Credit scores are central to nearly every major financial life milestone, from buying a car to renting an apartment or securing a mortgage. Yet for many consumers, they remain a source of confusion — and for younger generations, a growing source of stress. Understanding and managing credit isn’t just a financial skill; it’s a foundation for long-term security. And increasingly, members are expressing a need for trusted guidance in navigating this landscape.

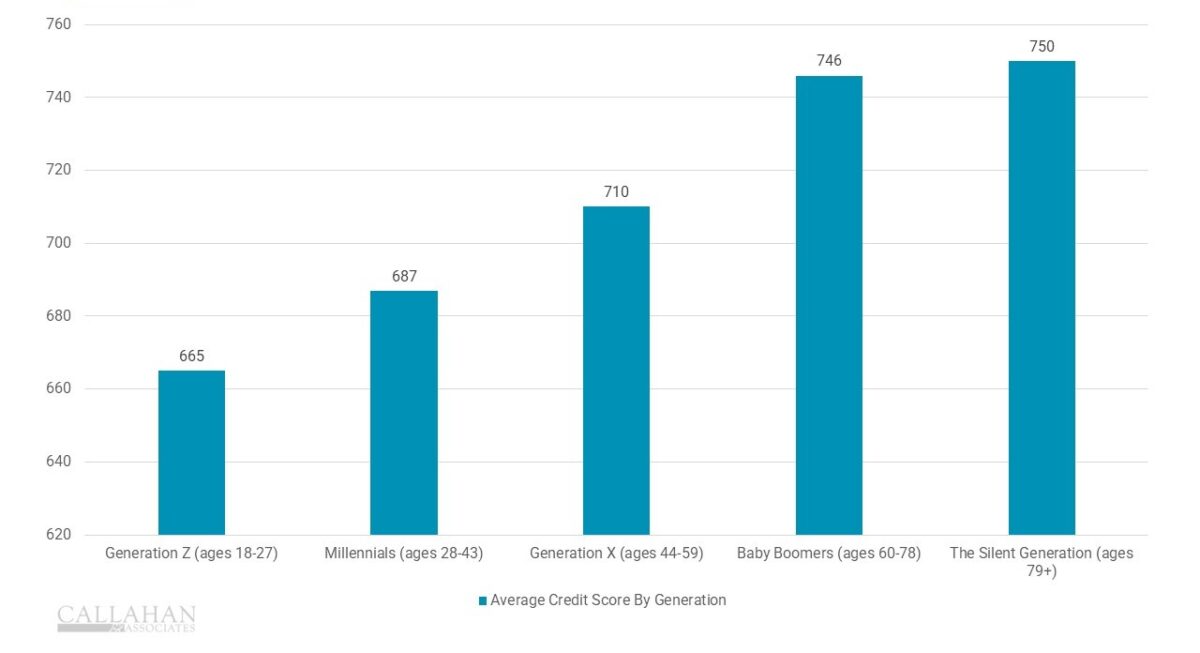

As credit unions look to deepen their impact, helping members take control of their credit presents a powerful opportunity. The generational spread in average credit scores tells a compelling story.

While these numbers rise steadily with age, they also reflect disparities in access, experience, and education. Many younger members are still building financial habits, often doing so without clear or accurate guidance.

In fact, nearly one-third of U.S. consumers don’t know their credit score, and more than half don’t understand what a FICO score is. Credit misconceptions also persist, such as the belief that checking your credit can hurt your score and that more credit cards automatically equate to a higher ranking. These knowledge gaps limit financial progress, especially for younger members. Data shows that only 54% of 18–24-year-olds know their credit score compared to over 70% of adults ages 25–64.

Compounding financial pressure amid a high-interest rate environment is revealing measurable impact with younger generations. Between 2022 and 2024, average credit card debt for Gen Z rose 62%, while millennials saw a 50% increase. The percentage of consumers with subprime credit scores is also rising across both groups.

Yet, despite the challenges, younger generations are actively seeking help. Over 70% of Gen Z and millennials report having financial questions — but they struggle to access trusted advice. This is where credit unions can make a difference.

By delivering practical education, offering responsible credit-building products like secured cards, and guiding members through tools that support everyday financial decisions, credit unions can empower members to build lasting credit confidence.

However, when offering these tools in-house, credit unions often face practical constraints such as limited liquidity to absorb charge-offs, tighter risk tolerance, and operational challenges in expanding underwriting. These limitations can prevent even the most member-focused institutions from offering the kind of credit access and support many members are seeking today.

By partnering with Elan, your cardmembers gain access to a full suite of products and tools to strengthen credit literacy and support responsible usage. Download the full whitepaper to access more insights into what members know about their financial health, what they want to learn, and how credit unions can step in as trusted partners to build financial confidence.