Top-Level Takeaways

-

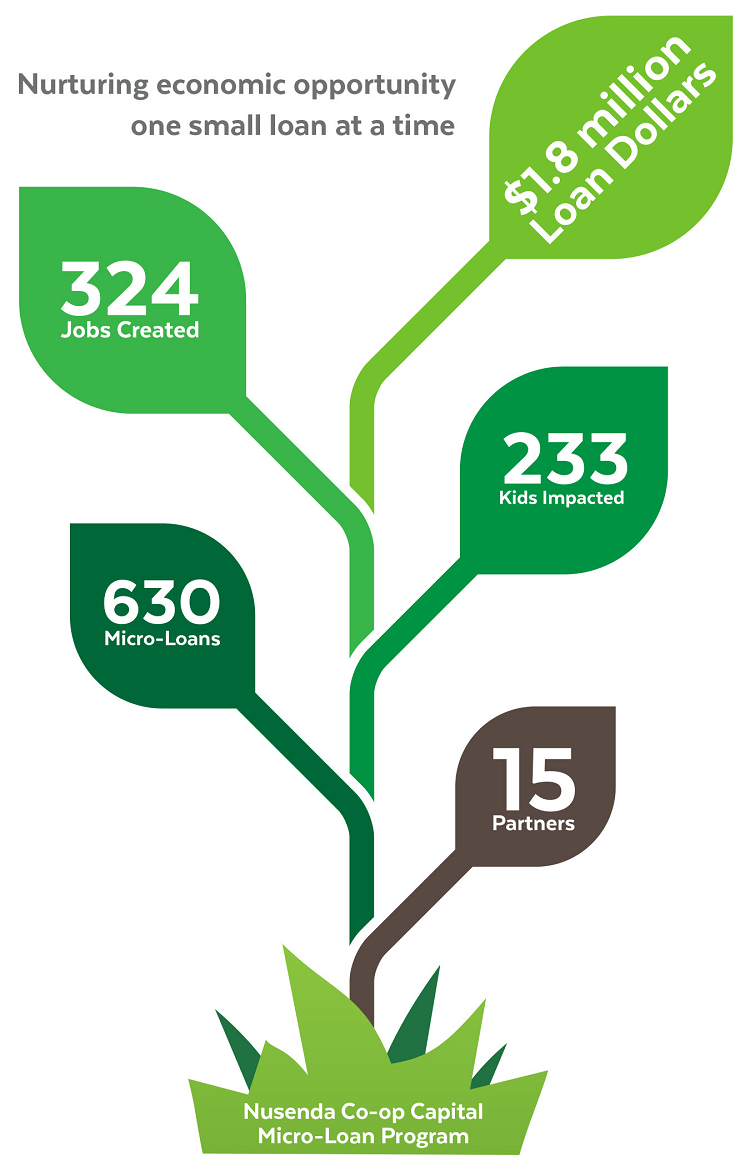

Nusenda began making microloans in 2010. In 2018, it formalized a program and started working with community partners to identify borrowers.

-

The small entrepreneurs are posting a solid payback record while creating jobs and opportunity in their communities.

For more than a decade, Nusenda Credit Union ($3.4B, Albuquerque, NM) has provided financing to small entrepreneurs and created a community impact that extends well beyond the cooperative’s bottom line.

“We’ve funded restaurants and food services, childcare, jewelry and other artisan production, a barbershop, and much more,” says Amy Nigrelli, Nusenda’s chief marketing officer.

It All Started With A SEG

Nusenda kicked off its microlending effort in 2010 with a five-year loan pilot program created to support La Montaita Co-op, New Mexico’s largest community-owned natural foods market and one of Nusenda’s select employee groups.

According to Nigrelli, many growers in La Montaita’s network didn’t meet traditional loan collateral or credit requirements and couldn’t access the funding to increase production and grow their businesses. The microloan pilot program was Nusenda’s solution to this growing problem and it worked. In fact, the pilot was so successful, the credit union started working with other community organizations to expand the model and reach additional underserved borrowers.

“We have some fantastic organizations in New Mexico that serve underserved and marginalized groups,” Nigrelli says. ‘Their daily focus is supporting and building mutual trust with their constituents. We partner with such organizations to identify and qualify potential borrowers.

Nusenda dubbed its expanded program Co-op Capital and issued the first loans from it in 2018.

Character Fills The Credit Gap

Typical underwriting rules including credit scores create a gap that the Co-op Capital program is built to address.

