West Community Credit Union ($461.6M, O’Fallon, MO) created a new role for the longtime CEO of a smaller suburban credit union it merged with earlier this year.

Josh Rodriguez brought with him a distinct skill set sharpened during his 18 years, the past 11 as president and CEO, at Missouri Valley FCU ($49.6M, Saint Peters, MO). He is now the assistant vice president of fintech and mission integration for WWCCU, a 32,575-member cooperative with seven locations in and around St. Louis and three more approximately 120 miles to the west in Columbia, home of the University of Missouri. Those are branded as Tigers Community Credit Union.

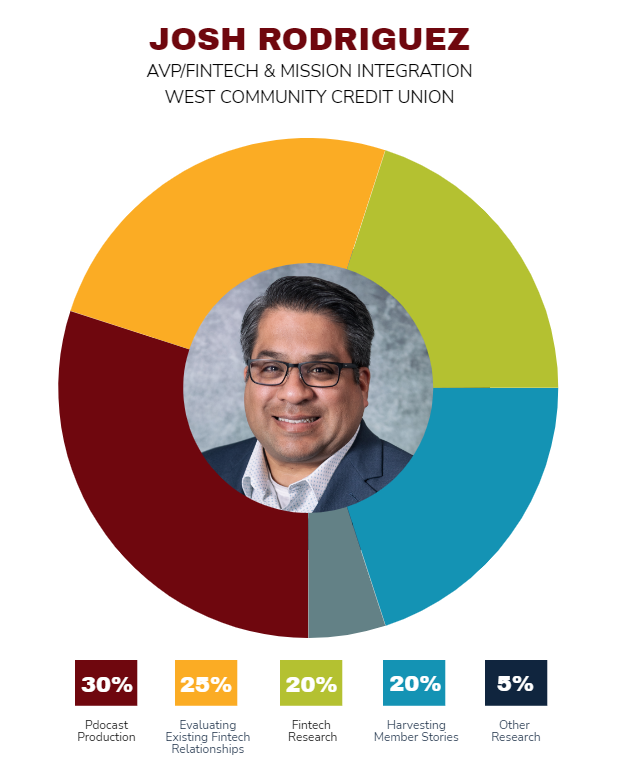

The new role encompasses fintech research and relationship management on one hand, and oversight of a new member podcast and community outreach efforts on the other. That’s the mission integration piece.

Together, they combine Rodriguez’s experience with IT and emerging technologies; his comfort with managing people, balance sheets, and vendor relations; and his passion for storytelling.

How did your new role emerge from the merger?

Josh Rodriguez: As our two credit unions combined, West Community’s CEO, Jason Peach, and I worked together to craft a position that used my strengths and interests as well as filled a need for a dedicated employee to manage our current and future fintech.

Meanwhile, I have my own recording and production studio and storytelling has long been a passion for me. A credit union is an ideal place to leverage the power of storytelling, and that’s going to be a big focus for us now.

Check out West Community’s job description for its assistant vice president of fintech and mission integration. Browse hundreds of ready-to-use job descriptions in the Callahan Policy Exchange and tweak your favorites to make hiring as efficient as possible. Learn more today.

Whose stories are you going to tell? To whom will you tell them?

JR: We have two audiences: our community and ourselves. We’ve already begun harvesting member stories, and in 2024, we’ll launch a podcast that will share their tragedies, their triumphs, their difficulties, and their successes.

We serve some amazing individuals. Included in their stories will be how WCCU/TCCU played a small part in their lives. We’ll share those stories for promotion and inspiration as we work to integrate more into the communities we serve.

Our members are our inspiration and serving them is our fuel. Hearing our member stories will inspire us to help more members and change more lives in the process. We plan to use the podcasts to inspire our staff to integrate our mission, vision, and values into what we do every day. That includes creating training modules.

CU QUICK FACTS

West Community Credit Union

DATA AS OF 09.30.23

HQ:O’Fallon, MO

ASSETS: $461.6M

MEMBERS: 32,575

BRANCHES: 10

EMPLOYEES: 128

NET WORTH: 8.2%

ROA:1.15%

Along with your mobile and online banking offerings, what fintech does West Community offer and how do you plan to refine or expand your offerings?

JR: We currently have relationships with an SMS provider and a company that specializes in AI-based solutions, and we are about to launch a buy now, pay later product with another partner.

What challenges and opportunities does your new role address? How do you address them?

JR: In the few months I’ve been in this role, I’ve learned a lot about the startup/fintech culture and how greatly it differs from long-established companies and industries such as ours. We have a long and storied relationship with our membership. The startup world is on an entirely different plane. A measured approach rather than chasing the shiny new object is a challenge.

As for mission integration, we want to bring our mission, vision, and values back to the forefront to inspire our staff and our community about how our credit union can make a difference for them. Storytelling in podcast form and in training is how we’ll meet this challenge.

What are some goals you have for your job, and how do you plan to achieve them?

JR: We’ll use our current and future fintech relationships to enable us to provide our members with smart financial solutions. And, we’ll inspire our staff and community with well-told stories of members’ trials and triumphs. Our goal here is to integrate “people helping people” into every aspect of our operations using storytelling.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What makes you a great fit for the job?

JR: My credit union experience, my IT background, my passion and experience with audio storytelling, and my passion for helping people.

To whom do you report? Who reports to you?

JR: I report to Koren Gruebel, our vice president of marketing and digital engagement. I have no direct reports at this time.

What’s your daily routine at the credit union?

JR: The position is new and developing, and I’m still learning the ins and outs of WCCU. I’m gathering stories from staff members and building out a production process for our podcast. I’m also working with other team members on enterprisewide improvement efforts. Plus, we’re still wrapping up loose ends from our recent merger.

How will you track success in your job?

JR: For fintech, success will mean our strategies and initiatives are in line with our enterprise goals and strategic objectives. We’ll measure community and employee engagement, follow our podcast metrics, and watch for industry recognition.

How do you stay current with topics that fall under your role?

JR: On the fintech side, we engage with venture capital organizations and incubators, and I stay up to date through fintech and credit union-specific news. On the mission integration side, we gather stories from our staff and members. We’re in constant communication about that project.

This interview has been edited and condensed. It originally appeared on CreditUnions.com on Dec. 11, 2023.