’s all customized.”

Notably, Y-12 Credit Union offers Y-Fi @ Work free-of-charge for members and non-members alike, intentionally putting mission over profit.

“We want people to know we’re here to help them live better lives whether they become members or not,” Strange says. “If we do our job well, people will naturally want to bank with us.”

Deeper Relationships With Area Businesses

Today, Y-12 Credit Union partners with more than 30 employers, ranging from large companies with more than 2,000 employees to smaller ones like GoTeez Clothing Company in Alcoa, TN, which Strange says has 35 employees but is one of the most engaged partners.

“Engagement from the business owner down makes a huge difference,” she says.

The credit union tracks program success via the number of new partner employers, the length of those partnerships, the number of interactions and events per partner, and member impact.

CU QUICK FACTS

Y-12 FCU

HQ: OAK RIDGE, TN

ASSETS: $2.7B

MEMBERS: 117,866

BRANCHES: 16

EMPLOYEES: 356

NET WORTH: 11.6%

ROA: 1.07%

“Some partners want just one session, while others want ongoing engagement,” Strange says. “We measure not just new memberships but deeper engagement like members who add loans or open new accounts after attending sessions.”

Y-12 Credit Union offers a $300 deposit for Y-Fi @ Work participants who become members and maintain an active account with direct deposit for 90 days.

Up next, the credit union is looking to launch a peer-sharing component, which Strange describes as a sort of “mini chamber” among the institution’s partners.

“We’ll host regular calls so they can exchange ideas within the Y-FI @ Work framework,” she says. “The program’s really growing wings.”

Trust. Patience. Mission.

According to Strange, the growth and success of Y-Fi @ Work is the result of buy-in from leadership across organizations, including from the credit union’s own newly appointed CEO, and former CFO, Dustin Millaway, who considers the program a shining example of how Y-12 Credit Union shows up for its community.

“Financial literacy is for everyone,” Strange says. “It’s not something we ‘own.’ It’s something everyone deserves access to.”

As for what other credit unions can take from Y-12 Credit Union’s experiences, the community relations leader offers three nuggets of advice. First, no program is too small.

“We started with three people and now support 24 branches across nine Tennessee counties and more in Kentucky,” Strange says. “Even if it’s just one company, you’re helping someone. That’s the goal.”

Next, don’t make it contractual. Strange says if the goal is to engage with the community, don’t throw up barriers or make resources overly conditional.

And, finally, be patient, especially with large organizations.

“You might not be their top priority, but they do care,” she says. “Follow up, stay flexible, and give them time.”

Join Callahan & Associates and Gallup to learn about exclusive research and insights on how emotional engagement and the perception of care drive member participation and, ultimately, credit union growth. Watch “A Roadmap To Credit Union Growth” today.