Three years ago, Emilio Cooper left behind 27 years of for-profit banking at local, national, and international institutions to join the not-for-profit world of credit unions as senior vice president of retail banking for Bethpage Federal Credit Union ($13.1B, Bethpage, NY).

That was in October 2021. In November 2023, Cooper transitioned to the new role of chief deposit officer to take full ownership of Bethpage FCU’s deposit strategies as part of a holistic approach that combines efficiency and mission.

Here, Cooper talks more about his work.

Why did Bethpage FCU create the title of chief deposit officer?

Emilio Cooper: We recognized the importance of having a defined leader for our deposit strategy and the businesses that directly gather deposits and financial investments from our members.

Did Bethpage create this job specifically for you?

EC: That’s a great question. I wouldn’t say it is specific to me. I joined Bethpage from a chief deposit officer role at a community institution in New Jersey, so I came to Bethpage with that skillset and background.

During the period from when I was hired to when we put the position into place, it become clear to us we needed this position to execute our deposit strategy. We needed a dedicated and specialized focus on our deposit-gathering businesses under one leader with the appropriate expertise.

I was hired as senior vice president of retail. My key responsibility at the time was to lead the retail network, Bethpage Financial Group, our investment services business, and the payments team. Shortly after joining, I was also given responsibility for our business banking team.

When we began work on our 10-year strategic plan, I was asked to take leadership for crafting our deposit strategy. I developed a plan for deposit growth that allows us to achieve our strategic objectives over the next 10 years. So, I think it was a natural progression for me to advance into the chief deposit officer role given the work I had done on the strategy and my unique background.

What challenges and opportunities does your role address?

7 Goals For A CDO

Emilio Cooper shares a few major goals for his role as chief deposit officer.

-

Lead a highly engaged team to deliver exceptional service to members.

-

Ensure Bethpage FCU achieves its deposit growth objectives while optimizing cost of deposits.

-

Enhance member satisfaction continuously.

-

Provide exceptional value to members beyond interest paid on deposits.

-

Increase checking balances as a percentage of deposits.

-

Expand business banking.

-

Grow investment assets under management of Bethpage Financial Group.

EC: Our most pressing challenge is growing deposits at an optimal cost during a time of intense competition and demand for deposits.

From my perspective, we’ve been in a war for deposits for the past two years. When the pandemic started, there was a massive inflow of deposits into banks and credit unions. Deposits were abundant and interest rates were near zero. The biggest challenge at that time was finding a way to earn an appropriate return on that excess money. That challenge has passed, and now we’re competing intensely for a shrinking piece of the deposit pie.

At the conclusion of the pandemic and the onset of inflation, the Fed began to raise rates and reverse some of the monetary actions it had taken, which led to a sharp removal of deposits from the system.

In addition to banks and credit unions battling over a shrinking pool of deposits, historic interest rate levels caused consumers to evaluate how they were managing their liquid cash. We saw tremendous migration of deposits moving out of lower interest paying accounts like checking and money markets into certificates and other high-yield savings products.

We also are battling another challenge the pandemic created. Consumers began to adopt digital banking at a rapidly accelerated pace. At the same time, the number of financial institutions offering online high-yielding products significantly increased. This changes the dynamic of deposit gathering for the foreseeable future.

Institutions with a physical branch presence are forced to compete against institutions that don’t have a physical presence. And with interest rates at a 20-year high, it can be very compelling for consumers to explore online options that might or might not include a physical branch presence. These dynamics have increased the separation between the cost to retain a relationship from the cost to acquire new deposits. This means we must do the work to better understand and deliver the value our different members seek. Some members value rates paid on deposits; some value rates charged on loans; others value an account with low or no fees; and many value access to physical locations. Most value and appreciate a high level of service.

How will you adapt and address those challenges?

EC: In the past, we had a more uniform approach to the way we delivered deposits. I would describe it as one-size-fits-all. In this new environment, we’re working through the challenge of delivering exceptional value to our members in the ways they desire. This extends beyond the interest we pay on deposits.

The better we get at understanding the intersection between personalized perceived value and rate, the better we’ll be able to manage our cost of deposits effectively while optimizing growth and member satisfaction. We work to address this by ensuring we understand our members. We use member satisfaction surveys to poll our members, and we spend time with our member-facing teammates to elicit their feedback on products and services our members desire. We also use data and analytics to monitor and track trends.

Armed with those insights, my role is to collaborate internally to deliver what members have told us they want. That sometimes takes the form of changing our existing products and services, and it often means we need to evolve and develop new products and capabilities.

Talk about your transition from senior vice president of retail banking to chief deposit officer. What’s different, what’s the same?

EC: The transition was seamless. I had already started to perform many of the duties I have today. I retained all the responsibilities I had as SVP. A key difference is that I went from crafting the strategy to specifically owning it. I also provide broader input and leadership as part of the C-suite. In addition, I now attend every board meeting and am a member of the credit union’s asset liability risk management committee.

