Top-Level Takeaways

- Centralized analytics and reporting at Texas Trust Credit Union offers a single source of truth and provides deeper knowledge about members.

- Data detected a disruption in members’ finances from the COVID-19 pandemic; the credit union responded with a targeted skip-a-pay offering.

A central, single source of truth for data at Texas Trust Credit Union($1.6B, Arlington, TX) allows marketers to target members on a granular level. It also has revealed surprising new truths.

“We thought we knew our membership, but we didn’t,” says Ron Smith, who took the new role of chief growth officer in 2020,after serving as senior vice president of sales and marketing at the Dallas cooperative. “Instead, we were using what we call ‘ITIF’ thinking, meaning ‘I think, I feel.”’

It’s understandable that veterans like Smith, who has played a key integration role for mergers during his 14 years at Texas Trust, would think they had a pretty good handle on the makeup of their membership.

But it wasn’t until Texas Trust centralized analytics using a combination of the Trellance data analytics platform, psychographics, and the Power BI dashboard tools a couple of years ago that leaders there realized how wrong they were.

Spray No More

“We were using a ‘spray and pray’ approach to marketing,” Smith says. “But with 1,000 people a day moving into the Dallas-Fort Worth Metroplex, our market is too large for that to be efficient. We had to get more targeted.”

Besides adopting new software, the credit union created a three-person data team led by a senior vice president. Together, the team centralizes and synchronizes analytics and reporting so decision-makers are aligned, which gives them the ability to target like never before.

“Say we want to grow in the city of Arlington,” Smith says. “But we actually want to grow in a specific ZIP code within the city. Within that ZIP code, we want to market credit cards within one block, but in the next block we want to talk about mortgages. We can do all this.”

Indeed, according to Smith, the new data structure, along with the psychographics now available, helps the credit union identify opportunities, spend less money, and be more effective all of which leads to a higher ROI.

What’s Unknown Can Hurt Or At Least Hinder

Texas Trust can trace the genesis of its analytics program to a single staffer in accounting a decade ago. It then moved data into IT. Now its own department, an SVP and three staffers focus on the processes that produce approximately 120 different reports a month all based on the same data and presented using the same tools.

“We have true data analysts looking at true data now,” Smith says.

And the credit union is uncovering startling facts about its membership.

“If you were to ask us three years ago what the average income of our membership was, we wouldn’t have been within 50%,” the veteran Texas Trust executive says. “And we were probably 75 points off on what their average credit scores were.”

But, really, what kind of impact does poor member knowledge have on a credit union?

“For one, you could be designing a $250,000 to $300,000 mortgage product while your members are looking at $600,000 houses,” Smith says. “That’s really missing the mark.”

Revelations like this prompted Texas Trust to create a high-rewards checking account that requires a $5,000 minimum balance, something not typically seen among cooperatives these days.

Take A Dive Into The Data At Texas Trust Credit Union

Skip-A-Pay

Texas Trust’s Skip-A-Pay dashboard allows leaders to look at activity for the campaign in this case, nine months of activity.

