Top-Level Takeaways

-

MSUFCU operated a branch in a suburban mall for two weeks in December 2017.

-

The pop-up branch brought in nearly 800 adults and children and brought to light practices to try at other, permanent locations.

There was change afoot at Michigan State University Federal Credit Union ($4.0B, East Lansing, MI) in the fall of 2017.

MSUFCU had opened its first, and to date only, branch in Grand Rapids, MI. The $4 billion institution has a large and loyal membership in its East Lansing headquarters, yet the expansion into a market only an hour away offered new challenges and insights.

CU QUICK FACTS

MSUFCU

Data as of 03.31.18

HQ: East Lansing, MI

ASSETS: $4.0B

MEMBERS: 255,284

BRANCHES: 19

12-MO SHARE GROWTH: 8.4%

12-MO LOAN GROWTH: 19.2%

ROA: 1.15%

“We weren’t as well known there,” says Deidre Davis, chief marketing officer at MSUFCU. “We had to think about how we could drive awareness.”

Inspiration hit one day in November when CEO April Clobes visited her local shopping mall. It was there that she noticed an open retail space in a location that would be heavily trafficked during the holiday season. The team discussed the space’s potential as a holiday season pop-up branch, thinking it could extrapolate lessons learned in minor to the larger branch network.

“We knew we could pull the pop-up together quickly, and we wanted to test ideas,” Davis says. “Could we pull in traffic? Could we pull in non-members? What kind of awareness could we build around the credit union, our products, services, or technology that didn’t exist before?”

Pop-Up Planning

MSUFCU worked with the mall’s leasing management to select the right two-week timeframe, eventually deciding on Dec. 4-17.

“We didn’t want to take it right up to Christmas Eve, even though it’s a big time for shopping,” Davis says. “We wanted to be respectful of our employees and balance the workload.”

The pop-up was open Monday-Friday from 11 a.m. to 8 p.m.; Saturday from 10 a.m.to 8 p.m.; and Sunday from 11 a.m. to 7 p.m. These were longer hours than a traditional branch, Davis acknowledges, but more in line with the mall’s operating hours.

For staffing, the credit union put out a call to all employees of the credit union — not just front-line staff. The pop-up was in a mall, where people stopping in would be pre-occupied with shopping lists and other activities, so shy personalities wouldn’t be as successful as those comfortable initiating conversations with strangers.