CU QUICK FACTS

BETHPAGE FCU

HQ: Bethpage, NY

ASSETS: $13.1B

MEMBERS: 465,002

BRANCHES: 34

EMPLOYEES: 813

NET WORTH: 9.1%

ROA: 0.84%

What makes you a great fit for the job?

EC: The No. 1 thing that makes me a great fit for the job is my passion and desire to help people. I’ve had the benefit of working for large commercial and international banks, regional banks, a community bank, and now a credit union.

I’ve worked in multiple geographies and served many different segments of the population. This provides me with a wealth of experience, which helps me in my collaboration with the great team of people at Bethpage as we deliver exceptional outcomes on behalf of our teammates and members.

What about the move from for-profit to not-for-profit banking? Do you feel differently about the credit union and your role there?

EC: I’m excited that in this role at a credit union I work directly for our members, and my main goal is to maximize the value we can return to our membership. This is very different from working for a publicly held financial institution where maximizing shareholder value is the primary goal. Sometimes doing what’s in the best interest of your membership doesn’t align with maximizing shareholder value. I very much prefer focusing on delivering maximum value for my members.

To whom do you report? Who reports to you?

EC: I report to our CEO, Linda Armyn. Retail, business banking, Bethpage Financial Group (our investment services business), payments, and deposit products management report to me.

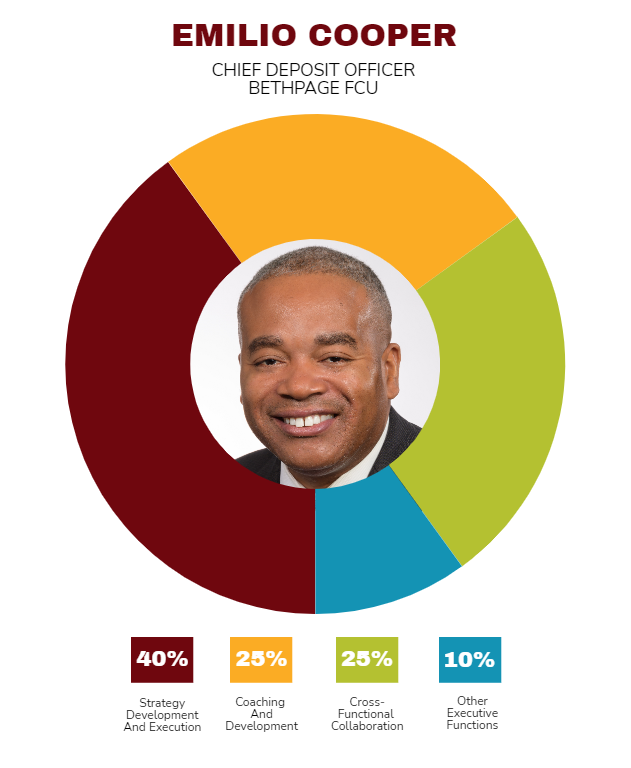

What’s your daily routine at the credit union?

EC: No two days are exactly alike. Most days I start the morning reviewing reports and analyzing information. I’ve developed several reports that have helped me stay on top of key trends and metrics related to deposits and the other businesses I lead. Once I review our internal data, I spend some time reviewing current events and get updates on any relevant economic information that will inform strategy or my coaching around execution for the day.

I typically spend a portion of each day working collaboratively with cross-functional teams to drive our initiatives forward. I spend the remainder of the day interacting directly with my team members, partners, and key vendors. I’ve set aside time for each of the key leaders who report to me and make it a priority to be available to support them in accomplishing their specific objectives.

Many days also include conversations with members or potential new employees. The best days are those where I get to interact in-person with our teammates or spend time with members. I share my direct office line and my cell phone on my e-mail signature and encourage members and teammates to reach out to me directly. Speaking with them is one of the best parts of my job.

Job titles can say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How do you track success in your job?

EC: I know I’ve been successful in my job when my teammates are happy and highly engaged. Highly engaged teammates deliver phenomenal member experience. And when members have a high degree of satisfaction and recognize the value we provide, they do more business with Bethpage, which leads to our growth. As we grow, we deliver against our strategic objectives. I believe this formula leads to sustainable success.

We have multiple ways to track our progress in key areas, including a twice-annual employee survey, daily member satisfaction surveys, financial reports, peer comparison reports, and more.

How do you stay current with topics that fall under your role?

EC: Staying up to date with key developments is critical. I read all the time, including several industry publications, and I have specific Google alerts set on areas of interest.

I attend conferences, present at conferences, and seek feedback. I spend time talking to vendors. They help me stay on top of evolving trends, new services, and capabilities coming to market.

I also speak with industry peers to trade stories and obtain guidance when exploring paths we might not have traveled before. Perhaps most importantly, I like to stay close to our teammates who are closest to the member. They’re the best and most reliable source of critical insights that help inform our strategy and approach.

This interview has been edited and condensed.