“There are many people often women, people of color, Native Americans, and immigrant communities who have never had access to financial institutions,” Nigrelli says. “Co-op Capital provides a path to capital for borrowers in our community who would not traditionally have access. The microloans administered under this program use a character-based lending model, rather than the traditional five Cs of credit, to qualify a borrower.”

According to Nigrelli, the program initially relied on support from Program Related Investments (PRI) from the Kellogg Foundation, the Albuquerque Community Foundation, and the Dakota Foundation. Under that model, 70% of the loans were collateralized through PRI, 20% from the credit union, and 10% from the partner organization.

But that changed as Co-op Capital expanded and Nusenda demonstrated its ability to serve the micro market.

In 2020, Nusenda began collateralizing 90% of the loans with the remaining 10% from the partner organization, Nigrelli says.

Currently the program relies on a revolving collateral fund that contains $1 million in PRI money and $3 million from the credit union.

The Multiplier Effect

Since 2010, Nusenda has made 630 microloans totaling $1.8 million. According to the credit union, those funds have helped those small businesses create 324 jobs.

The Co-op Capital program alone, which formally launched in 2018, has accounted for 218 loans that have averaged $5,050 each and have helped establish 41 new businesses and 129 new jobs. Of those 218 loans, Nusenda has charged-off only two.

The credit union has made loans through 15 different partners representing a diverse group of tribal organizations, local economic development organizations, and more. Borrowers are located across New Mexico, primarily in Bernalillo, Sandoval, Santa Fe, and Taos counties, as well as the Navajo Nation, and their pursuits range from traditional businesses to startups like a coding school and a commercial test kitchen.

Most recently, the credit union partnered with Albuquerque’s International District Economic Development (IDED) to support small businesses and entrepreneurs in the capital city’s southeast neighborhoods, which the credit union and IDED describe as one of the city’s most culturally diverse and underserved areas.

Assistance often extends beyond loans, too. For example, the IDED partnership includes funding, office space, workshops, and training to help support the budding businesses.

But that’s not all.

“Access to capital even in small amounts has a multiplier effect,” Nigrelli says. “It helps the borrower on their personal journey and as an investment can help whole communities improve and thrive.”

The Broader Product Picture

Co-op Capital deepens the connections among the credit union, the programs it works with, and the communities they all serve.

“Nusenda is deeply involved in communities across the state,” Nigrelli says. “What’s special about our Co-op Capital program is that it fosters a deep understanding of the communities we serve and their needs especially traditionally marginalized groups. It’s powerful to see what we do come to life at a very human level.”

Nigrelli calls Co-op Capital an extension of the cooperatives efforts to ensure its products benefit the community and serve low-income members.

“We’re always looking for ways to help our members and support the communities in which they live,” she says.

