CREDIT UNION BRANCHES AND DEPOSITS PER BRANCH

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

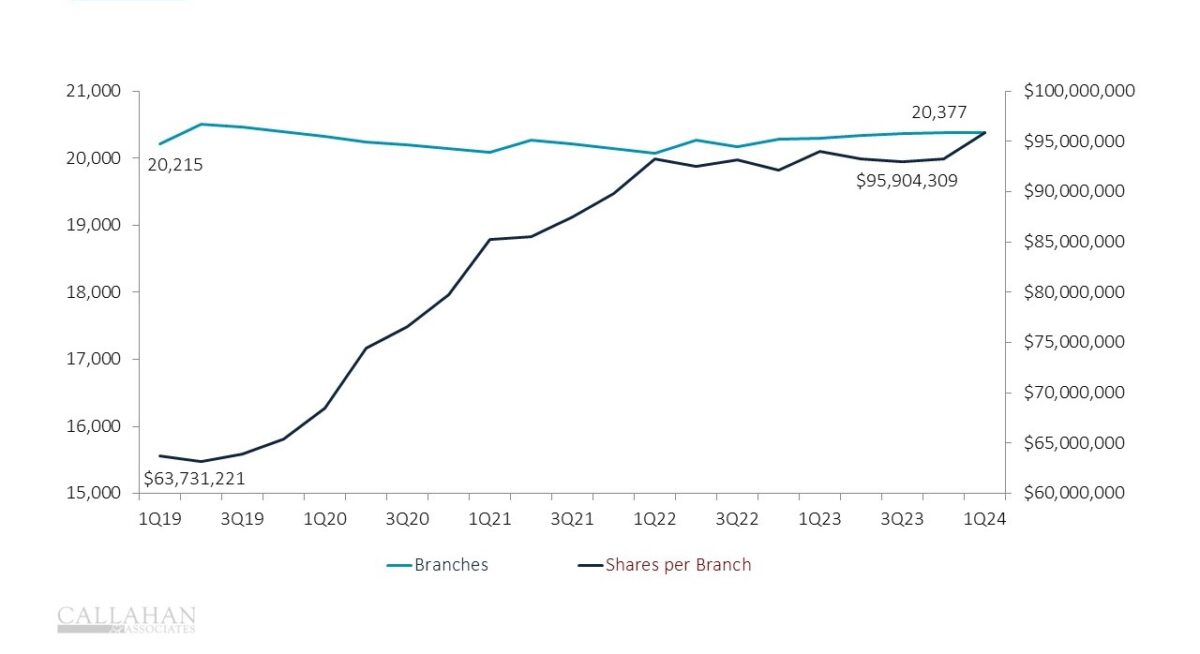

- Credit unions’ shares per branch have risen by 50% in the last five years despite minimal change (a 0.8% increase) in branch numbers. The industry has become more efficient at absorbing deposits in that time, thanks to increased usage of self-service channels and the boost in deposits from economic stimulus payments consumers received early in the pandemic.

- This shift has allowed credit unions to reorient their staff from traditional branch services toward more holistic endeavors. The number of credit unions offering members financial literacy workshops has steadily risen over the years, helping members as well as the credit union bottom line.

- The timing for all this couldn’t be better, as more and more customers expect their financial institutions to not just offer loans and savings, but also advice. A 2022 retail banking survey from J.D. Power revealed declining satisfaction with the quality of financial advice consumers receive from financial firms. Credit unions that position themselves correctly could capitalize on this vacuum.