CUSO Loans And Investments

Data as of 03.31.22

Source: Callahan & Associates

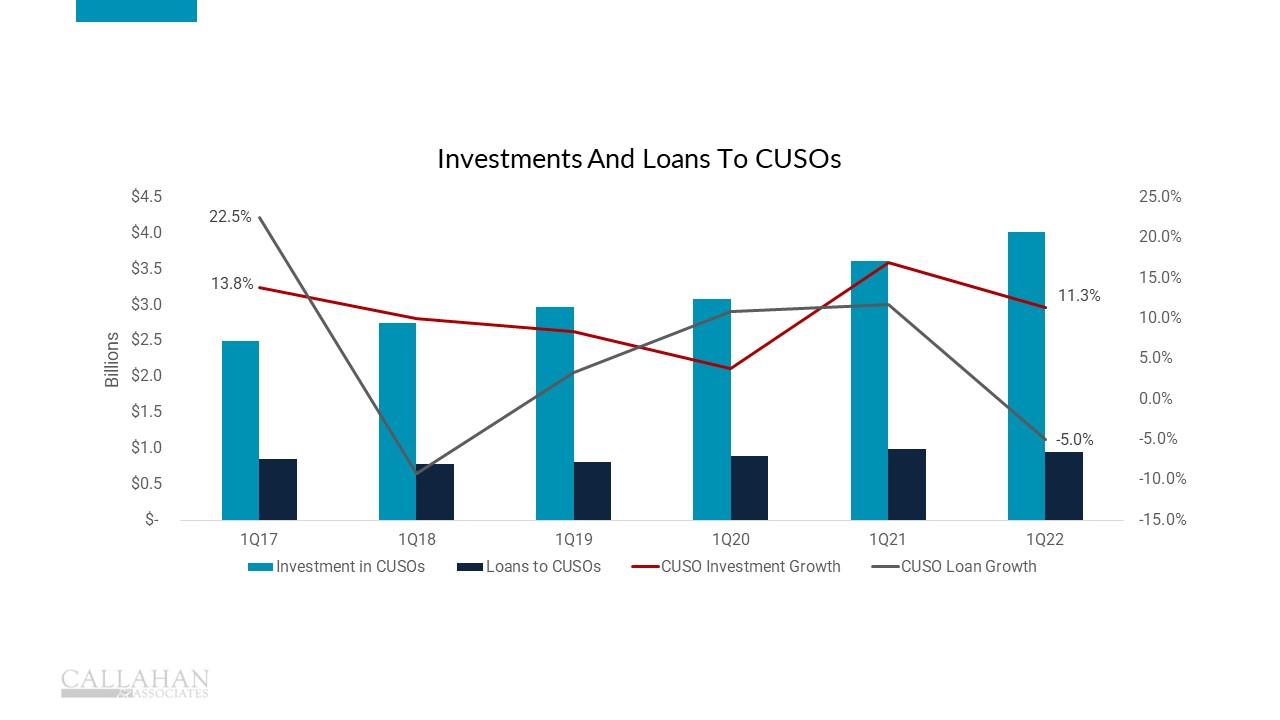

- Since the National Credit Union Administration began tracking the amount of money invested in credit union service organizations (CUSOs) in 2010, credit unions have allocated a significant amount of funds toward these organizations. CUSOs have access to capital now more than ever, and credit unions are interested in investing.

- Credit union investments in and loans to CUSOs have risen by 7.8% since the start of the COVID-19 pandemic, with investments comprising 80.9% of the total funds as of March 2022.

- Per NCUA regulation 12 CFR § 712.2, federally chartered credit unions can only invest in or lend to CUSOs 1% of the amount in paid-in share accounts and deposits based on their last year-end financial report. This rule makes it difficult for credit unions with low assets to allocate any significant funds to CUSOs, even if those investments could be valuable. Of the 1,958 credit unions with an aggregate cash outlay interest in a CUSO at the end of the first quarter, 645 are under $100M in assets. These small institutions comprise only 32.9% of CUSO-investing credit unions but make up 63.4% of all credit unions in the country. More than 150 of these smaller CUs have investments of $10,000 or less. For now, CUSO investing is predominantly a large credit union game – though small shops can still benefit from CUSO service offerings.

- Non-interest income data from Callahan & Associates shows that credit unions who reported income deriving from CUSOs in 2020 saw a 37.2% year-over-year increase in their CUSO earnings by December 2021.

- All things considered, CUSOs have proven to be a great alternative for credit unions to increase and diversify their non-interest income, while at the same time investing in an industry that is specifically targeted to serve credit unions and their members.