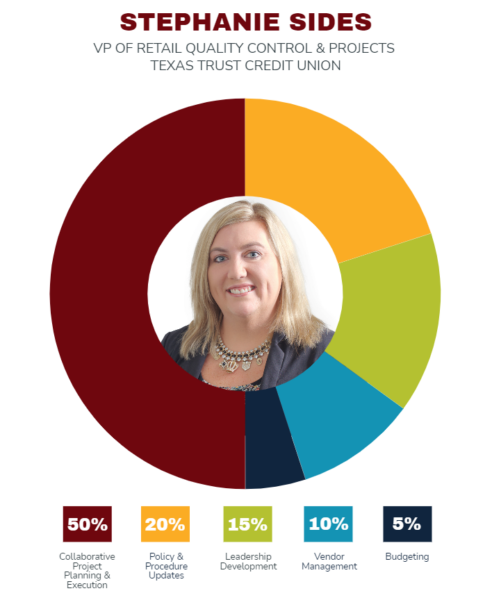

What’s In A Name: Vice President Of Retail Quality Control And Projects

Stephanie Sides straddles daily branch operations and strategic management to ensure retail quality at Texas Trust.

Stephanie Sides straddles daily branch operations and strategic management to ensure retail quality at Texas Trust.

The veteran leader and Motor City hype man looks back on a career centered on living the “people helping people” philosophy.

Americans face challenges in retirement planning and rising debt. Credit unions can help them tackle that.

Demands for hybrid or remote work and a stronger emphasis on company culture remain key recruitment trends four years after the pandemic.

The chief executive shares her vision on what it means to balance future vision with day-to-day imperatives.

Discover how Liberty FCU and Veridian Credit Union are successfully increasing mortgage portfolios with strategies tailored for Gen Z and millennials.

Emilio Cooper brings a comprehensive approach to deposit growth at Bethpage FCU, moving from a one-size-fits-all method to a more nuanced strategy.

In this Q&A, CRIF Select President Jeremy Engbrecht explains how credit unions are navigating the competitive indirect auto loan industry.

After two large Minnesota credit unions merged, staff set to work creating a new brand identity.

A unique set of skills gained during a merger prompted West Community to craft a role dedicated to storytelling and fintech.

Stephanie Sides straddles daily branch operations and strategic management to ensure retail quality at Texas Trust.

Branching experts share the pros and cons behind ditching the traditional teller role in favor of a new staffing model.

Evolving technology and alternative staffing models offer greater flexibility and efficiencies, but the conventional service model remains a mainstay at many credit unions.

The California cooperative has partnered with a catering company to open a café in its two headquarters buildings, offering fresh, affordable food to the public.

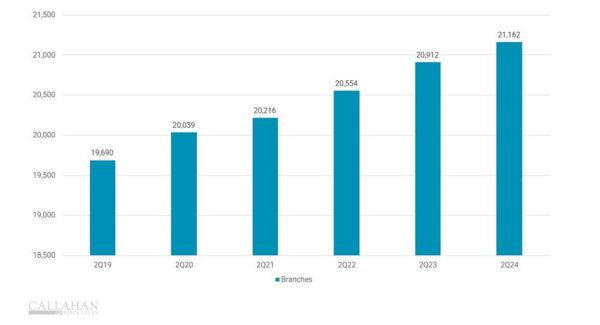

Cooperatives are expanding branch networks as banks of all sizes pull back from brick-and-mortar.

The Texas credit union is extending financial services and resources to geographical areas with limited or no banking presence.

Fluctuating loan demand upset credit union lending pipelines and balance sheets in the first half of the year. How significant were these impacts?

Six data points showcase what’s happening in the U.S. economy that could direct credit union decision-making for the rest of the year.

Credit unions have made the choice to back away from indirect auto lending, but that has come with a substantial opportunity cost.

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.