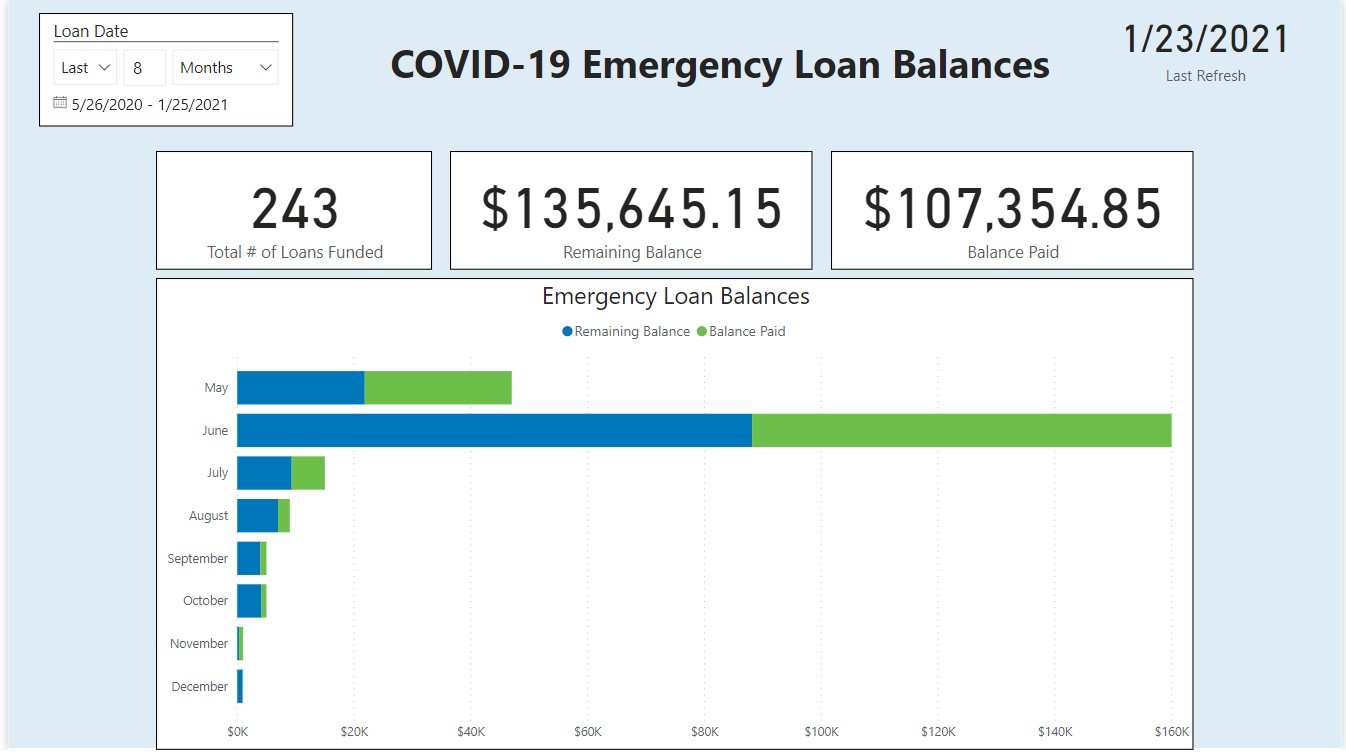

Emergency Loans

During the pandemic, Texas Trust made 243 emergency loans and now monitors the balances and monthly activity for them.