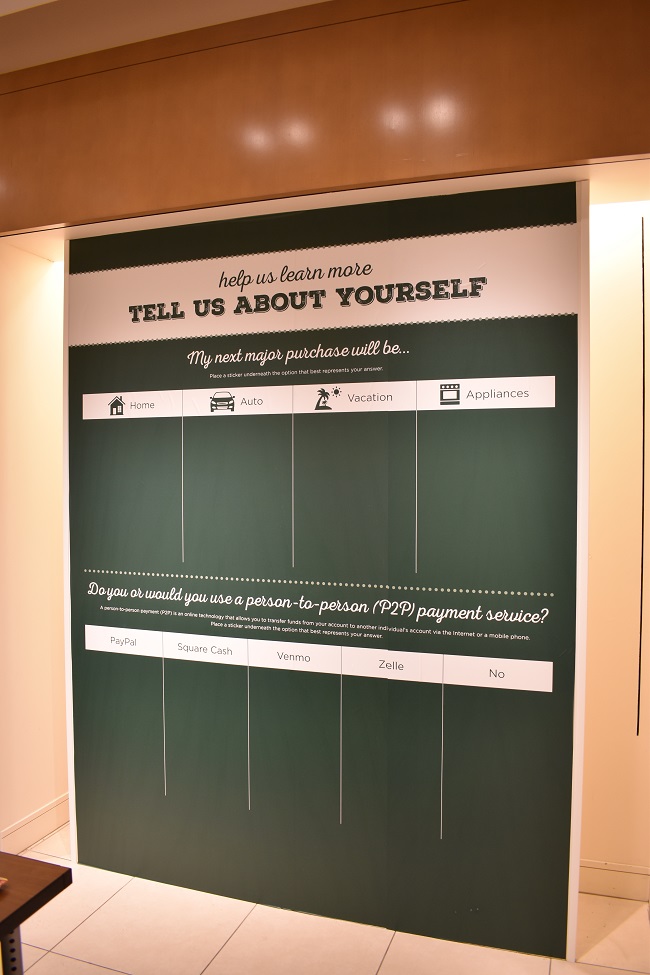

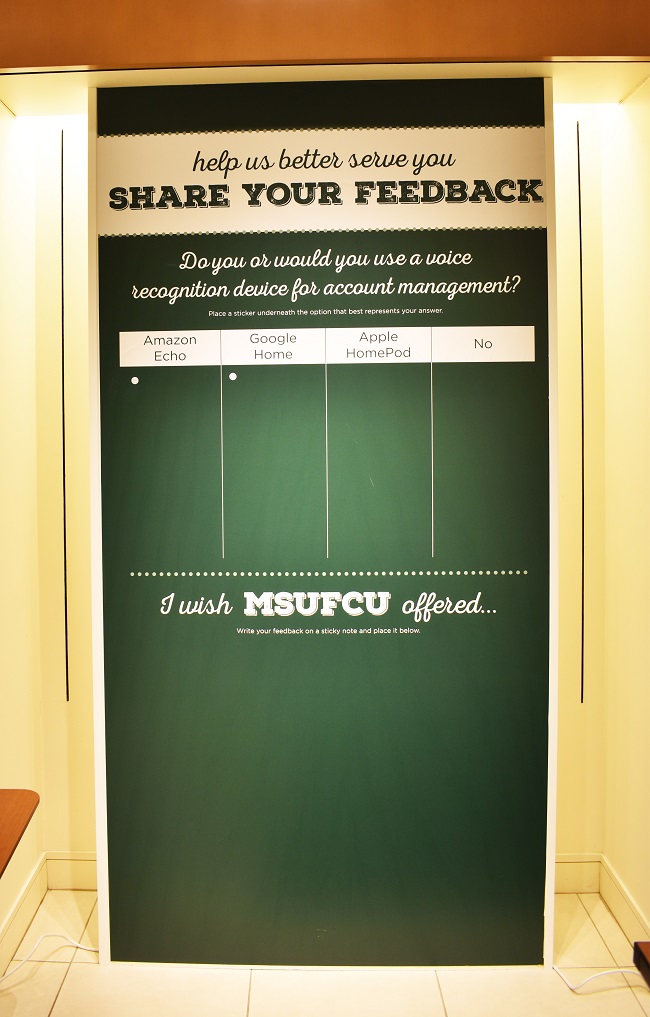

MSUFCU didn’t design the pop-up branch to process transactions, although the location did open six accounts and process two loans in its two weeks. Rather, the space showcased branding materials, a large feedback wall for impromptu surveys, and iPads loaded with the credit union’s flagship mobile banking app as well as its youth apps that taught kids financial concepts.

“These are some things that our members don’t really know about,” Davis says. “We wanted kids to get accustomed to them and show parents how easy all these apps were to use.”

Pop-Up Perception

To draw in passersby and maximize its testing time in the mall, MSUFCU needed to let people know it was there and give shoppers a reason to visit.

During the two weeks the branch was operational, MSUFCU set up a geofence around the mall. The credit union used this technology to target people who went online or logged into the credit union’s mobile banking app with tailored messages about the pop-up location and pop-up specials available to those who visited the pop-up, such as a limited time rate on auto loans and certificates as well as refer-a-friend benefits.

Inside the branch, MSUFCU counted nearly 150 responses to its wall surveys. The credit union posed questions with multiple choice responses, and visitors stuck Post-It notes by their answers. For example, MSUFCU asked if visitors had used any of five listed P2P payment services; it also asked if, in the next six months, visitors were in the market for new appliances, a car, or a home.

The survey wall also served as a home for members to write their own feedback on the institution’s products and services, including items they wished the credit union offered.

“Answers underscored the need for awareness,” Davis says. “We had some comments asking for things we already offer.”

The credit union also offered 20-minute financial education classes throughout the day, with topics ranging from ID theft to buying a home. Those did not end up as popular as the credit union hoped.

“It wasn’t a long-time commitment, but it didn’t quite fit in,” Davis says. “People were at the mall shopping. They didn’t mind talking about an app or filling out a survey but sitting down for a 20-minute seminar wasn’t popular.”

All told, 622 adults and 165 kids stopped by the pop-up, and the credit union identified several concepts it wanted to steal for its other branches. The one that stands out to Davis is the ability for kids to play around with the credit union’s youth apps.

“We had a father come in with a couple of children,” the marketing executive says. “His kids were having such a good time playing with the apps that he had to bribe them with ice cream to get them to stop playing. We thought maybe this is something we need to do at all our branches.”