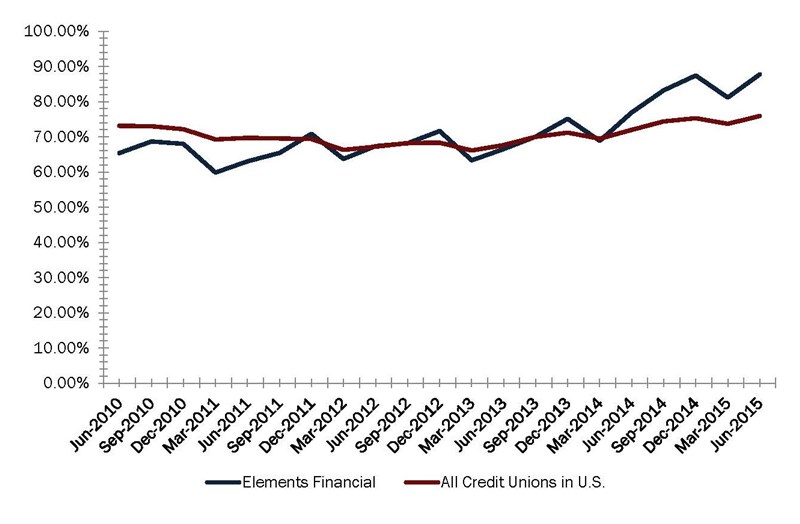

The loan-to-share ratio at Elements Financial Federal Credit Union ($1.1B, Indianapolis, IN) at second quarter 2015 was 87.75%, slightly higher than the 80.42% average that credit unions with more than $1 billion in assets posted.

The loan-to-share ratio for all U.S. credit unions has risen from a low of 66.11% in first quarter 2013 to its current 75.88% as of midyear. This reflects the industry’s robust lending performance in recent years and underscores the industrywide need to increase deposits to even out the balance sheet.

In a January 2015 CreditUnions.com article, Chip Filson reviewed quarterly trends in loan and share growth. According to the Callahan co-founder, Most of the share growth for credit unions occurs in the first quarter of each year. With the exception of 2010 and 2011, loan growth surpasses share growth in each of the following three quarters of the yearThe trend of loans growing faster than shares is accelerating. With one minor exception, the first quarter of each year is the only quarter from 2012 through 2014 when shares grew faster than loans.

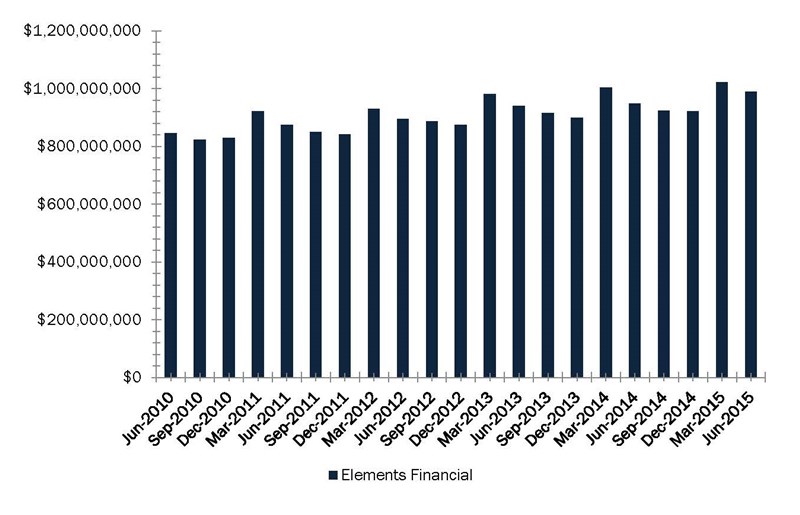

Elements is no outlier. Shares at the Indiana credit union increase by hundreds of millions of dollars every first quarter as employees of its largest SEG and No. 1 source of deposits pharmaceutical company Eli Lilly deposit their year-end bonuses.

The credit union has a goal to sustain a 5% YOY growth rate. As of second quarter 2015, it posted 4.24% YOY growth in shares. For loans, YOY growth was 18.87%.