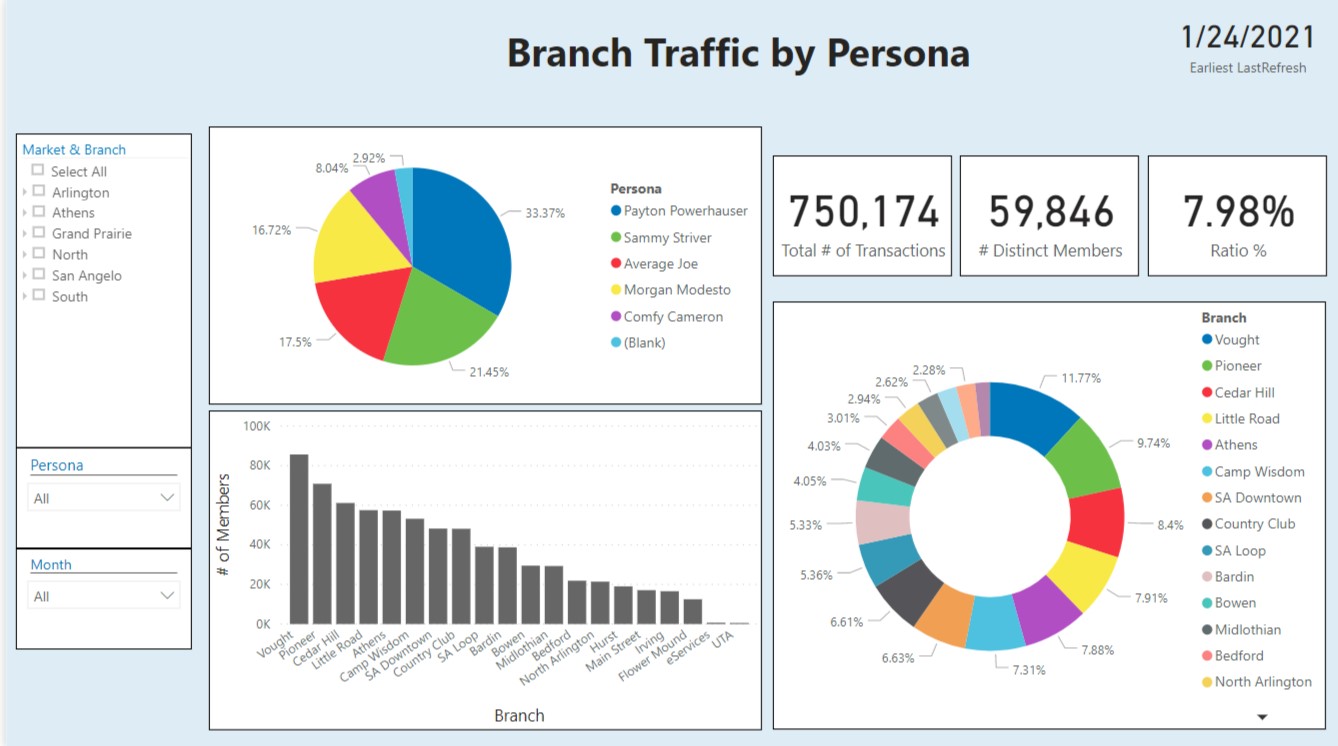

Branch Traffic

The team at Texas Trust also monitors activity by “personas” at its branches.

The credit union altered its credit card strategies, too.

Texas Trust had been operating under the assumption that rate matters most. But that’s not the case to a large group of members who pay their full balances every month.

“They want rewards,” Smith says.

Resolving those discrepancies, and creating avenues for internal and external growth, was what Jim Minge, Texas Trust’s CEO, made Smith’s charge when Smith was promoted to CGO.

Centralizing the data analytics operation has been a key to unlocking and deploying that new knowledge. Instead of branch operation information coming from a data source different from auto lending, for example, it all flows through the same channel.

That channel is where Smith and his data team work their magic, without external influences to skew the facts.

“Before, we might look at something that was blue and say, ‘I think it might be green,”’ Smith says. “We didn’t trust the data. Now, with our data centralized and analyzed, we can say, ‘You know what? Your report says its blue. It’s blue.'”

Pivoting To The Pandemic

The ability to perform tasks such as finding out how many members with credit scores exceeding 700 opened a loan and a checking account within 30 days of each other is great for marketing outreach in normal times. In a pandemic, it can be critical.

As the economy reeled and joblessness spiked, Texas Trust used its number-crunching prowess to identify members who might need help and when they might need it.

“Like every other financial institution, behavior among our members drastically changed,” Smith says. “We were pulling data daily and watching balances decrease, watching where their money was going, watching overdrafts. We knew who had lost jobs and how many were getting unemployment benefits. Because of that, we were able to identify who needed help the most.”

The credit union looked at how many members had loan activity that was of interest, it then offered a skip-a-pay program to ease their financial pain.

That strategy has expanded into tactics such as looking at members whose credit scores are lower now than last year and strategizing around what the rest of their story might be to ultimately create products and services that address those specific needs.

“No more sending people offers that aren’t relevant to them,” Smith says. That wastes money and time. We can now provide the most benefit to members and to the organization by knowing what members need and when they need it and making sure they know it’s there.”