Strategic planning season has arrived, and many credit unions are considering ways to take more deposits in so they can loan more money out.

It might sound simple, but with yields ranging from low to nil and competition fierce among lenders of all kinds, attracting share deposits calls for some creativity.

As reported in the second quarter Trendwatch review from Callahan & Associates, credit union members are saving and borrowing at record rates, with share balances now totaling approximately $1 trillion. Total borrowing for the first six months of 2015 was $200 billion, also a record.

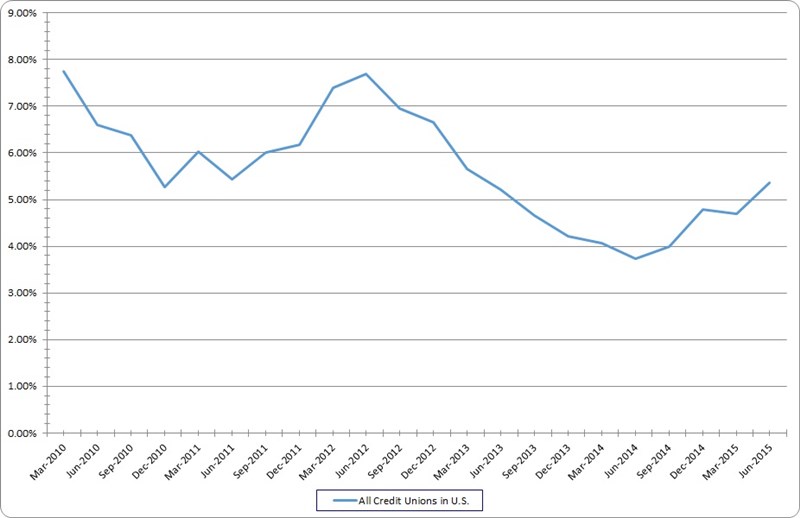

SHARE GROWTH

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Share growth as an industry was at 5.36% year-over-year at the end of the second quarter, down more than two percentage points from three years earlier. Meanwhile, the overall loan-to-share ratio has risen sharply in the past two years, standing at 75.88% on June 30, 2015, and that raises the need for more deposits, ideally without borrowing.

LOAN-TO-SHARE RATIO

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

According to Callahan co-founder and board chair Chip Filson, the first quarter is an ideal time to re-price by paying slightly above market to lock in long-term CDs and reactivate interest in money market offerings. Along with re-pricing, credit unions across the land are using other means to attract much-needed deposits.

Some of this money is not going to stick. The opportunity for us, and the challenge, is to find ways to engage members before the CD matures.

1. New Money Chasing Yield

Our goal is to grow loans, says David Birky, chief strategy officer at Interra Credit Union ($765.5M, Goshen, IN) As we do that, we need deposits.

In November 2014, the credit union offered a two-month, 2% CD with a minimum deposit of $500 and a maximum deposit of $2 million. The CD helped Interra take in $34 million in deposits through 890 CDs with an average balance of $38,000.

Approximately 60% of the CD money came from existing Interra accounts. The rest came from new members or new money from existing members.

Promotions like this bring the possibility of hot money from depositors that chase the best deal and withdrawal their money when the promo expires. But when managed well, they can also help credit unions raise deposits and cross-sell account holders with other, stickier products.

Some of this money is not going to stick, Birky says. The opportunity for us, and the challenge, is to find ways to engage members before the CD matures.

Read more about Interra’s strategy on CreditUnions.com.

2. Piling On The Perks

Purdue Federal Credit Union ($941.7M, West Lafayette, IN) wasn’t trying to raise deposits as much as member interest when it launched My Member Perks. But the incentive program’s four-tiered offerings helped the Indiana credit union grow total deposits by $46 million in 2014, a 6.51% annual increase.

Although attracting deposits was a factor, we were looking for more activity in our member accounts that could contribute back to the program and make it sustainable, says Heather Nally, Purdue Federal’s vice president of sales and services.

My Member Perks uses four graduating tiers of users: bronze, silver, gold, and diamond. Bronze members qualify only for the credit union’s standard rates, while higher tiers earn rate increases on deposits and rate discounts on loans.

Our goal is to grow loans. As we do that, we need deposits.

The number and value of loans, CDs, and share accounts a member holds helps determine their status, but so do the use of other services, such as mobile banking, debit cards, and paperless statements. As such, a member’s status can change monthly.

Read more about Purdue FCU’s strategy on CreditUnions.com.

3. Attracting Deposits At The Expense Of Payday Lenders

Attracting primarily Hispanic residents who often aren’t using banks or credit unions has helped First Imperial Credit Union ($81.9M, El Centro, CA) increase its deposit base.

The Imperial Valley credit union near the Mexico and Arizona borders serves a community more than 80% Hispanic, and many of its residents use check cashers, payday lenders, and reloadable prepaid cards from their employers.

To encourage direct deposit and help members build a relationship with a traditional financial institution many for the first time First Imperial offers a starter account called Opportunity Checking.

For $10 a month, Opportunity Checking provides a debit card but no overdraft privileges. Those and lower fees come after members show they can handle their new financial relationship.

Although the credit union encourages direct deposit, First Imperial does not require it. The credit union also does not require a ChexSystems check.

Opportunity Checking has helped First Imperial increase regular shares by 12.07% year-over-year at midyear 2015, nearly twice the rate of the average credit union of $50 million to $100 million, according to data from Callahan & Associates.

It’s easy to help those that have perfect credit scores and stable jobs, says First Imperial’s president and CEO, Fidel Gonzalez. When you position your credit union as one that’s willing to work with those that truly need it, the word gets around.

Read more about First Imperial’s strategy on CreditUnions.com.

4. A Four-Way Focus

At midyear 2015, BCU’s ($2.2B, Vernon Hills, IL) year-over-year share growth of 9.75% outpaced the average for both credit unions with more than $1 billion in assets as well as credit unions nationwide which posted a YOY growth rate of 6.56% and 5.36, respectively.

The Land of Lincoln credit union prefers to stay loaned out, often at 100% loan-to-share or higher. To fund that, BCU focuses as much on deposits as loans.

They go hand in hand from a liquidity perspective, says Ken Dryfhout, director of balance sheet management. You need the dollars if you are going to lend them.

To ensure it has plenty of deposits, BCU follows a four-pronged strategy. First it charges its manager of deposit products with reinvigorating deposits. Next, it leverages its engagement data collected from its growing deposit base to create more efficient marketing, outreach, and cross-sell opportunities.

Third, it sets and tracks goals through a robust system of dashboard reporting and metric comparisons that extend across more than three-dozen branches.

Finally, it uses resources such as short videos to update staff on the performance of the deposit portfolio from an institutional and branch level.

The videos allow the organization to get to know us and what we’re trying to do, Dryfhout says. They’ve lowered potential barriers that would otherwise be in place and sped up the time we’ve needed to increase our visibility.

Read more about BCU’s strategy on CreditUnions.com.