Loans-To-Shares Ratio

For all U.S. credit unions | Data as of 06.30.15

Callahan Associates | www.creditunions.com

Total Shares

For all U.S. credit unions | Data as of 06.30.15

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

But in addition to Eli Lilly, for which the credit union was originally named, Elements has nearly 70 other employee groups through which the closed-membership financial institution can increase deposits. To that end, in 2012 it introduced a health savings account (HSA). Thus far, the credit union has been pleased with the results.

What Is A Health Savings Account?

An HSA is a tax-advantaged medical savings account available to taxpayers who are enrolled in a high-deductible health plan. Account holders may use their HSA to pay for qualified medical expenses without federal tax liability or penalty.

Basically, it’s a way for members to save money for future medical expenses.

Unlike Flexible Spending Accounts, unspent funds in the HSA roll over and accumulate year to year. And unlike Health Reimbursement Arrangements, the individual account holder not the employer owns the HSA.

Contributions to HSAs can come direct from the account holder, direct from other individuals, or through a payroll deduction. In this re

Elements’ HSA pays up to a 1% annual dividend and charges few fees. It also gives members access to an investment program through TD Ameritrade. Features like this makes the product competitive in the credit union’s central Indiana market, says Andrew Vahrenkamp, the credit union’s senior vice president of marketing and member experience.

We’re a $1.1 billion credit union with six branches, Vahrenkamp says. We pride ourselves on our member giveback in terms of rates and fees. This is just an example of that.

To date, Elements has 7,132 open HSA accounts at 18 employee partners, totaling $9.7 million in balances.

Becoming Better Healthcare Consumers

Because the nature of healthcare can be confusing, when a company selects Elements as its HSA provider, credit union representatives go on-site to teach employees how to use the account. The credit union hands out a welcome kit that explains the product and describes how employees can make the most of it. It’s all about active education for Elements.

We do a lot of events and seminars on how to use the product, how to be the model healthcare consumer, and how to prepare for retirement, those kinds of things, Vahrenkamp says.

That’s one of our competitive advantages, adds Michelle Payne, the credit union’s assistant vice president of branding and communication. There are several local institutions that offer the product, but we actually go on-site and teach people how to use it.

It’s that package of advantageous fees, rates, educational materials, and expertise that sells new employee partners on the credit union. The account appeals to companies that want to improve the financial health of employees and make their healthcare programs more appetizing.

The sell to the companies is that your employees are not productive if they are worried about their finances, Vahrenkamp says. If you have a high-deductible healthcare program, then you need an HSA. Why don’t you pick on that is local and has great rates and tools?

Expanding Relationships And Member Growth

When Elements introduced its HSA product, it did so with the idea the account would be an entry point for a larger relationship.

Elements has an assistant vice president of business development who fosters new partnerships with community businesses. Currently, the AVP is focused on companies with 500 employees or more. The credit union also has two additional employees who maintain existing employer relationships.

The credit union’s HSA has proven fruitful for ginning up additional business from two of its SEG partners that offer the product, the Indiana Chamber of Commerce and Angie’s List, the Indianapolis-based crowd-sourced reviewing website.

The Chamber holds financial wellness seminars and events for HR managers through its Wellness Council of which the credit union is a sponsor. Elements uses these events to not only share its story but also drive new relationships.

It’s part of the overall SEG relationship with the credit union, but we consider it a business partnership too, Vahrenkamp says. We are providing financial wellness to employees.

Although the credit union’s relationship with the Chamber is a great example of how it is building rapport within the community, the credit union’s relationship with Angie’s List is perhaps more representative of how the HSA can provide future value to employees through additional loan and deposit products.

The first year Elements offered the HSA to Angie’s List, Elements added few additional members.

But we kept pushing, Vahrenkamp says.

Elements continued holding events and seminars at the company’s headquarters, and one by one it started to get loans.

They started telling co-workers who then told their co-workers, Vahrenkamp says.

Since the end of 2013, the credit union’s loans to Angie’s List members have increased from $250,000 to $4.2 million, or 1700%. Among its other HSA SEGs, loans have increased as well, by 136%.

Although the product has been a great source of member and deposit growth, cross-selling has been more difficult than anticipated, according to Vahrenkamp.

Elements will continue to push HSAs for employee groups, and Vahrenkamp is optimistic the product will grow and more cross-sell opportunities will present themselves.

To deepen that relationship takes time, he says. We can’t just send emails telling people they have a relationship with us. It’s about the one-on-one impact that we can have. It’s about good, old-fashioned, member service.