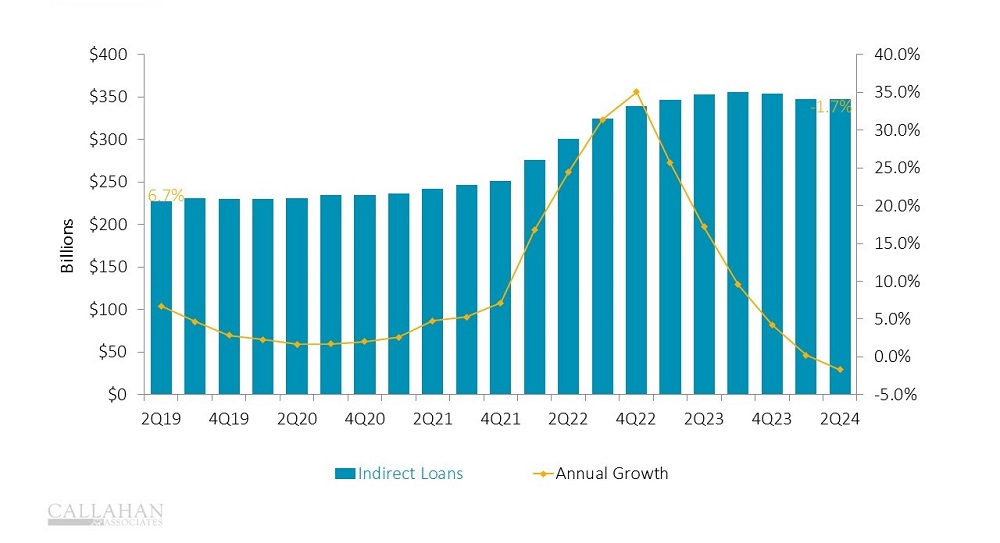

After more than a year of navigating tightened liquidity, cooperatives have scaled back on indirect lending. Such auto loans comprised 55% of all vehicle balances as of the second quarter of 2024 and are a strong source of loan and membership growth. Turning off these levers comes with a performance cost, and the drop in credit union auto market share during the past few quarters has been substantial. Auto lending growth has decelerated since early 2023 and went outright negative in 2024.

INDIRECT LENDING AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

A Primer On Recent History

Credit unions ramped up indirect lending in 2022, when CARES Act relief flooded financial institutions with excess deposits.

Credit unions were looking to lend, and an auto market pinched by supply chain issues, sky-high car prices, and borrowers struggling to find affordable loans set the stage for indirect partnerships to broaden the reach of credit unions. As a result, annual growth in indirect balances topped 35.0% in the fourth quarter of 2022.

Then, consumer savings rates started to slow as increases in the cost of living left people with fewer funds to sack away at the end of the month. Higher interest rates did dampen loan demand, but loan applications still came in faster than new funds.

Industry liquidity began to dry up and became the dominating concern in 2023. Every funding dollar became more valuable, and many credit unions reversed course on indirect lending to make more of those funds available for direct lending.

Fast forward to 2024: Indirect balances have decreased 1.7% year-over-year with total balances falling three quarters in a row.

Although credit unions have generally gained a handle on their liquidity, most are not flush with funds and, consequently, are stepping back from indirect lending. However, given that high rates have depressed the auto buying industry, many credit unions are struggling to grow their auto footprint without the aid of an extended indirect network.

What Does Auto Lending Look Like Today?

Auto loans are a core product of credit unions, and many cooperatives supplement their portfolio with indirect loans. However, as credit unions pulled back from indirect, the portfolio followed: New auto loans fell 4.3% while used auto stayed flat year-over-year as of June 30.

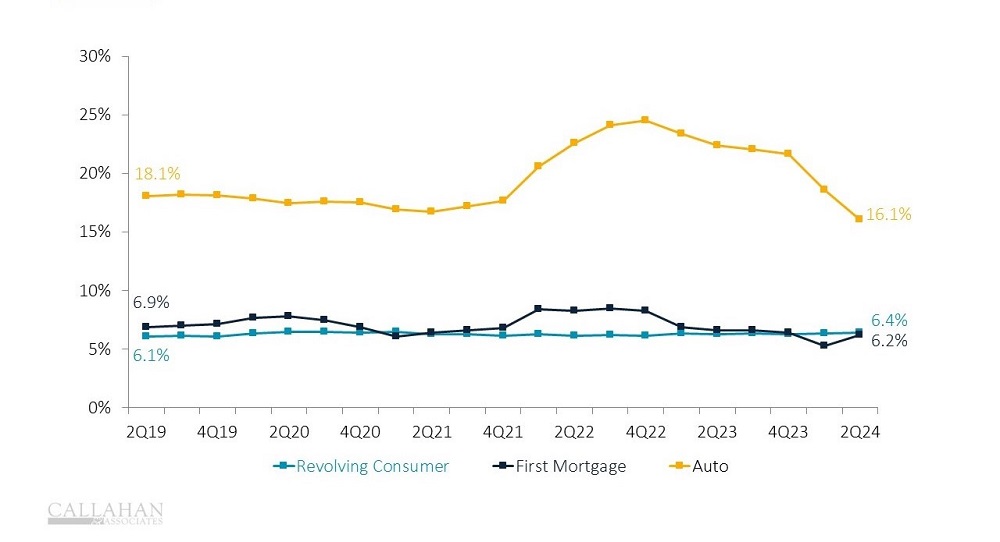

Although annual loan growth is slowing for most products given the high-rate environment, vehicle loans have been hit the hardest. Auto closed out the second quarter as the only major loan product reporting negative annual growth.

Simply put, credit unions are making a choice to back away from indirect auto lending but are struggling to make direct loans.

CREDIT UNION MARKET SHARE OF ORIGINATIONS BY PRODUCT

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

The Lay Of The Auto Market Share Land

For lenders, the auto market can be highly competitive. Credit unions took advantage of market conditions in 2021 and 2022 by offering competitive prices, whereas captive lenders — auto manufacturer financing subsidiaries like Toyota Financial Services — withdrew amid inventory constraints. Using both direct and indirect channels, cooperatives captured 24.5% of the market by the end of 2022.

Even as interest rates increased, credit unions were slower to reprice loans, which gave them a temporary edge against banks and captive lenders. Now that credit unions have pulled back from indirect lending, their auto market share has sagged. Captive lenders, meanwhile, have reemerged in full force. Vehicle production is back to pre-pandemic levels and manufacturers are juggling excess inventory with many willing to finance at discounted rates to make a sale.

Consequently, credit union auto market share sunk to 16.1% as of mid-year 2024, according to data from Experian. Whereas credit unions originated one in four auto loans just two years ago, their share of the market has now dropped to approximately one in six.

Today’s auto market is notably different from what it was during the pandemic. So is the credit union industry.

Without floods of cash, credit unions are taking a more stringent approach to lending and members are less likely to open their wallets for pricey purchases. Add to this the drawback from indirect lending and it becomes apparent credit unions simply aren’t pursuing the auto market the way they have in past years. With multiple Federal Reserve rate cuts forecasted in the near future, it remains to be seen how vehicle buyers will respond and credit unions will adjust.

How Does Your Auto Portfolio Compare At Midyear? Sit down with a Callahan advisor to review a tailored performance packet, and we’ll show you how your credit union measures up against others. Armed with this knowledge, your team can make better plans and set stronger goals for 2025 and beyond. What are you waiting for? Request Your Packet Today.