Teamed with the appropriate expertise and experience, member business loans offer several benefits for credit unions. Namely, in today’s interest rate environment, these relatively small dollar loans often provide greater yields than investments such is the case at Listerhill Credit Union. Also, member business loans allow the credit union to demonstrate its financial commitment to and support of the communities it serves.

Listerhill Credit Union ($674.5M, Sheffield, AL) held more than $84 million in member business loans at the end of third quarter 2015. That’s approximately 18% of the credit union’s total loan portfolio.

CU QUICK FACTS

Listerhill Credit Union

Data as of 09.30.15

- HQ: Sheffield, AL

- Assets: $674.5M

- Branches: 18

- Members: 84,488

- 12 Month Share Growth: 4.56%

- 12 Month Loan Growth: 7.85%

- ROA: 0.47%

That total is impressive considering how quickly and soundly Listerhill has built the portfolio. At first quarter 2012, the credit union held just north of $49 million in MBLs. That date is important because it represents what Fred Lindsey, vice president of business service operations, inherited when he joined Listerhill later that year. At the time, Lindsey had 27 years of prior lending experience, including 15 years in commercial, five years in mortgage, six years in consumer, and one year in consumer underwriting, he says.

Member Demand

Daryl McMinn has been with the credit union, in varying capacities, for 21 years. The current chief operating officer was working in lending when Listerhill first started making member business loans, but, he remembers, it was never thought of as a long-term strategy.

Hear firsthand about the ins and outs of MBL from these credit unions in the know. Watch This Video. Then Watch This Video, Too.

We did a few commercial loans, he says. Maybe we made a loan for the guy with a backhoe who digs septic tanks across the street, but we had no real intention of doing all that many.

Perhaps strangely enough, what jumpstarted Listerhill’s portfolio was an examination. After noting a number of business loans mainly to local churches on the credit union’s balance sheet, the examiner felt it was in Listerhill’s best interest to create a separate loan policy for business loans, which differ in complexity and risk from traditional mortgage or auto loans.

That was approximately 10 years ago, McMinn says. And it was around that time that credit union leagues identified business loans as the products du jour, the next growth opportunity, McMinn recalls.

So Listerhill established a plan to start approving more, small member business loans.

Today, the credit union primarily approves commercial real estate loans.

We don’t do inventory loans, we don’t do restaurants or startups, McMinn says. That’s by design.

We’re not out here to try and put a bunch of loans on the books. We’re here to grow steady and do the right things.

Listerhill Lending

Listerhill is a low-income designated institution, meaning it does not run up against the NCUA’s member business loan cap. That’s a good thing for Listerhill because member interest skyrocketed as the credit union started making more business loans. Interest is so strong that three years ago, the credit union built out an entire department dedicated to MBL and brought in Lindsey.

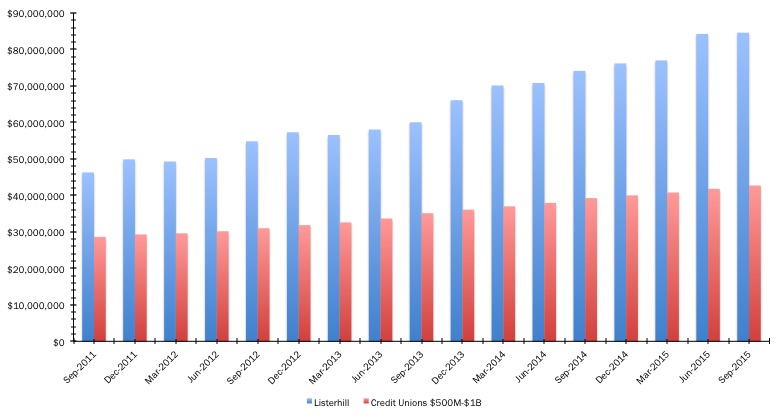

MEMBER BUSINESS LOAN BALANCES

For all U.S. credit unions | Data as of 09.30.15

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

Listerhill Credit Union held more more than $84 million in member business loans at the end of third quarter 2015. That’s approximately 18% of the credit union’s total loan portfolio.

If our member business lending was to grow any bigger, it needed its own individual owner and department to carry it any further, McMinn says.

As of Nov. 18, 2015, Listerhill has 342 loans in its business portfolio, totaling $84 million. Of those loans, according to Lindsey, 291 are in improved real estate; 13 each are in equipment, unsecured business cards, and unimproved real estate; and another 12 are in construction and development.

Lindsey is aiming for 10% growth year-over-year across the entire portfolio. That’s a feat well within the credit union’s grasp. As of third quarter 2015, Listerhill posted a year-over-year MBL growth rate of more than 14%.

MEMBER BUSINESS LOAN GROWTH

For all U.S. credit unions | Data as of 09.30.15

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

Listerhill Credit Union didn’t focus on building a business loan portfolio until approximately 10 years ago when an examiner suggested the credit union create a separate loan policy for business loans. In 2012, the current vice president of business service operations started with Listerhill.

Despite aggressive demand, Listerhill says its MBL philosophy will remain conservative because the credit union itself is conservative.

We’re not out here to try and put a bunch of loans on the books, Lindsey says. We’re here to grow steady and do the right things.

The approach is serving the credit union well. Delinquencies within this portfolio are minimal 0%, in fact and notably lower than the still-strong 0.99% average for Listerhill’s asset-based peer group.

But critics should not confuse Listerhill’s demonstrated effective risk measures with being too conservative with its lending practices.

We know the people; if not, we get to know them, McMinn says. And any business loan we’ve done goes through our commercial loan committee.

How Do You Compare?

Check out Listerhill’s performance profile.

That committee is composed of four individuals: McMinn, Lindsey, CFO Clay Morgan, and CEO Brad Green. After a given loan goes through the standard third-party underwriting process, it’s handed to this committee to make a final decision.

We all get an opportunity to hear about the deal and look at the credit, McMinn says. We dedicate the time to look at and study these loans so they don’t become a potential problem down the road.

Marketing And Yields

Listerhill has a tight relationship with the communities it serves. As such, it understands the people and businesses that dot the streets and the towns in which they live and operate. And often, those people know Listerhill.

When it wanted to increase balances, McMinn says, we didn’t spend a dime’s worth on advertising.

Instead, the credit union relied on the locals who buy commercial property to spread awareness of its MBL program through word-of-mouth. In this way, positive experiences are leading to positive growth.

The philosophy of this credit union is that we treat people fairly. We look for ways to make loans, Lindsey says. We are smart about the way we do business in that we try to mitigate loss, but we don’t just look for ways to deny folks.

You Might Also Enjoy

- How Attentive Listening Makes For Stronger Lending

- 6 Things To Know About Credit Union Lending Trends

- Turn Approved Loans Into Funded Ones

- How 2 Credit Unions Became Leaders In 12-Month Loan Growth