The U.S. economy officially hit 22 consecutive quarters of expansion when real GDP increased at an annual rate of 1.9% in the third quarter of 2019. Consumers tend to spend more and save less during economic expansions. But according to the latest release from FRED Economic Data, the personal saving rate in the United States has gradually increased since 2010, inching up from 5.0% at the beginning of 2010 to more than 7.5% in October 2019.

The Federal Reserve increased its benchmark interest rate four times in 2018 and cut it three times in 2019. But as the Fed raised rates last year, member demand for higher-yielding term deposits likewise increased, causing credit unions to reprice in 2019.

Key Points

- Deposit balances have increased by $84.7 billion in the past year to top $1.3 trillion as of Sept. 30, 2019.

- In the third quarter of 2019, 58.6% of members held a share draft account with a credit union.

- The average share balance at U.S. credit unions increased to $10,710 in the third quarter.

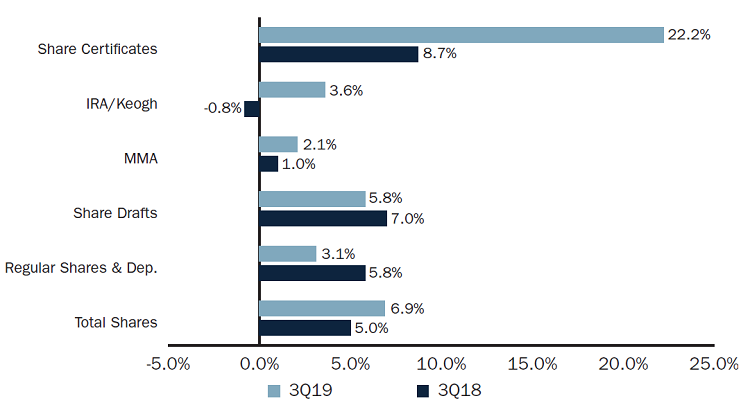

- Share certificate growth was 22.2% as of Sept. 30. This segment added $12.8 billion to total deposits in the third quarter alone.

- IRA/Keogh balances reached $81.3 billion in the third quarter. The 3.6% year-over-year growth rate was the fastest for this segment since 2010.

Click the tabs below to view graphs.

SHARE GROWTH BY TYPE

SHARE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

With annual growth of 22.2%, certificates drove total share growth in the third quarter of 2019.

DEPOSIT PORTFOLIO

DEPOSIT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

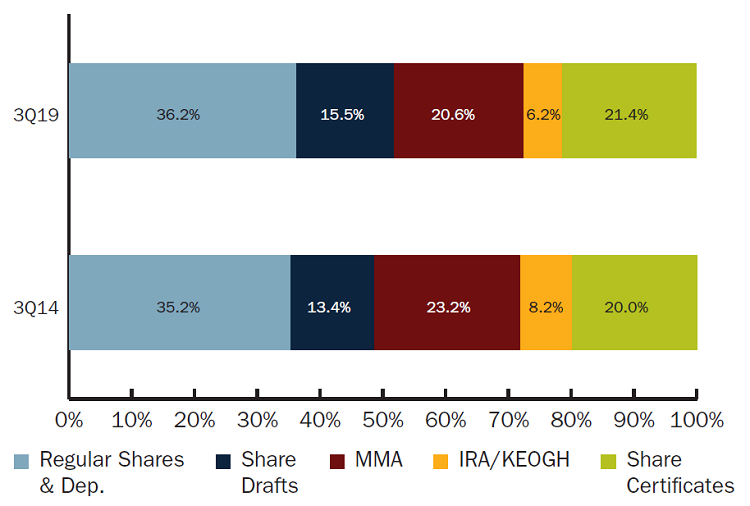

Core deposits composed of regular shares, share drafts, and money market accounts accounted for 72.4% of total deposits at U.S. credit unions.

LOAN-TO-SHARE RATIO

LOAN-TO-SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

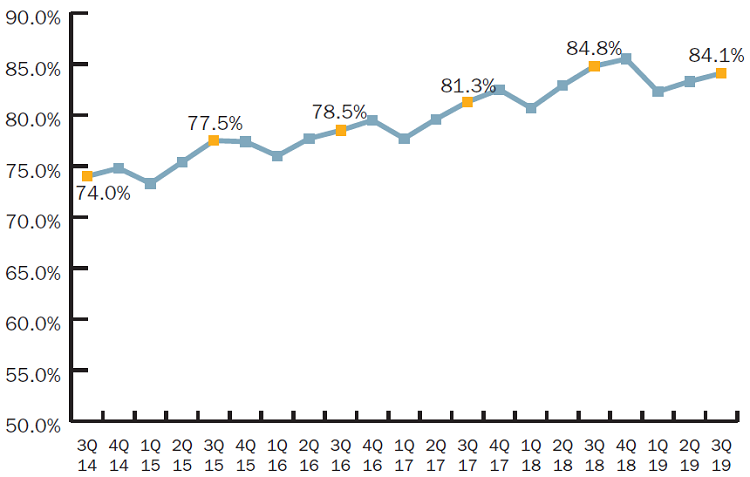

The third quarter’s share growth (6.9%) outpaced loan growth (6.0%), resulting in a drop in the loan-to-share ratio for the first time in six years.

The Bottom Line

Interest rate increases in 2018 pushed credit unions to reprice deposits. Consequently, the cost of funds increased 26 basis points year-over-year to 0.99% as of Sept. 30, 2019. However, higher-yielding term deposits enticed members to park their cash with their credit union. Balances in share certificates grew 22.2% and accounted for 60.2% of total annual deposit balance growth. Notably, the third quarter marked the fourth consecutive quarter of accelerated total deposit growth.

Also notable, the quarter’s deposit performance resulted in slightly eased liquidity pressures. The average loan-to-share ratio fell year-over-year for the first time in six years. At 84.1%, it was 78 basis points lower than in the third quarter of 2018.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.