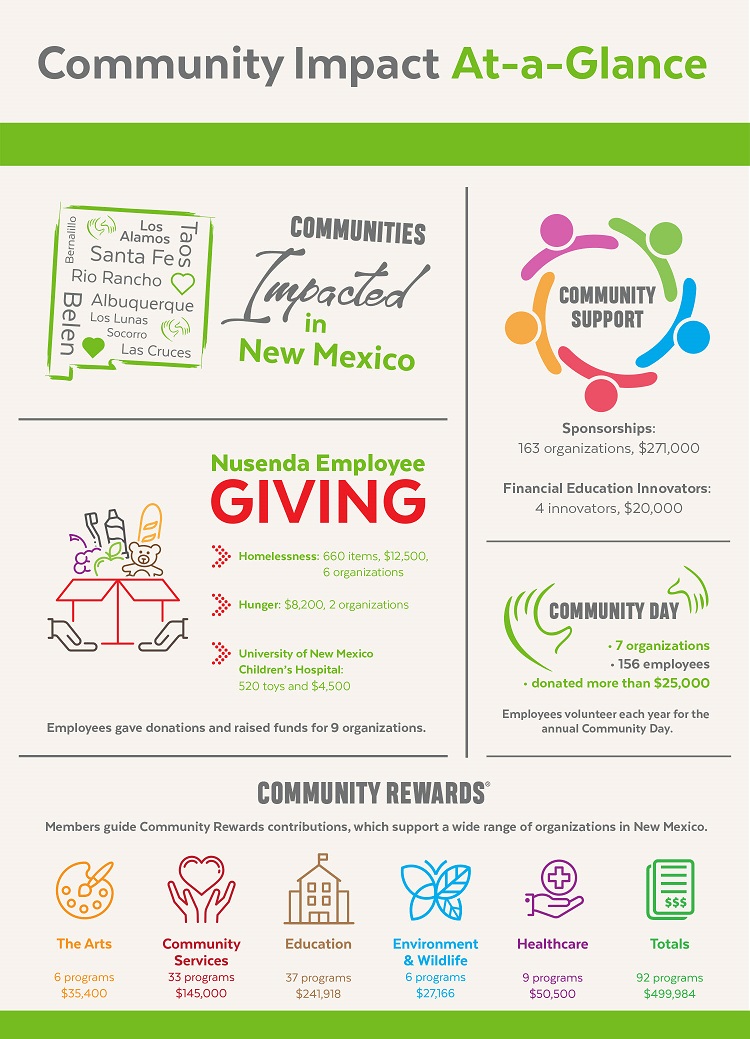

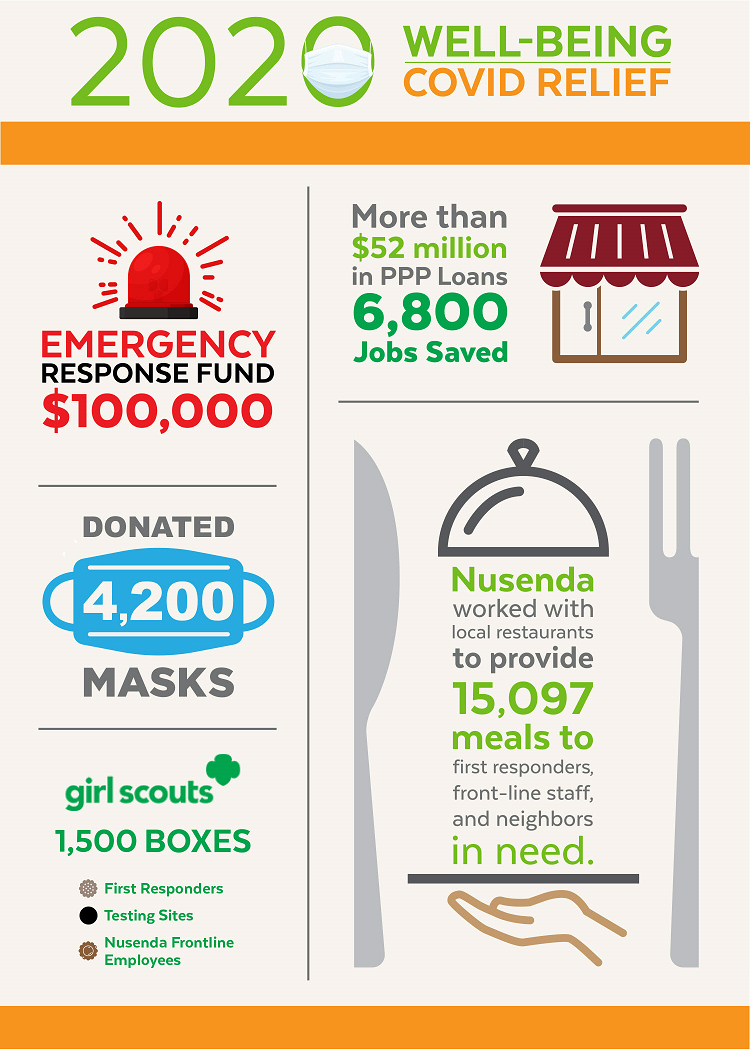

Other examples of the credit union’s help include first-time homebuyer programs, checking accounts targeted to students and people working to fix their finances, and a debit card that allows members to round up purchase charges to pay down loans, save, or donate. Its efforts during the pandemic have included donating 4,200 masks and supporting first responders as well as neighbors-in-need with more than 15,000 meals from local restaurants and 1,500 boxes of Girl Scout cookies.

Community Connections. Lasting Impact.

According to Nigrelli, one of her goals when she joined Nusenda in December 2020 was to help expand microlending and connect more New Mexicans to safe, affordable banking.

“We’ve learned so much from our Co-op Capital work and the positive power of collaborating with community partners,” the CMO says. “I’m looking forward to even more.”

Although some borrowers have moved into more traditional banking products, the bottom line isn’t Nusenda’s ultimate goal.

“Nusenda is here to empower our members and the communities we serve,” Nigrelli says. “We have a responsibility to understand our field of membership and connect them to affordable, responsible, modern products and services they can trust. This program is a great example of how we can leverage our community connections and our people-first focus to do things together that make a great impact.”